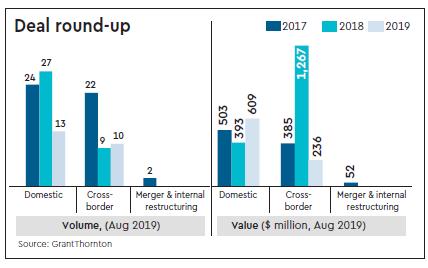

With the ongoing global uncertainties impacting business confidence and dampening deal making, August recorded only 23 deals worth $845 million, which is a 49% decline in deal values over the same month last year, said the dealtracker report by Grant Thornton.

The month witnessed only one deal valued over $500 million and one deal valued over $100 million, together totalling $0.7 billion and forming 84% of the total M&A deal values.

The largest deal during the month was witnessed in the energy and natural resources sector, with the Adani-GMR deal being valued at $512 million, followed by Air Water’s acquisition of Linde India in the manufacturing sector. Both the sectors witnessed one deal each, together accounting for 83% of the total M&A deal values.

Contrary to the previous month, August was dominated by deals in the IT and ITeS sector with 8 deals worth $35 million, pushed by consolidation in the software development and the IT solutions segment. The start-up sector remained active after the IT sector with five deals worth $25 million.