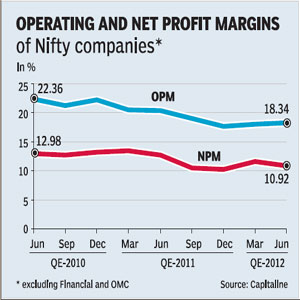

June quarter numbers of the Nifty companies show sustained contraction in operating and net profit margins of the top blue-chip companies. For a second consecutive quarter, operating profit margin, a gauge of company’s operating efficiency, contracted 2% y-o-y for the Nifty companies (excluding those from finance and oil marketing domains). The net profit margin, also slid for a second quarter by 1.8%, compared with the previous year. Muted other income and a sequential decline in revenue were the key reasons for the contraction even as raw material and interest expenses demonstrated a slowing yoy growth compared to last four quarters.

According to IDFC, during the June quarter, Ebitda (Earnings Before Interest Tax Depreciation and Amortisation) margin, an equivalent of operating margin, of sectors like oil & gas, metals & minerals and telecom witnessed sharp contraction while that of pharma companies expanded significantly.

According to IDFC, during the June quarter, Ebitda (Earnings Before Interest Tax Depreciation and Amortisation) margin, an equivalent of operating margin, of sectors like oil & gas, metals & minerals and telecom witnessed sharp contraction while that of pharma companies expanded significantly.

In the first quarter of 2012-13, at 16.7%, the topline witnessed its weakest y-o-y growth in more than four quarters while sequentially it shrunk nearly 6%, higher than the last sequential decline reported during the June 2011 quarter.

As per Citi, sales momentum for the June quarter confirms a pronounced downtrend which it says is ?reflective of slowing GDP and India Inc’s shift from growth to profitability?. The brokerage house expects the earnings growth to maintain a trend it has observed in the last six quarters, that of a range bound movement to sustain over FY13 and FY14.

For three months to June, the other income of the top largecaps (Nifty ex-fin, ex-OMC) shrank by nearly 3% yoy, further weighing on the net profit margin. Collectively, the net earnings of the Nifty companies fell 1% compared to the same period last year and observed a sequential decline of 11%. Adjusted profit of the sample however remained flat.