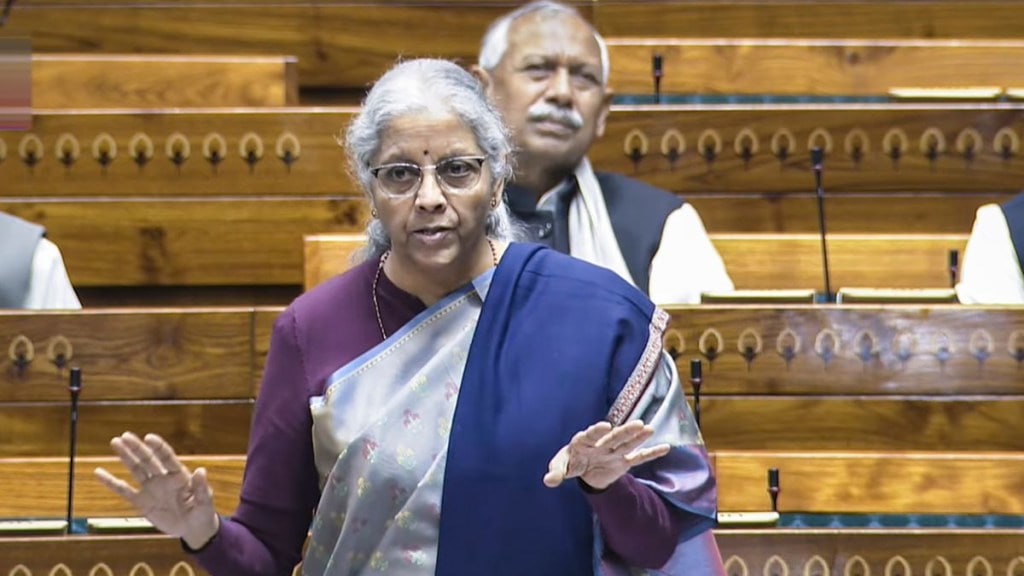

The Lok Sabha on Friday passed the Health Security se National Security Cess Bill, 2025, that proposes to levy a cess on manufacturing units of pan masala, and use the generated funds for strengthening national security and improving public health. Finance Minister Nirmala Sitharaman had tabled the bill earlier this week proposing cess on pan masala companies.

Replying to the debate on the Bill, Sitharaman said the cess will be shared with the states, as public health is a state subject. The bill was passed by voice vote in the lower house of the parliament.

What does the bill say?

The ‘Health Security se National Security Cess Bill, 2025’ aims to augment the resources for meeting expenditure on national security and for public health by imposing a cess on the machines installed or other processes undertaken to manufacture pan masala and similar goods.

It has one clear purpose, which is to create a “dedicated and predictable resource stream” for two domains of national importance — health and national security.

Meanwhile, Sitharaman said pan masala will be taxed at the maximum 40 per cent rate under Goods and Services Tax (GST) based on its consumption, and there will be no impact of this cess on GST revenues. The proposed Health and National Security Cess will be over and above the GST.

She said the cess will be levied on the production capacity of machines in pan masala manufacturing factories. The minister added that the cess as a percentage of gross total revenue was 6.1 per cent in the current fiscal, lower than 7 per cent between 2010-2014.

Idea behind the Bill

On Thursday, elaborating on the rationale behind the Bill, FM Sitharaman said that a cess is being imposed because under the GST system taxes consumption, pan masala is taxed under GST at 28 per cent plus compensation cess. Since the compensation cess is going to end, that portion will shift into a 40 per cent cess.

However, many types of pan masala still do not fall under the tax net because GST is applied on the basis of consumption. Under GST, there is no tax based on production capacity or output. That is why tobacco is taxed under GST and was also ,” brought under excise duty recently, the minister said.

She also added that excise duty taxes production, but pan masala cannot be taxed on production because it is not classified as an excisable product.

“So, while cigarettes were brought under excise duty and ideally pan masala should have been included too, it cannot be added because it is not in the excise category. Therefore, cigarettes now face excise duty, as they should, with more than 40% tax, so they are not cheaply available, but pan masala cannot be taxed this way. Hence, through the new law, the government is imposing a production-based tax in the form of a cess,” Sitharaman added.

(With agency inputs)