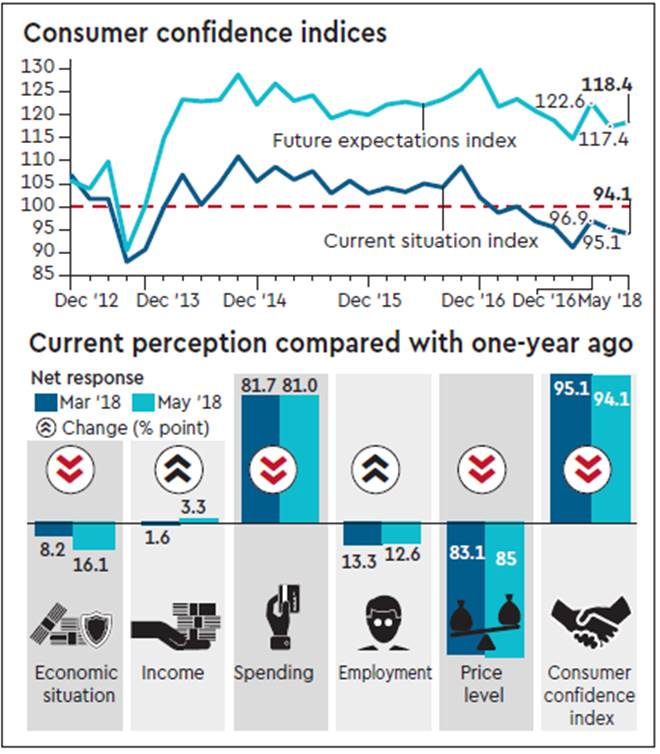

The Reserve Bank of India’s (RBI) latest monetary policy statement was more sanguine about the state of economy than many analysts viewed it — while keeping GDP growth for FY19 at 7.4% with risks evenly balanced, it expected both rural and urban consumption to remain healthy and predicted strong investment activity. But the central bank’s own consumer confidence survey, the latest edition of which came out on Wednesday, doesn’t quite corroborate the optimism.

On all parameters — general economic situation, income, spending, employment and price level — the current perceptions and expectations of the households surveyed worsened from a year ago. The survey, which records views of the citizens in six metropolitan cities, said 48% felt the general economic situation in May 2018 was worse than a year ago and 31.9% perceived an improvement.

When confronted with the same question in May 2017, only 37.7% saw the general economic situation worse than a year earlier; 36.4% saw an improvement. So the net response was -16.1 percentage points in May 2018, much worse than -1.3 in the year-ago month. The net response was -14.4 in June 2014, immediately after the Narendra Modi government assumed office. As for expectations of the economy one year from the survey period, the net repose was 21.7 percentage points in May 2018, compared with 28.3 in May last year and a much better 39.1 in June 2014.

Compared with the immediate past survey done in March 2018, net responses in May 2018 improved on “current perceptions”of ‘income’ (5 percentage points) and employment (70 basis points), but there was a worsening of the perceptions on all other parameters. In terms of expectations of the situation a year from the survey, too, improvement was seen between March and May 2018 on economic situation, income and employment, in what reinforced the RBI’s view that the economy was lately in recovery mode.

India’s GDP grew at 7.7% in the final quarter of the last financial year (Q4FY18), the fastest pace in seven quarters, aided primarily by sustained government spending. While private investments are struggling to recover, a slowing of private consumption, the main growth engine, is also a cause for concern. The share of private consumption expenditure in GDP was lower at 54.6% in Q4FY18 against 59.3% in the previous quarter.