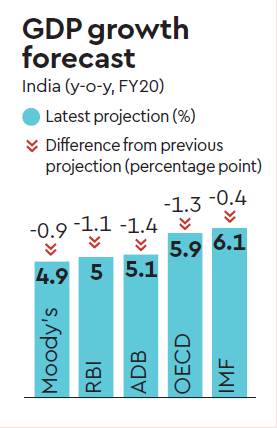

Observing that what was once an investment-led slowdown has now broadened into weakening consumption, Moody’s on Monday cut its FY20 GDP growth forecast for India steeply to 4.5% from 5.8% predicted in October, reports FE Bureau in New Delhi. The agency had predicted India’s growth this fiscal to be 6.2% in August.

The slowdown, according to Moody’s, is driven by financial stress among rural households on the back of stagnating agriculture wage growth, constrained productivity and weak job creation.

Last Wednesday, S&P Global Ratings published an FAQ where it said India’s GDP growth would decelerate to 5.1% this fiscal, adding that the year would “be a particularly difficult one for the general government’s fiscal position…”

On November 8, Moody’s had cut India’s sovereign credit rating outlook to ‘negative’ from ‘stable’ — the first step towards a downgrade —, citing “increasing risks that the country’s economic growth will remain materially lower than in the past” and the resultant gradual rise in an already-high debt burden.

The agency said on Monday that credit crunch among NBFCs exacerbated the slowdown. It said the government measures to stimulate domestic demand — income support to farmers and low income households, monetary policy easing and a broad corporate tax cut — would be “limited in offsetting the slowdown” and added that a modest recovery was expected for next year.

“While the income shock to households has been unfolding over several years, it was not visible on headline growth as long as households could borrow from (NBFCs). With the materialization of a credit supply shock, we now see the impact of these twin shocks on growth,” Deborah Tan, a Moody’s assistant vice-president and analyst, wrote.

Stating that India’s long term economic out-performance remained intact, S&P’s credit analyst Andrew Woods wrote last week, “If this recovery does not materialise, and it becomes clear that India’s structural growth has significantly deteriorated, we could lower the (sovereign) rating”.

Official data showed that almost all sectors of the Indian economy save the government continued to slide further in the September quarter to report an overall expansion rate of just 4.5%. That was the lowest quarterly growth for the country since Q4 of FY13, or a 26-quarter low. The economic growth for the first quarter of the current year was registered at 5%, a 25-month low, in the midst of elections-related disruption in government spending.

At just 1%, growth in gross fixed capital formation in the September quarter was the lowest since the third quarter of FY15 and its share in GDP (31.3%) was the meanest since the second quarter of FY18.

Nominal GDP grew just 6.1% in Q2, the lowest in decades, posing additional challenge to the government in adhering to the fiscal glide path, as per which the Centre’s fiscal deficit is to be 3.3% of GDP in FY20.

Most analysts feel that real GDP growth for FY20 could be 5% or slightly above that. This will be a series low, even with the benefit of a favourable base for the second half.