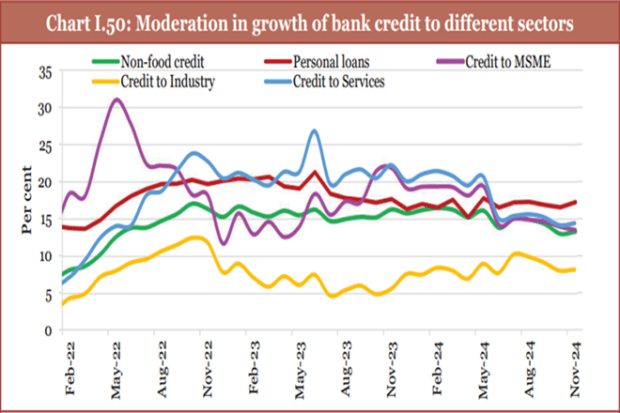

Bank credit to MSMEs has been growing faster than credit disbursal to large enterprises, according to the Economic Survey tabled by Finance Minister Nirmala Sitharaman on Friday. As of the end of November 2024, credit to MSMEs registered a year-on-year growth of 13 per cent, whereas it stood at 6.1 per cent for large enterprises.

To facilitate credit to MSMEs, a revamp of the Credit Guarantee Scheme for Micro and Small Enterprises (CGTMSE) was undertaken with Rs 9,000 crore in the corpus of the Credit Guarantee Fund Trust for MSEs. This aimed to facilitate an additional Rs 2 lakh crore credit for MSEs at reduced interest rates.

Consequent to this, the survey said the credit limit for guarantee coverage under the scheme was enhanced from Rs 2 crore to Rs 5 crore, and the annual guarantee fees across all segments were reduced by 50 per cent.

In FY23, 11.65 lakh guarantees amounting to Rs 1 lakh crore were given. The government also made special provisions for informal micro enterprises (IMEs) under the existing credit guarantee to avail credit easily.

Highlighting the issue of delayed payments faced by MSEs, the survey said from the date of launch of the delayed payment monitoring portal MSME SAMADHAAN, over 2.20 lakh have been filed by MSEs, out of which 20,652 have been mutually settled, 53,493 are yet to be viewed by MSE facilitation councils, 60,714 have been rejected, 45,952 cases have been disposed and 39,893 cases are under consideration.

To boost credit to MSMEs, the government on January 29 approved the Mutual Credit Guarantee Scheme for MSMEs (MCGS- MSME) for providing 60 per cent guarantee coverage by National Credit Guarantee Trustee Company (NCGTC) to banks and other lenders for up to Rs 100 crore loan sanctioned to eligible MSMEs under MCGS-MSME for purchase of equipment or machinery.

The scheme will be applicable to all loans sanctioned under MCGS-MSME during the period of four years from the date of issue of operational guidelines of the scheme or till cumulative guarantee of Rs 7 lakh crore are issued, whichever is earlier.