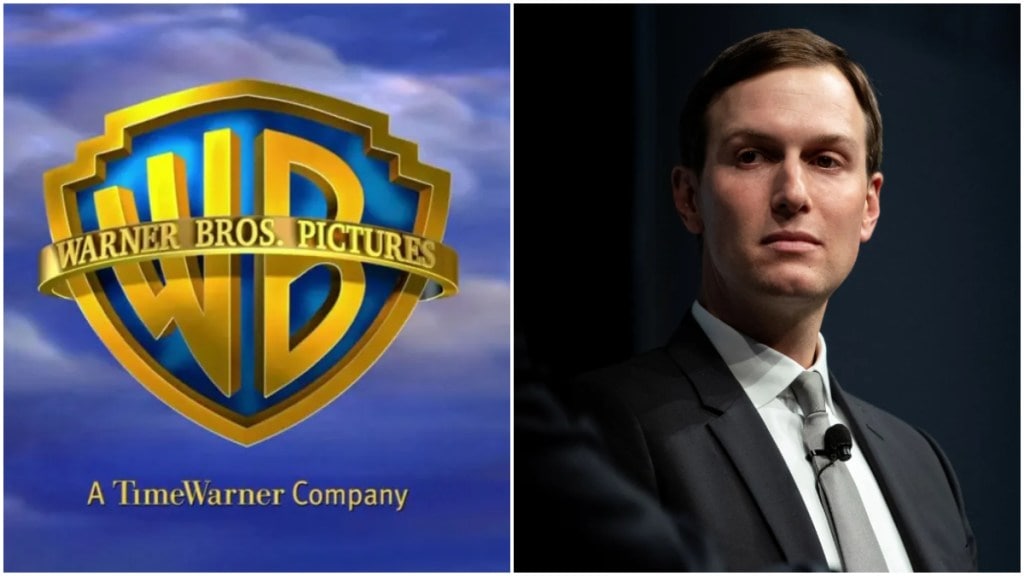

Warner Bros. Discovery’s board is likely to make a decision as soon as Wednesday about Paramount Skydance’s $108.4 billion takeover offer. A Reuters report, citing sources familiar with the matter said, the board is expected to tell shareholders to vote against the deal. Meanwhile, Jared Kushner’s private equity firm Affinity Partners, has said that it will no longer take part in the group backing Paramount Skydance’s aggressive bid to buy Warner Bros. Discovery.

Kushner exits as ‘dynamics of investment changed’

The report of Kushner’s firm pulling out of the group backing Ellison and Paramount Skydance, came soon after reports that Warner Bros. was getting ready to turn down Paramount’s takeover offer as early as Wednesday.

Affinity Partners, the firm led by Trump’s son-in-law, said it decided to step away because the situation had changed. The company explained that with two major bidders competing for control of the media company, it no longer wanted to move forward with the deal.

The firm also said that the investment no longer looked the same as it did when it first became involved in October. “The dynamics of the investment have changed significantly since we initially became involved in October,” the firm said. Even so, Affinity Partners added that it still sees strong strategic value in Paramount’s bid.

The Unexpected Takeover Bid

Paramount Skydance CEO David Ellison announced on December 8 an unexpected takeover bid worth more than $108 billion for all of Warner Bros. Discovery’s assets.

This move came only days after Netflix and Warner Bros. Discovery revealed a separate agreement in which Netflix would buy some of Warner’s most valuable businesses, including the HBO Max streaming platform, the HBO TV network, and the Warner Bros. movie studios.

Unlike that deal, Paramount’s offer aimed to buy the entire company. The bid was supported by the financial backing of David Ellison’s father, Larry Ellison, who leads Oracle as its chairman and main shareholder.

The takeover plan also included funding pledges from Jared Kushner’s investment firm Affinity Partners, Saudi Arabia’s Public Investment Fund, the Qatar Investment Authority, and a major investment fund based in Abu Dhabi.

Battle Heats Up

Choosing to move forward again with Netflix’s buyout offer would be another major turn in the battle over Warner Bros.’ valuable assets. These include its famous film and TV studio, a huge library of movies and shows, and well-known brands such as HBO and the HBO Max streaming service. The collection features classic films like Casablanca and Citizen Kane, as well as popular modern titles such as Harry Potter and Friends.

Whoever wins the deal would gain a major edge in the streaming market by securing one of the deepest and most sought-after content libraries in the industry.

In official filings, Paramount has argued that its offer is better than Netflix’s and would face fewer regulatory hurdles. Paramount said its bid is funded by $41 billion in new equity backed by the Ellison family and RedBird Capital, along with $54 billion in debt financing from Bank of America, Citi, and Apollo.