Most startups begin with a clear problem statement. Niyo did not. When co-founder and CTO Virender Bisht began building the company in 2014, foreign exchange was not the goal. What he carried instead was a long familiarity with payment rails, a sense of what routinely broke for users, and the patience to keep building until something worked.

Bisht grew up in Faridabad, in a family that had migrated from the Kumaon region. Engineering was the default choice for someone good at mathematics and physics in the late 1990s. He graduated in mechanical engineering from National Institute of Technology, Kurukshetra in 2000, even though computers interested him more than machines.

That inclination shaped his career early. He joined Tata Consultancy Services (TCS), trained in Thiruvananthapuram, and soon moved to work with GE Healthcare out of Mumbai. Over the next few years, he helped set up an offshore development centre in Budapest before relocating to Milwaukee to work from GE’s headquarters. The exposure was global, structured, and process-heavy.

By 2006, the Indian internet economy was beginning to stir. Bisht returned home, left TCS, and joined Tribal Fusion, then building its India engineering team. The role went beyond writing code. He observed hiring decisions, ad operations, and the mechanics of running a young company with limited resources.

That understanding sharpened at studyplaces.com, which he joined in 2008. The timing was harsh. The global financial crisis dried up capital, forcing the team to operate frugally before eventually merging with listed education company Educomp. For Bisht, it was an early lesson in surviving a funding winter, long before the phrase became common.

Large organisations still did not hold his interest. In late 2010, he joined MakeMyTrip soon after its IPO. As vice-president of engineering, he led its B2B platform, worked on the company’s earliest mobile initiatives, and ran the payments vertical. That role brought him face-to-face with how fragmented payment systems were and how easily customer experience broke at checkout.

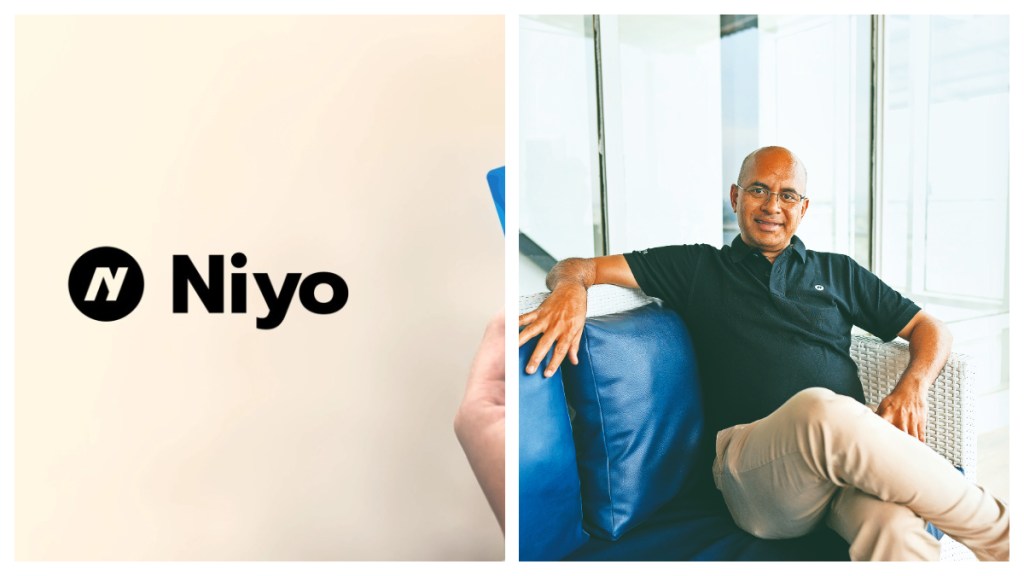

By his late thirties, the pressure to build something of his own became hard to ignore. After a brief stint as CTO at MobiKwik, to understand wallets and prepaid instruments more deeply, Bisht decided to start up. Early investor Prime Venture Partners introduced him to Vinay Bagri, who brought deep banking experience. They often describe their partnership as an arranged marriage. Niyo was incorporated in October 2014.

There was still no single defining idea. Early concepts were ambitious but impractical. One prototype allowed employees to access salaries twice a month. It addressed cash-flow mismatches but ran into employer resistance and regulatory complexity.

The first real traction came in 2015 with the Niyo Benefits Card, a multi-wallet product that digitised meal vouchers, allowances and reimbursements. Adoption was strongest among Bengaluru’s corporate workforce. This was followed by Niyo Bharat, a salary and payments solution for blue-collar workers, initially via prepaid cards and later full savings accounts in partnership with banks. At its peak, the company was issuing between 70,000 and 100,000 cards a month.

How Users Discovered Niyo’s “Killer Feature”

The most consequential shift came unintentionally. Some benefits-card users began swiping their cards overseas and realised there was no foreign exchange markup. At the time, Indian travellers routinely paid 3–5% per international transaction. Niyo moved quickly, launching Niyo Global – zero-markup international debit and credit cards – in partnership with DCB Bank.

The timing, however, was poor. The pandemic brought international travel to a halt, forcing a reassessment of priorities. As travel resumed, Niyo chose to narrow its focus, doubling down on global travel and gradually stepping back from other verticals. Today, Niyo Global contributes close to 90% of the company’s business, onboarding around 30,000–40,000 customers a month, largely through organic referrals.

Scaling the Student Niche

Students emerged as the strongest advocates, particularly those studying abroad. In campuses such as IIM Lucknow and among MBBS students overseas, the cards spread through peer recommendations. Bisht says the signal of product-market fit came when people began recommending Niyo in everyday conversations, without prompting.

Midway through this evolution, the financials began to reflect the shift. Niyo now employs over 500 people and is targeting profitability next year. In FY25, the company reported a 32% increase in operating revenue to Rs 123.4 crore, while losses narrowed to Rs 77.8 crore from Rs 143.5 crore a year earlier.

A decade after incorporation, Bisht still describes Niyo as being at “day zero”. It is less a statement of ambition than of method. The company did not begin with a sweeping thesis. It arrived at its core business by staying close to infrastructure, regulation and user behaviour.