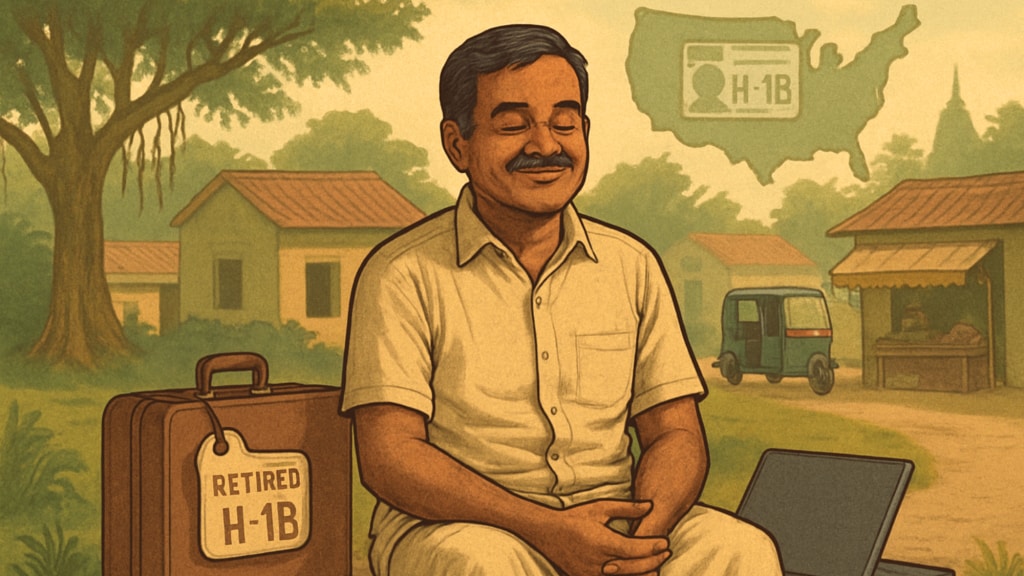

A man, who is currently living in the US on an H-1B visa, shared his retirement plan on Reddit. The man said that he wishes to take an early retirement, on his 45th birthday, in a tier-3 city in India.

The man, who goes by the username “@Kallu_786”, further revealed in his Reddit post that he is married with two Indian-born daughters. He claimed that his “role” is “moving” to Canada and that the company is offering him less salary – a reason that prompted him to think of an early retirement and return to India.

“I am currently living in the US on an H-1B visa. I’m a 44-year-old male, married, with two Indian-born daughters aged 13 and 10. My role is moving to Canada with less salary,” he wrote.

He added, “I am planning to move back to India rather than Canada, as my wife doesn’t like winter. So, no Canada/USA for long term.”

In his post titled “planning to retire after 45 years”, he added that he has Rs 4 crore savings, along with a plot and his wife’s monthly salary.

He further said, “I’m considering retiring in a Tier-3 city in India with a total corpus of Rs 4 crore (approximately Rs 2 crore in mutual funds and Rs 2 crore in bank accounts, high-yield savings accounts, and gold).”

Household income is Rs 1.1 lakh

The man dived deep into his finances to help fellow Redditors understand his situation and better advise him.

“I own a fully paid 2BHK + study flat, which generates a rental income of Rs 28,000 per month. My wife is a government school teacher in a tier-3 city. Our current monthly income is approximately Rs 1.1 lakh (from her salary and rent). We also own a plot worth around Rs 75 lakh,” he further shared.

‘By retire I mean…’

In the next few lines, he clarified what he meant by “retirement”, which is, in his words, stepping away from the full-time job. He also shared that although he would step away from his full-time role, his wife would continue her government job.

“By ‘retire’, I mean stepping away from full-time employment but remaining engaged through part-time work in areas I enjoy, such as teaching or working with non-profits. My wife intends to continue her government job,” his post further read.

He shared one more plan: “We plan to rent a place in a Tier-3 city, with estimated monthly expenses of around Rs 50,000.”

The 44-year-old ended his Reddit post with several questions for the community: “Am I falling short in funds? Should I consider extending my retirement timeline by another 5 years? Should I continue working in the US for a few more years while my wife continues her job in India? Kids’ education and marriage expenses are big expenses in the near future. Is it a wise decision to sell the plot?”

Did Reddit support his retirement plan? Is Rs 4 cr savings enough? Read on to find out.

“Moving back to India would be a good practical decision. You have adequate savings and enough income from your real estate and your wife’s job to quit your US/Canada job. You don’t have to retire. Take a couple of years’ break and explore additional income sources in India,” suggested one Reddit user.

Another, answering all his questions, said that they believe that the OP is falling short of funds and should extend his retirement by five more years. “It’s a dumb decision to sell plot for marriage and education. In India, only land is the greatest asset you can have. Look at people who had lands from 30-40 years back; they are millionaires now,” they further wrote.

One person chimed in, “You could always consider moving back to India and take up a high-paying Job for a few more years. With education and wedding expenses coming up, I’d want a bigger safety net to cover those, retirement and old age healthcare.”

Yet another social media user did maths and commented, “With 6L expenses per year, you are at around 65X at Rs 4 Cr. You also have 1.1L monthly income. You can easily retire/take a break, etc.”

“I don’t know if 50k per month in India would be enough. India feels a lot more costly now,” said another. In response, the OP said that even if monthly expense goes up slightly, he is willing to give it a shot, all for “living together” with his family.

Another thinks, “4 cr is nowhere near fat retirement amount in my opinion.”