By Lokesh Shah

The legal framework for the administration of foreign exchange transactions in India is provided by the Foreign Exchange Management Act, 1999 (FEMA). Under FEMA, all transactions involving foreign exchange have been classified either as capital or current account transactions.

Specifically in the context of the Liberalised Remittance Scheme (LRS), all resident individuals, including minors, are allowed to freely remit up to USD 2,50,000 per financial year for any permissible current or capital account transaction or a combination of both. LRS Scheme was introduced in February 2004, with a limit of USD 25,000, and thereafter, the limit has been revised in stages consistent with prevailing macro and micro economic conditions.

Tax Collection at Source (TCS) provisions have existed in the income tax law since 1988. While TCS provisions were not aimed at augmenting tax revenue, they served several other purposes – such as tracking the transactions, enabling the tax officer to verify whether individuals have filed their tax returns, and assessing the accuracy of income declaration of such taxpayers. Recent amendments have raised concerns about whether the increased TCS rate aligns with the original intent behind the TCS provisions besides the expanded scope of these provisions.

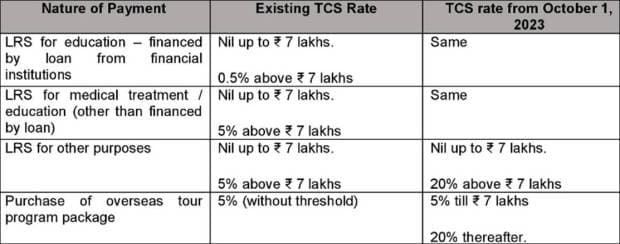

TCS on LRS and overseas tour packages were first introduced in the income tax law effective from October 1, 2020, with the intent to widen and deepen the tax net. Finance Act, 2023 amended the law to increase the TCS rate from 5% to 20% for LRS remittance as well as the purchase of overseas tour packages; and to remove the threshold of Rs 7 lakh for triggering TCS on LRS.

Owing to various representations from stakeholders, including banks and financial institutions, the threshold of Rs 7 lakhs was restored for TCS on all categories of LRS payments besides postponing the applicability of TCS on certain transactions to October 1, 2023.

Existing and new TCS rates effective October 1, 2023

On May 16, 2023, the Ministry of Finance issued a notification amending the current account transaction rules to include the use of international credit cards within the cap of USD 250,000 LRS. This was later postponed citing concerns about insufficient time for banks and card networks to develop their IT systems. The postponement of the classification of use of international credit cards while being overseas as LRS came as a big relief for banks as well as remitters.

TCS shall consequently not apply to expenditures incurred through international credit cards.

TCS provisions also require a person collecting tax to comply with certain filing obligations. Failure to comply with these provisions may lead to interest and penal consequences.

At this stage, there is no real-time facility available to AD bank to track all LRS payments, including prior remittances. Keeping this in mind, CBDT clarified that if the AD bank correctly collects TCS based on the information given in an undertaking by the remitter, including details of prior remittances, the AD bank will not be treated as an assessee in default and should not face penal consequences. CBDT has further clarified that the same methodology, of collecting an undertaking from the remitter, may be adopted by sellers of overseas tour packages to collect TCS.

TCS is available as credit while computing tax liability in addition to TDS and advance tax. To the extent tax liability is lower than the TCS amount, such excess tax paid, by way of TCS, will be available as a refund. With the increased TCS rate of 20%, there are likely to be cash-flow issues for the remitter including a wait time for a year or more to file the tax return and thereafter obtain a refund.

Government’s decision to increase TCS on LRS from 5% to 20% is still perplexing considering the original intent which was to widen and deepen the tax net through tracking individual transactions. Stakeholders are nevertheless geared up to implement it effective from October 1, 2023.

(Author is Partner, IndusLaw. Views expressed are personal.)