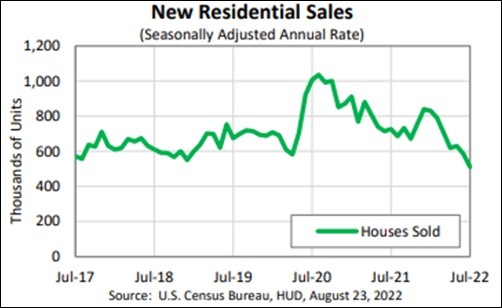

The U.S. Census Bureau and the U.S. Department of Housing and Urban Development have jointly announced the new residential sales statistics for July 2022. Fewer Americans are buying new houses if July figures are considered. Sales of new single‐family houses in July 2022 were at a seasonally adjusted annual rate of 511,000, which is 12.6 percent below the revised June rate of 585,000 and 29.6 percent below the July 2021 estimate of 726,000.

Despite the falling demand of new homes, prices are not coming down and have rather increased in July. The median sales price of new homes climbed to $439,400 last month from $402,400 in June, when prices dropped to the lowest level in a year after a record high $458,000 in April.

Also Read: Jackson Hole Economic Policy Symposium 2022: A landmark event amidst changing economic scenario?

The housing inventory is also showing a reasonably good supply. The seasonally‐adjusted estimate of new houses for sale at the end of July was 464,000. This represents a supply of 10.9 months at the current sales rate – it means the current supply needs 10.9 months to get extinguished.

The home prices went up sharply and then after the series of rate hikes by the Fed, the housing market cooled down. Even the housing construction activities are slowing down and the July month’s new construction sales numbers also showed a dip.

Existing-home sales sagged for the sixth straight month in July, according to the National Association of Realtors. All four major U.S. regions recorded month-over-month and year-over-year sales declines. Total existing-home sales completed transactions that include single-family homes, townhomes, condominiums and co-ops, slipped 5.9% from June to a seasonally adjusted annual rate of 4.81 million in July. Year-over-year, sales fell 20.2% (6.03 million in July 2021).

Also Read – Tesla Stock Split: 2 additional shares get credited to account, trading on a split-adjusted price soon – Check dates

The housing sector woes are far from over. The mortgage rates have increased and may rise further when Fed hikes rates next month. As home prices continue to remain high, the languishing demand for new homes and construction of new homes may continue as well.