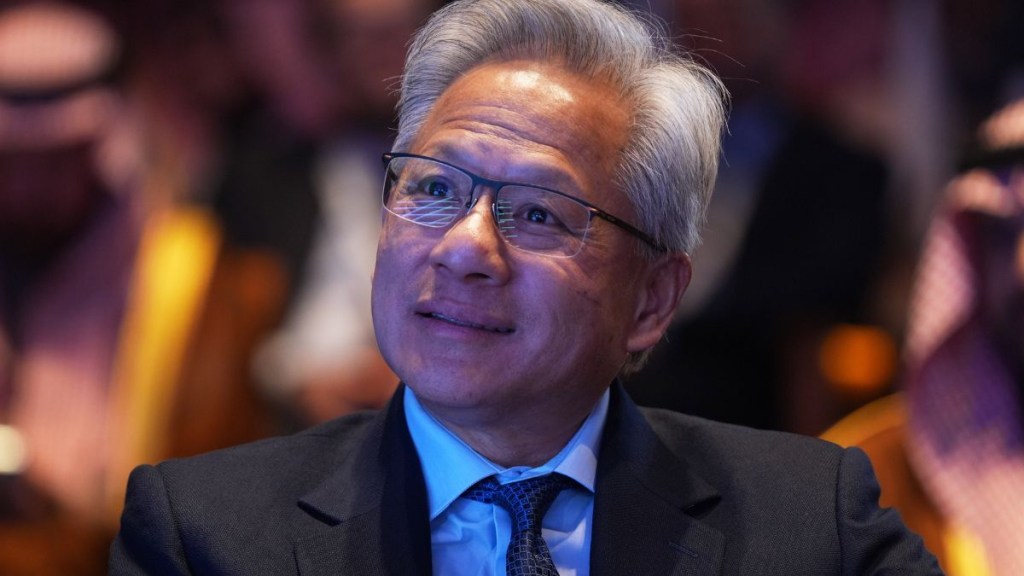

The ‘AI bubble’ questions keep finding their way to Nvidia CEO Jensen Huang, as the market continue to debate on whether such an thing even exists. The Taiwanese-American business executive joined Elon Musk for a brief interaction at the US-Saudi Investment Forum at the Kennedy Forum in Washington DC on Wednesday (US time). Given the current artificial intelligence boom, even the interview moderator couldn’t hold back from asking the big question to Huang.

“Are we going to have an AI bubble,” he asked, instantly eliciting a cheeky laugh from Huang, who, in turn, wondered, “That’s the last question?” What followed was a three-minute response, in which Jensen went on to break down the current scenario and dispel the worries fuelled by the potential “AI bubble.”

Jensen Huang dismisses AI bubble fears

Contrasting the arising concerns with how Nvidia views things, Huang pointed towards “three things” happening right now.

He began his explanation, “We all know that Moore’s laws run its course and the ability that the amount of demand for computing vs the amount of computation we can get out of general purpose computing is really challenging.”

Noting how the world has been progressing towards “accelerated computing” for a while, Huang said even Nvidia has been pushing it for over 20 years. Turning to supercomputing statistics, he continued to divulge that CPUs were 90% of the world’s top 500 supercomputers six years ago. However, the figures had dropped so significantly these past years that in 2025 the same number had reduced something close to 10%.

On the contrary, he said, accelerated computing embraced a different path altogether, going from 10% to 90%. “One of the most intensive computation things the world does in cloud is data processing,” Huang went on. “Several hundred billions dollars of computation id done on just raw data processing,” he said, while emphasising that it has nothing to do with AI.

The Nvidia CEO further pointed out that these AI-devoid data frames are the very thing driving the different worlds of banking, e-commerce and a lot more in the world today.

He then looked at generate AI. “The most important application of the last 15 years is called Rexus – recommender systems – do we know know what information to recommend to us is a social feed? How do you know what ad to recommend to somebody?” and so on and so forth.

Jensen Huang noted, “The Internet is so gigantic without a recommender system. That little tiny phone of us will have no chance of ever seeing the right information.”

With Rexus as the “engine of the Internet today,” he said even that is all generative AI. “It used to be running on CPUs, now runs on GPUs.”

Huang finally explained the third opportunity: Agentic AI. “This is Grok, OpenAI, Anthropic, Gemini,” he said, adding, “agentic AI sits on top of that.”

“Don’t forget to think about what is happening underneath what everybody sees as AI today. There’s a whole movement of computing from general purpose computing to accelerated computing,” Huang concluded. “If you take that into consideration, you’ll come to the conclusion that, in fact, what is left over to fuel that revolutionary agentic AI is not only substantially less than you thought, and all of it’s justified.”

What is AI bubble?

Earlier this year, OpenAI Sam Altman reportedly pointed towards artificial intelligence being in a bubble. “Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes. Is AI the most important thing to happen in a very long time? My opinion is also yes,” The Verge quoted him saying in August.

Although Huang counters claims of any AI bubble, Google boss Sundar Pichai said this week that every company would be affected if the said bubble were to burst, according to the BBC. He noted that while AI investment’s growth had been extraordinary, there was some “irrationality” behind it. “I think no company is going to be immune, including us,” he said.

But what does the term mean? In simple words, Silicon Valley is fearing that the drastic surge in AI tech companies’ value in recent times would ultimately hit rock bottom. Given the intense condition of the AI market, these tech leaders are shelling hefty costs to stay ahead of the curve, but stock markets are already fearing a repeat of the Dot-com boom era, which culminated with a shocking bust in the late 1990s.

Much like the current scenario, the era of Dot-com rise saw internet-based companies soaring to a rapid rise in their values until the life-changing crash resulted in job losses. Similarly, the stock markets are now fearing that AI companies may be overvalued, with even JPMorgan boss Jamie Dimon telling the BBC, “the level of uncertainty should be higher in most people’s minds.”

Nvidia earnings calls: Q3

During the Wednesday chat with analysts, Huang further reiterated that his company at the centre of the artificial intelligence boom saw things very differently than the emerging talks about an AI bubble.

Laying down the same three-point argument, he said, “As you consider infrastructure investments, consider these three fundamental dynamics. Each will contribute to infrastructure growth in the coming years,” as per CNBC.

The earnings report indicated that Nvidia’s revenue and profit crossed the prior $500 billion forecast for AI chip sales Huang made over the 2025-2026 calendar.

The fiscal third-quarter earning and revenue report also jumped past Wall Street expectations, with Nvidia’s shared rising above 4% in extended trading. The AI chipmaker company revealed that the Q3 net income rose 65% to $31.91 billion or $1.30 per share, from $19.31 billion, or 78 cents per share when compared to the previous year’s same period.