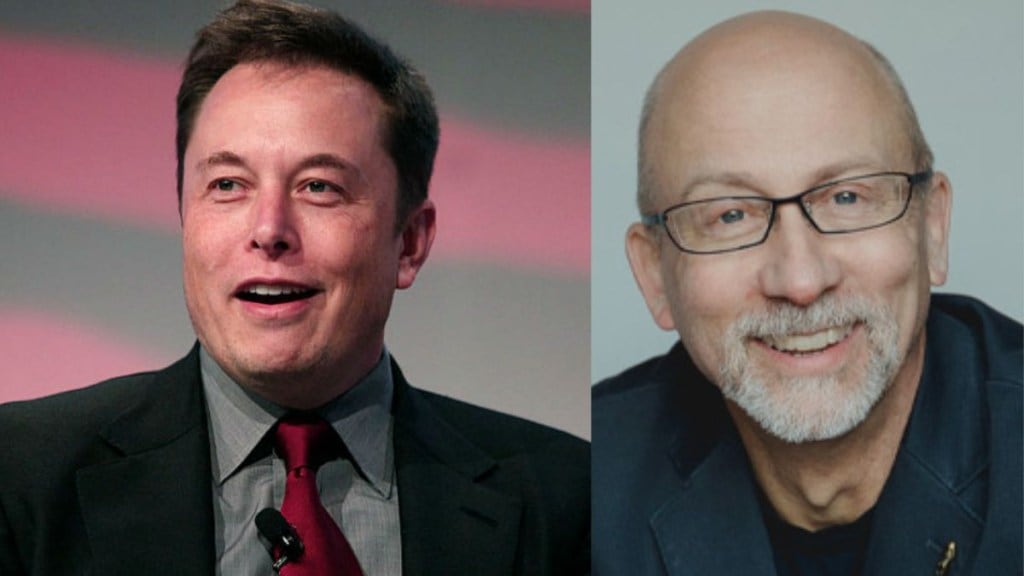

Elon Musk has backed Keith, Chief Investment Officer of Fitz-Gerald’s claim that Tesla, the electric vehicle giant, could reach a staggering $20 trillion valuation. Quoting a post from Muskonomy that stated Fitz-Gerald’s bullish forecast, Musk said on X, “Extreme execution is needed, but a valuation of $20 trillion for Tesla is possible.” Fitz-Gerald also stated, “Betting against Elon is like betting against Steve Jobs,” adding that Tesla is on track toward an unprecedented market cap milestone.

How much is Tesla worth in 2025?

Currently valued at just over $984.73 billion, Tesla would need to increase its valuation more than 20-fold to hit the $20 trillion mark. The prediction hinges on Tesla’s continued dominance in electric vehicles, advancements in AI and robotics, energy storage, and autonomous driving technology. Still, the SpaceX and Tesla CEO made it clear that such a valuation won’t come easy.

Keith on Tesla

Speaking to CNBC, Keith Fitz-Gerald noted that while Tesla is aiming to make strides in artificial intelligence, it also needs to prioritise launching affordable vehicle models. He suggested that referring to Tesla solely as a car manufacturer underestimates its broader potential. Addressing the challenge posed by China’s manufacturing surge, Fitz-Gerald pointed out that Tesla’s long-standing presence in the Chinese market has given it a solid understanding of local business strategies and technological trends. Still, he stressed that the company must ramp up its innovation efforts to stay competitive.

What does Elon Musk’s remark imply?

Elon Musk’s remarks focuses two critical factors: the need for “extreme execution” and the possibility of immense valuation growth. To reach such ambitious targets, Keith suggests Tesla must execute its plans scaling up robotaxis, deploying Optimus robots, and expanding its energy storage business. Any missteps could put that vision out of reach. The $20 trillion valuation is not just a speculative figure, it reflects Tesla’s strategic shift beyond automobiles into AI and clean energy. Keith compare this evolution to Apple’s reinvention under Steve Jobs.

Why are Tesla’s shares falling?

Tesla shares tumbled nearly 9% on Wednesday after the company posted its second-quarter earnings, revealing a 12% year-over-year drop in revenue, which is the sharpest decline in over a decade. With revenue coming in at $22.5 billion, Tesla missed Wall Street expectations, triggering fresh concerns about its short-term growth prospects. The earnings miss rattled investors, which has led to a sharp sell-off and renewed scrutiny of Tesla’s immediate strategy. Tesla’s stock has fallen more than 33 per cent this year as the company struggles to meet investor expectations for vehicle sales.

“Investors have given Tesla the benefit of the doubt for several quarters, even in the face of clear challenges,” Garrett Nelson, an analyst at CFRA Research, told CNN. “But now, they’re reassessing the narrative. One of Musk’s strengths has been keeping investor focus on the long-term vision, brushing aside near- and mid-term issues. That’s becoming harder to do as the headwinds mount.”