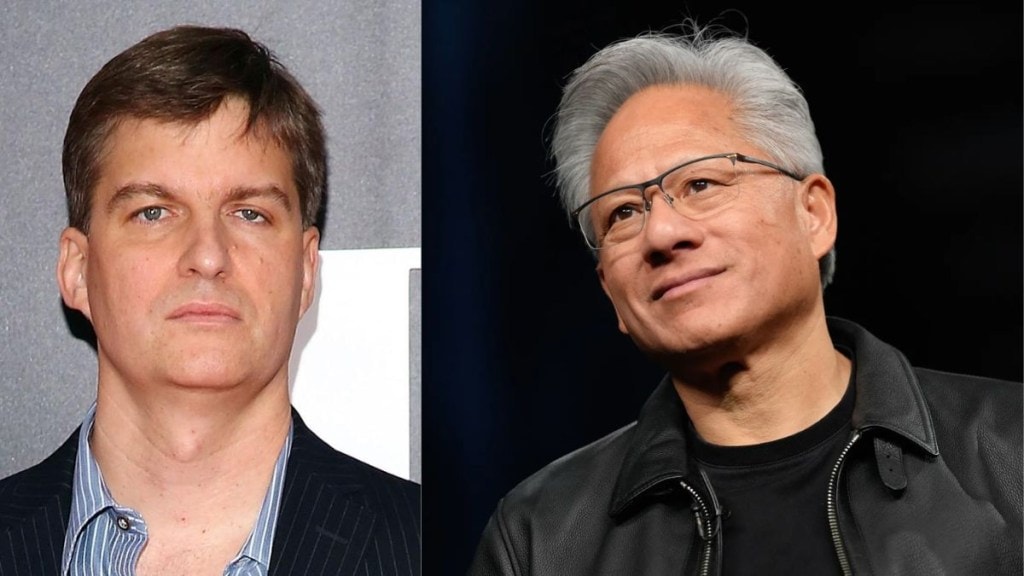

Michael Burry, the investor made famous by The Big Short, has once again criticised Nvidia and the wider AI boom, even after the chipmaker posted record earnings and gave an upbeat outlook.

Nvidia’s latest quarterly results showed all-time-high revenue and profit, and the company even predicted strong growth in the coming months. Though investors celebrated, Burry warned that the excitement around AI stocks is turning into a bubble.

Since the beginning of 2018, NVDA earned about $205B net income and $188B free cash flow, assuming all cap ex was growth cap ex.

— Cassandra Unchained (@michaeljburry) November 20, 2025

SBC amounted to $20.5B.

But it bought back $112.5B worth of stock and there are 47 million MORE shares outstanding.

The true cost of that SBC dilution… pic.twitter.com/u8VhZyokrB

What are Burry’s concerns?

Burry’s latest post on X reveals what he is worried about. He wrote, “Since the beginning of 2018, NVDA earned about $205B net income and $188B free cash flow, assuming all capex was growth capex. SBC amounted to $20.5B. But it bought back $112.5B worth of stock, and there are 47 million MORE shares outstanding. The true cost of that SBC dilution was $112.5B, reducing owner’s earnings by 50% /rant.”

He is basically saying that Nvidia is spending huge amounts of money on buying back its own shares just to balance out the stock it gives to employees, and that this makes Nvidia’s real profits for shareholders much lower.

Meanwhile, Nvidia’s leaders pushed back against bubble fears. The company’s finance chief, Colette Kress, said on the earnings call that Nvidia had “visibility to $0.5 trillion in Blackwell and Rubin revenue” for 2025 and 2026, and predicted “$3 trillion to $4 trillion in annual AI infrastructure build” by 2030.

CEO Jensen Huang also addressed bubble concerns directly, saying, “There’s been a lot of talk about an AI bubble. From our vantage point, we see something very different.”

But Burry is not convinced. As Nvidia’s stock jumped more than 5% after hours, he used X to criticise the company’s accounting practices, especially how it handles stock-based compensation (SBC).

Dissonance in NVIDIA’s SBC

According to reports, Burry argued that while Nvidia officially reported $20.5 billion in SBC since 2018, the real cost is much higher because the company spent $112.5 billion on stock buybacks yet still has 47 million more shares than before.

He believes this shows that Nvidia’s true SBC cost is closer to $112.5 billion, not the smaller figure reported.

He also noted that Nvidia earned $205 billion in net income and $188 billion in free cash flow during the same period and said that once the full dilution effect is considered, the company’s earnings could drop by half.

Burry also repeated his bigger worry about the entire AI industry. He shared a Bloomberg chart titled “How Nvidia and OpenAI Fuel the AI Money Machine”, which shows more than $1 trillion in connected investments between companies like Microsoft, AMD, Oracle, CoreWeave, xAI, Mistral and others.

Along with the chart, Burry wrote: “Every company listed below has suspicious revenue recognition. The actual chart with ALL the give-and-take deals would be unreadable. The future will regard this a picture of fraud, not a flywheel. True end demand is ridiculously small. Almost all customers are funded by their dealers. If you can name OpenAI’s auditor in 1 hour you win some pride.”