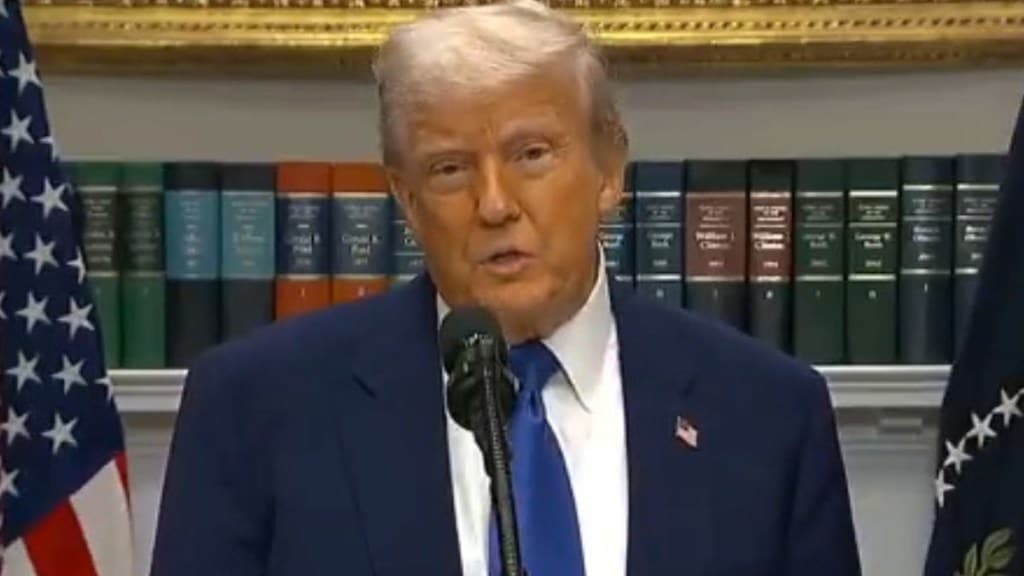

All eyes are on how Trump’s drug order would impact Indian pharma industry. Industry experts are closely watching the implications of the US President’s strategy on the Indian pharma sector. Most await clarity on exact implementation details.

The “most-favored-nation” pricing model is designed to allow Americans to purchase medications directly from manufacturers—bypassing intermediaries—and pay what citizens in the world’s most competitive healthcare systems pay.

Although clarity on the implementation of the order is still awaited, analysts are already weighing in on the potential impact.

No major worry for CDMOs: JM Financial

Sharing its outlook, JM Financial noted that the Executive Order could have a mixed impact on the pharmaceutical landscape: “Sun Pharma, Lupin, Dr. Reddy’s, Zydus, Cipla, Aurobindo, and Biocon may be impacted. CDMO companies may not see a sizable immediate impact. In fact, they could benefit from incremental orders as companies look to reduce costs. On the other hand, CRO revenues are likely to decline as R&D spending is expected to drop immediately.”

Trump’s latest move builds on his earlier attempt during his first term to bring down drug prices by aligning Medicare prices with those in peer countries—a measure later overturned by courts. This time, the order includes Medicaid along with Medicare.

US market may become less attractive for Indian players: JM Financial

JM Financial elaborated on the scope of the order: “If implemented only for Medicare/Medicaid, it would impact 25% of the US market (representing 35% of volumes). Currently, Indian generic companies have limited exposure to this segment. If applied across the entire US market, it may not significantly affect the existing US sales of generic companies but would certainly erode the attractiveness of the US pharma market, reducing the overall opportunity size.”

US biotech sector to be impacted: JM Financial

JM Financial report stated that the order may impact US biotech sector as well. “Such an executive order could severely impact the US biotech sector. Major US pharma companies aiming to cut manufacturing costs won’t be able to shift production to the US. Instead, they would have to rely more heavily on CDMO players to manage costs. It remains to be seen how Trump’s administration plans to achieve these conflicting objectives during its tenure.”

HDFC Securities: Generic companies unlikely to be impacted

HDFC Securities too sees limited impact on generics. “The generic companies are unlikely to have any impact,” the brokerage said. It added that while Sun Pharma’s specialty business (which contributes 15–18% of its U.S. sales) may be exposed to the MFN pricing ceiling, this would only affect a few products marketed globally, such as Ilumya, Winlevi, Odomzo, and Cequa. Other products—Levulan, Absorica, Bromsite, Xelpros, Yonsa, Sezaby, the Sprinkle portfolio, and the recently-approved Leqselvi (Deuruxolitinib)—are marketed solely in the U.S., and therefore may escape the MFN framework.

Indian Pharmaceutical Alliance: Generic drugs safe as Trump targets high-cost pharma

Responding to Trump’s order, the Indian Pharmaceutical Alliance (IPA) emphasized the resilience of generics amid the policy shift. “The generics industry is unlikely to be impacted, as it operates on razor-thin margins. In the US, the generics industry represents 90% of prescription volumes while accounting for only 13% of the market value.”

As Trump’s previous attempt was struck down by the federal court, experts—particularly Republican observers—are closely watching to see whether this time the policy will take effect and the fine print therein.