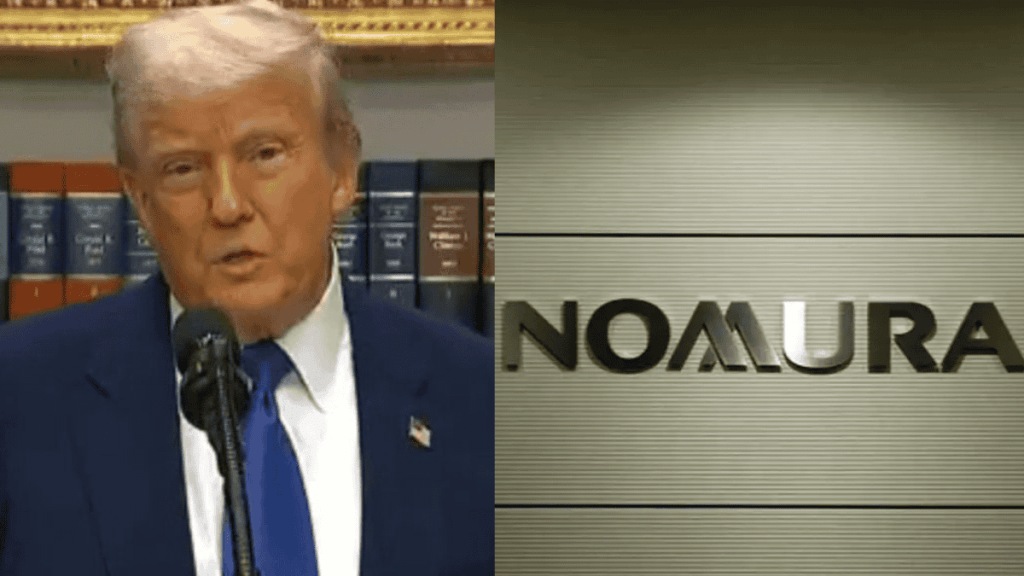

The pharma sector is staring at more uncertainty ahead after US President Donald Trump signed a new executive order on May 12, mandating that US drug companies align prices with other developing nations. Typically, the prices in the US are much higher, often 2-5x) than that in other countries where the government negotiates for lower prices. Japanese brokerage firm Nomura sees the move ushering in near-term uncertainty in the sector. Though they feel the actual implementation needs to be seen, the order has been described as “negative for the specialty/branded segment and a mixed bag for generics.”

Nomura on Trump’s executive order: Negative impact on Pharma sector

On May 12, the pharma sector stumbled at the announcement. “If implemented, this executive order could have a significant negative impact on revenues and earnings,” Nomura stated that it might also “discourage other Indian pharmaceutical companies from pursuing specialty business in the US.”

Nomura on Trump’s executive order: Sun Pharma may be hit hard

Nomura belives that Sun Pharma may be hit hard as it has significant US footprint. “We estimate that US specialty sales are at $1,036 million (FY25) for Sun Pharma. The largest product, Ilumya, with forecasted US sales of $570 million, is largely supported through Medicare Part B,” Nomura noted. The report further highlighted that Ilumya’s listed price in the US is approximately four times higher than that in other developed countries, making it particularly vulnerable to price alignment mandates.

This is particularly worrying as Nomura believes that the pricing is likely to be applicable to US government-sponsored Medicare and Medicaid programs. These programs that cover the elderly, disabled and economically weaker sections of the population account for 30-40% of the pharmaceutical prescriptions in the US

Nomura on Trump’s executive order: Mixed impact on pharma generics

The executive order also has complex implications for the generics market. According to Nomura, “Lower drug prices in the US lower the addressable market for generics and biosimilars,” especially for complex generics or those with limited competition, where current pricing is only modestly lower than branded drugs.

However, commoditized generics—where multiple players already exist—are unlikely to see much impact, as their prices are already deeply discounted due to market competition. “These generics are at significant discounts to the brand prices due to competition and here the prices are not likely to fall due to the cost structure,” Nomura explained.

Interestingly, the order’s emphasis on weakening the trade channel’s dominance may offer some upside. “If steps are taken to diminish the high bargaining power of the trade, it could lead to better price realisation and faster penetration of biosimilars,” the report added.

Trump’s executive order on pharma pricing: A detailed insight

The newly signed order from the US President Donald Trump instructs the administration to communicate targeted price levels to pharmaceutical companies within 30 days. Failure to comply could result in actions such as liberalising drug imports and restricting exports. It also proposes allowing direct-to-consumer sales, bypassing intermediaries in the supply chain.

Trump said, “Our citizens pay massively higher prices than other nations pay for the same exact pill, from the same factory, effectively subsidizing socialism abroad with skyrocketing prices at home. So we would spend tremendous amounts of money in order to provide inexpensive drugs to another country. And when I say the price is different, you can see some examples where the price is beyond anything — four times, five times different.”

While the order signals aggressive policy intent, Nomura sees hurdles in its implementation, as a similar executive move in 2020 under Trump’s earlier administration faced multiple legal setbacks and was eventually blocked by US courts.