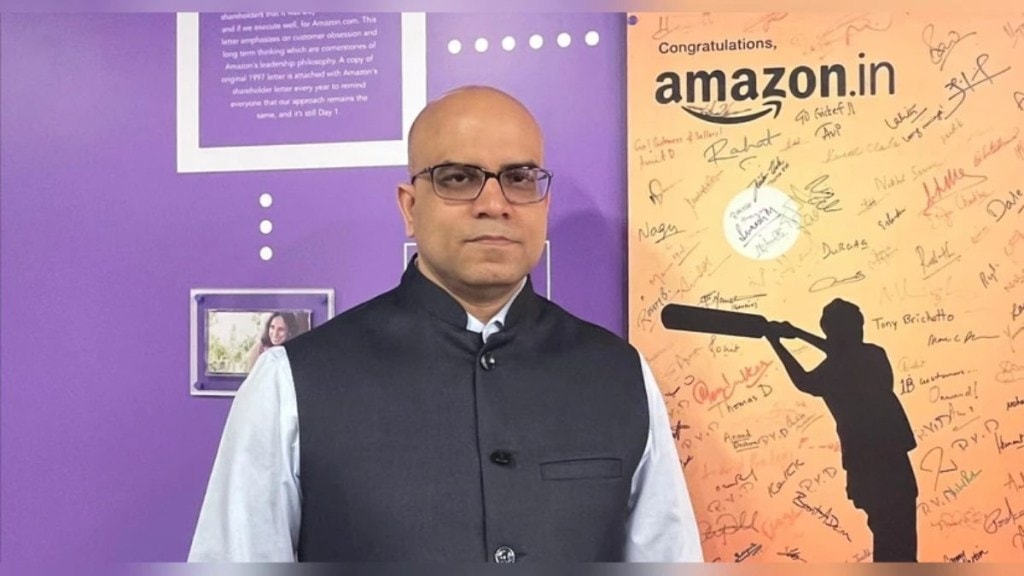

As festive shopping spreads beyond metros, smaller cities are driving record growth for Amazon India. The 2025 Great Indian Festival saw 2.76 billion customer visits, with nearly 70% from tier 2 and 3 cities, reflecting a shift towards premium choices and faster deliveries. Saurabh Srivastava, vice-president, Amazon India, discusses with Geetika Srivastava the evolving shopping trends, the role of AI, and Amazon’s focus on convenience and value. Excerpts:

What emerging consumer patterns have you seen in tier 2 and 3 cities during this festive season, and how is their shopping behaviour different from metro consumers?

The Amazon Great Indian Festival 2025 has transformed how India celebrates and shops during the festive season. This year, Amazon India recorded over 2.76 billion customer visits, with 70% coming from tier 2 and 3 cities, shopping for everything from smartphones and smart TVs to sarees, festive decor, beauty products, and everyday essentials, enabling hundreds of crores in GST savings across categories. Additionally, this year saw the highest-ever number of sellers across the country registering sales, spanning diverse regions such as Himachal Pradesh, Uttarakhand, Karnataka, Tamil Nadu, Bihar, West Bengal, Goa and Gujarat.

Two-day deliveries to Prime members in tier 2 and 3 cities grew by 37% year-on-year. Premiumisation remained a defining trend. Premium smartphones (above Rs 30,000) grew by 30%, with 65% coming from tier 2 and 3 cities. Fashion and beauty recorded up to 95% y-o-y growth in these cities, driven by a wider selection of top brands and rising interest in premium and festive categories. Amazon Bazaar saw new customers grow by over 400%, with more than 65% of users coming from tier 2 and 3+ cities.

Beverage trends showed coffee culture expanding nationally, outpacing tea with 30% growth, particularly strong in tier 2 and 3 cities at 60%. Demand for fruits and vegetables also surged by 50%, contributing to an overall 60% growth from tier 2 and 3 cities. Additionally, seller success reached a new high, with the highest-ever participation of small and medium businesses (SMBs), over two-thirds of which hailed from such cities and beyond.

Amazon launched Rufus, its generative AI-powered conversational shopping assistant in India. How has AI adoption impacted shopping behaviour?

To enhance customer experience, we have been continuously investing in our AI-powered shopping assistant, Rufus, which helps customers find the right products based on their requirements. Rufus enables customers to make informed purchase decisions through broad product comparisons, quick answers, price history, product summary videos, and personalised recommendations, specially trained to understand the diverse shopping needs of Indian customers. It is trained on Amazon’s extensive product catalog and information from across the web and has already assisted over 1 crore customers, guiding them on everything from general queries like “what to consider when buying headphones,” to occasion-based suggestions such as “gifting ideas this festive season,” to product comparisons like “which is better: a 4K OLED TV or a 4K LED TV,” along with trending recommendations and real-time support while browsing.

What sectors/categories saw impressive growth this festive season on the platform?

This festive season, we witnessed strong growth across categories, reflecting the diverse and evolving preferences of Indian customers. Gold jewellery sales surged 96% y-o-y, led by trusted brands such as Caratlane, Joyalukkas, and Malabar Gold & Diamonds, with growing demand for 14K and 18K modern designs. Fashion and beauty recorded significant growth driven by selection across top brands and rising interest in premium and festive categories. Lab-grown diamond jewelry witnessed an exceptional 390% growth, premium watches grew 55%, premium apparel brands rose 150% driven by festive wear, and precious jewellery and silver coins surged 200%. For the auto category, we saw two-wheeler sales grow by 105% y-o-y, led by an expanded selection from top OEMs and rising interest in connected mobility devices by 88%. The home, kitchen & outdoors category also saw strong festive momentum with festive decor growing 500%, home fitness equipment up 60%, and continued adoption of smart home and security products as customers invested in comfort and convenience. Amazon Fresh continued its robust expansion, now serving 270 cities, with tier 2 and 3 cities growing 60%, with fruits and vegetables driving 50% of this demand. Health, wellness and premium grocery categories—including organic, sustainable, and functional products, doubled y-o-y, highlighting a shift toward mindful consumption.

How does your ultra-fast delivery model/quick commerce model fit into Amazon’s broader festive shopping strategy?

To also cater to the immediate and urgent needs of the customers, Amazon Now has launched its ultra-fast delivery service in select parts of Bengaluru, Delhi and Mumbai. The service offers a curated selection across daily essentials, including groceries, personal care, beauty products, electronic accessories, small appliances, baby products, pet supplies, and last-minute festive needs among others. The company has opened more than 100 micro-fulfilment centres across three cities to enable faster deliveries with Amazon Now and plans to open hundreds more by the end of the year. We strongly believe that multiple models will exist to serve different customer cohorts. There are customers who index on speed, and then there are those who index on selection and value. So, our focus is to have something for everyone as we continue to build Amazon.in as India ki apni dukaan.

What consumer response have you seen to GST rate cuts?

This festive season, the new GST regime has positively impacted customers, further driving demand. To address this, we launched a dedicated storefront—The Great Savings Celebration, #GSTBachatUtsav—featuring badges on products indicating applicable GST savings, thereby enabling customers to easily identify and avail these offers. Amazon.in also enabled sellers to pass on GST benefits worth hundreds of crores through The Great Savings Celebration. #GSTBachatUtsav storefront was available across appliances, fashion, essentials and other applicable categories.

How has the demand been for gold and silver coins this Dhanteras?

This year, customers are increasingly turning to Amazon India for their auspicious purchases of gold and silver coins for occasions such as Akshaya Tritiya and Dhanteras, reflecting a growing preference for authentic, hallmarked products. Shoppers are exploring the widest range of gold coins across price points and weights, from 1g to 10 g, with 2 g coins emerging as the most popular choice. The festive spirit is also driving strong demand in jewellery — both gold and diamonds, including lab-grown diamonds, as customers lean towards pieces that combine tradition with contemporary trends. Precious and hallmarked gold jewellery has seen a remarkable 96% y-o-y growth, while lab-grown diamonds have emerged as a standout success, growing 150-180% across segments.