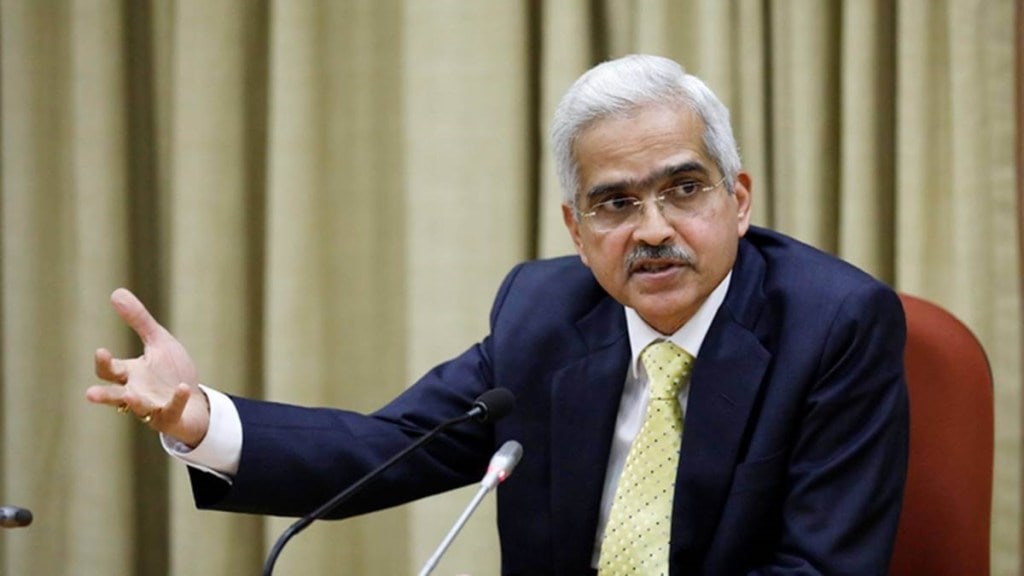

Reserve Bank of India (RBI) governor Shaktikanta Das on Friday said there is a need to address persistent issues related to customer services and protection in the financial services industry, including mis-selling, lack of transparency, hefty service charges and fines.

The strong-arm tactics used by recovery agents undo the work that is being done by lenders and the central bank, Das said at the annual conference of RBI Ombudsmen in Jodhpur. In a recent incident which went viral on the social media, a pregnant woman died after allegedly being mowed down by recovery agents working on behalf of Mahindra & Mahindra Financial Services. The RBI had earlier issued directions to banks and other financial services providers to follow fair practices while appointing recovery agents.

Also read: Instagram now has over 2 billion active users, WhatsApp has 2 billion daily users

Banks and other financiers are responsible for the actions of their service providers and the use of strong-arm methods is unacceptable, Das said.

Several incidents of payment frauds are a cause for concern as customers struggle to use the products or use them wrongly or seek help from strangers, making customer education an important issue, Das said.

“This calls for serious review of the working of the customer service and grievance redress mechanism in regulated entities. The root cause of persistence of such grievances needs to be analysed and necessary corrective measures undertaken,” he said.

In order to address this issue, banks need to strengthen their internal ombudsman processes, eliminating the need for customers to approach the RBI ombudsman, Das said. Internal ombudsman was initiated in 2018 as an independent apex authority within the bank or NBFC. The office is tasked with reviewing the proposed rejections of customer complaints before a final decision is made. The officer is also required to analyse the pattern of complaints and suggest measures to address root causes.

“We also need to strive harder to further reduce turnaround times without compromising on the quality of our resolution. There needs to be a proper and deep evaluation of the facts and evidence of a case to ensure a fair settlement,” Das said.