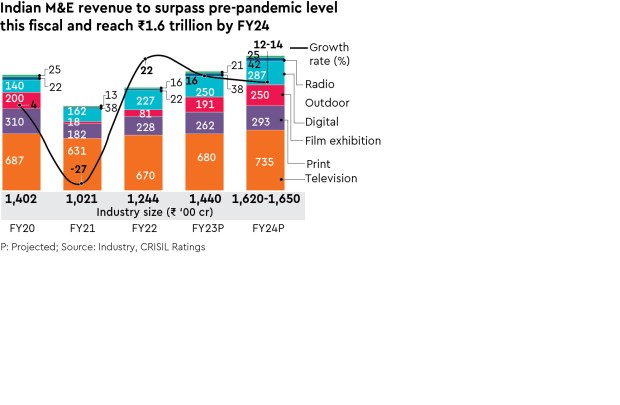

The Indian media and entertainment (M&E) sector is expected to post revenue growth of 12-14% year-on-year to approximately `1.6 trillion in FY24, against around 16% growth expected this fiscal, according to a report by Crisil Ratings. The revenue growth from advertising would be led by digital platforms, followed by TV and print, the report added.

Advertisement revenue, which accounts for around 55% of the sector’s revenue, will grow 14%, with the general elections expected in mid-2024 triggering an increase in ad spend in the last quarter of next fiscal. Subscription revenue, accounting for the balance (45%), will grow at a slower pace of around 12%, led by strong recovery in business. If film exhibition is excluded, the revenue growth would be a modest 4-5%.

Dheeraj Sinha, CEO, Leo Burnett, South Asia & chairman, BBH India, has already warned of a challenging year ahead for the advertising industry. “We will face the headwinds of the slowdown in the big tech companies as well as the start-up ecosystem,” he said.

As per the Crisil report, television will continue to hog the biggest share of the ad revenue pie but digital will lead in terms of rate of growth, rising 15-18% annually over the medium term. TV ad revenue growth rate is expected to be 12-14% in FY24. For its part, the print media will see healthy ad revenue growth of about 15% next fiscal, but would fall short of the pre-pandemic growth level because of slow recovery in ad yields, especially for English editions. Other hyperlocal media such as radio and outdoor could reach pre-pandemic levels next fiscal, helped to an extent by higher ad budgets for micro, small and medium enterprises, the key drivers for these segments, said the report.

Naveen Vaidyanathan, director, Crisil Ratings, said, “Television has emerged as the medium of choice in the past few years amid accelerated adoption of over-the-top (OTT) platforms, online gaming, e-commerce, e-learning, and online news platforms. After the pandemic, digital has become the second-largest segment after TV in terms of ad spends. Together, they account for over three-fourths of the ad revenue for the M&E sector, followed by the print segment with a one-fifth share.”

Increasing digitalisation would affect TV and print subscription in the long run, necessitating rapid integration of digital media into traditional segments, said Rakshit Kachhal, associate director, Crisil Ratings.

Crisil expects theatre collections for film exhibition, which was hit the hardest by the Covid pandemic, to surpass pre-pandemic levels with strong 30% growth next fiscal, after making a comeback in FY23. The addition of screens amid rising occupancy will support the growth. “While moviegoers are back in cinema halls, increased OTT consumption could impact theatrical collections. Some of the pandemic-driven changes in consumer behaviour may lead to structural changes in business models in the M&E sector over the long term and will need to be monitored,” said Kachhal.

Subscription revenue growth for TV and print would be driven by moderate improvement in realisations in the near term but would bear the heat of shifting consumer preference towards digital medium in the long-term, it said. “Digital today has taken centrestage in every brand-building conversation,” Rana Barua, group CEO, Havas Group India, wrote in in his column for FE recently. “Going forward, its importance is bound to get bigger and even more pronounced.”