Cipla announced the filing of an ANDA for ProAir HFA in the US, making it the first inhaler filing of the company in the US and positioning it as the second disclosed filer for the product behind Perrigo. The filing puts it on track for a launch in Q1FY20 or even earlier depending on the period of litigation. Following the Advair pMDI approval in the United Kingdom in Dec’16, this filing further reaffirms Cipla’s capabilities in the respiratory space. We expect sustained momentum on US filings and launches. Re-iterate Buy.

Second disclosed generic filer after Perrigo: Cipla announced the filing of ProAir HFA (albuterol pMDI) in the US through the ANDA route. Even after allowing time for litigation and a 30-month stay, we believe its launch is likely in Q1FY20. ProAir had CY2015 sales of $540m, with the three albuterol brands combined accounting for over $1 bn in sales in the United States. As per Perrigo’s settlement with Teva, its launch was triggered in December’16, though it has not received an approval so far, with Teva recently guiding to an earliest generic launch in Q3CY17. Lupin has an ongoing clinical endpoint trial.

High entry barriers for the product: Inhalers present one of the most complex dosage forms among generic drugs. Within inhalation, the regulatory route to the market for pMDIs is relatively easier compared to DPIs, (single flow rate, homogenous manufacturing lines), with albuterol having a predictable regulatory route given the guidelines (requires a PD trial with bronchodilatation endpoint, PK study, and invitro data). However, the challenge for pMDIs is to navigate IP due to various formulation patents for pMDI products even though the two key propellant patents (HFA-134a for albuterol and HFA-227 for Advair) have expired. ProAir HFA has four patents covering the device, valves, but importantly also the suspension aerosol formulation expiring in September ’23 and the success of generics will lie in developing a Quarter 1/Quarter 2 non-infringing formulation.

Moreover, pMDI products are difficult to scale up with the three albuterol brands accounting for 67 million devices (Cipla has 75 m unit capacities). Of this, ProAir accounts for ~35 m units, though we expect ProAir generics to gain market share from the other two brands (Ventolin and Proventil) and believe the addressable market size will be substantially large.

You May Also Like To Watch This:

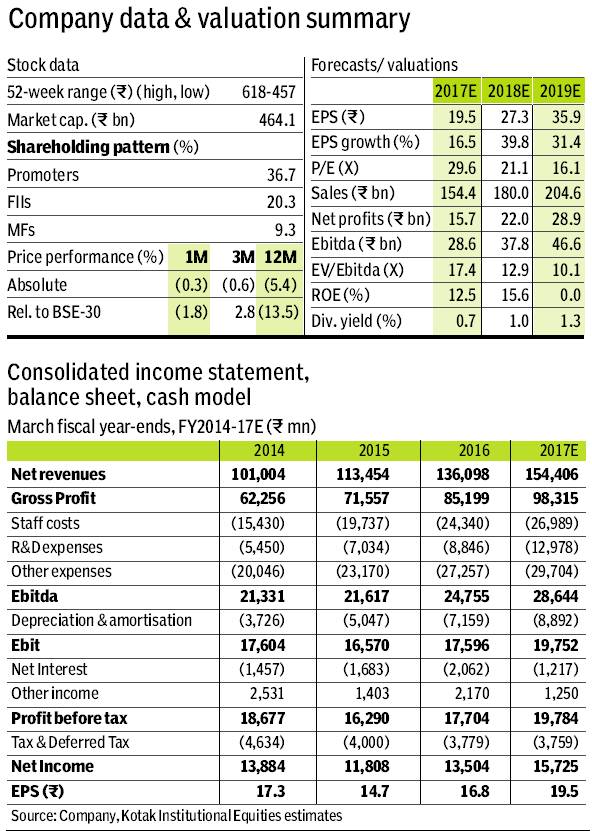

Latent technology under-appreciated—Filing and launch momentum to sustain: We expect Cipla’s US filing and launch momentum to continue through FY2018-19. We expect ProAir to contribute from FY2020 onwards, and see a potential for $80-100m revenue in the first year of launch. With strengthening evidence of an improved and focused strategy supported by a low base, diversified portfolio and solid pipeline in the US, we expect its performance to improve sequentially.