Suresh Kiranawala, who runs a grocery store in Mumbai’s Santacruz suburb, says business is booming. “Not just for me but also for my relatives in Rajasthan who run a grocery shop. Sales have been brisk they tell me,” he says, rushing to attend a group of shoppers. Indeed, a revival in India’s rural economy appears to be boosting the sales of staples.

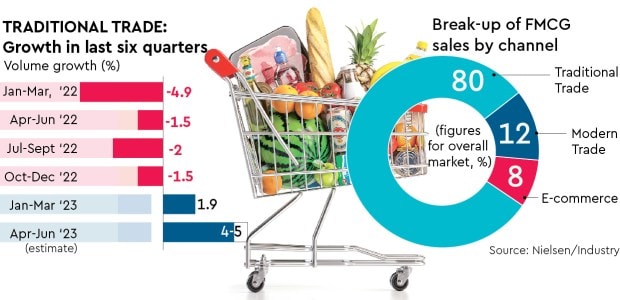

The March 2023 quarter saw a revival in FMCG sales from traditional trade after four quarters of decline in calendar year 2022, data from market research agency NielsenIQ showed. The trend may have spilled over to the June quarter as rural areas showed a consumption uptick. Over half of the nearly 12 million traditional trade or kirana stores in India are located in rural areas.

NielsenIQ data points to a growth of 1.9% in FMCG sales from traditional trade in the March quarter. Conversations with companies, analysts and industry experts suggests that the June quarter could see growth rates in the region of around 4-5% for traditional trade as stocking improves at kiranas.

“Crude-linked inflationary pressures have been waning,” says Mohit Malhotra, chief executive officer of Dabur India. “While agri-commodity inflation is a key monitorable, the larger trend has been of a moderation in inflation, which augurs well for FMCG, especially in rural areas,” he says.

India’s Rs 5-trillion fast-moving consumer goods (FMCG) market derives around 80% of its sales from these mom-and-pop stores. They remain the backbone of the FMCG industry despite the growing share of modern trade and e-commerce in last many years, especially in cities. Modern trade accounts for approximately 12% of FMCG sales while e-commerce accounts for 8%, according to industry estimates. A revival in kirana sales, say experts, is good for the FMCG market, which is considered a barometer of consumer demand.

Typically, most kirana stores have an inventory for about 30-45 days and replenish stock every 8-10 days depending on shop-floor sales. “An improvement in stocking at kiranas points to growing demand on the ground led by moderating inflation. FMCG companies are also cutting product prices which will aid volume growth and kickstart a virtuous cycle,” says Kaustubh Pawaskar, deputy vice-president, fundamental research at brokerage Sharekhan.

During Hindustan Unilever’s (HUL’s) annual general meeting last week, company chairman Nitin Paranjpe said that the firm had taken “modest price cuts” across its product portfolio. Paranjpe also said that his company was focused on volume growth as raw material inflation reduced.

“The balance between volume growth and pricing will undergo a change. We will see less pricing and more volume growth coming in,” he said of how the FMCG market would evolve in the coming quarters.

Trade sources say that HUL has taken price cuts of around 5-10% across soaps, detergents and shampoos in recent weeks. The pricing action could prompt rivals such as Godrej Consumer and Procter & Gamble to react, analysts tracking the market said, as the industry adjusts to new market realities.

For kiranas, all of this is coming after a difficult period and most want to take advantage of the momentum. Like Suresh, Darshan Kiranawala, located in the vicinity, is also optimistic. “Business is good after the high inflation we saw last year,” he says. “I find that sales offtake has improved, led by price cuts, offers and grammage increase. I hope this period continues for a while,” he adds