Data never lies. And fortunately for us, the Reserve Bank of India (RBI) puts out enough and more to be able to answer questions like the one we are digging into today – Is there really a household debt bubble in India?

Let’s dig in.

First. Let’s look at the headline data.

India’s household debt rose to 42.9% of GDP (at current prices) at the end of June 2024, from 37.6% of GDP in March 2023, as per the Reserve Bank of India (RBI) Financial stability report for December’24. Now, this clearly shows that indebtedness of Indian households did increase during this time period.

Dig a little deeper, and as per RBI’s database, outstanding portfolio of personal loans of Scheduled Commercial banks (SCBs), a subset of total household debt, grew by 24% on annualized basis between March’23 and June’24 against aggregate bank credit growth of 18%. The total outstanding personal debt stood at Rs 54.9 trillion, about 33% of total loan of SCBs.

A look at these data points alone makes the situation look grim.

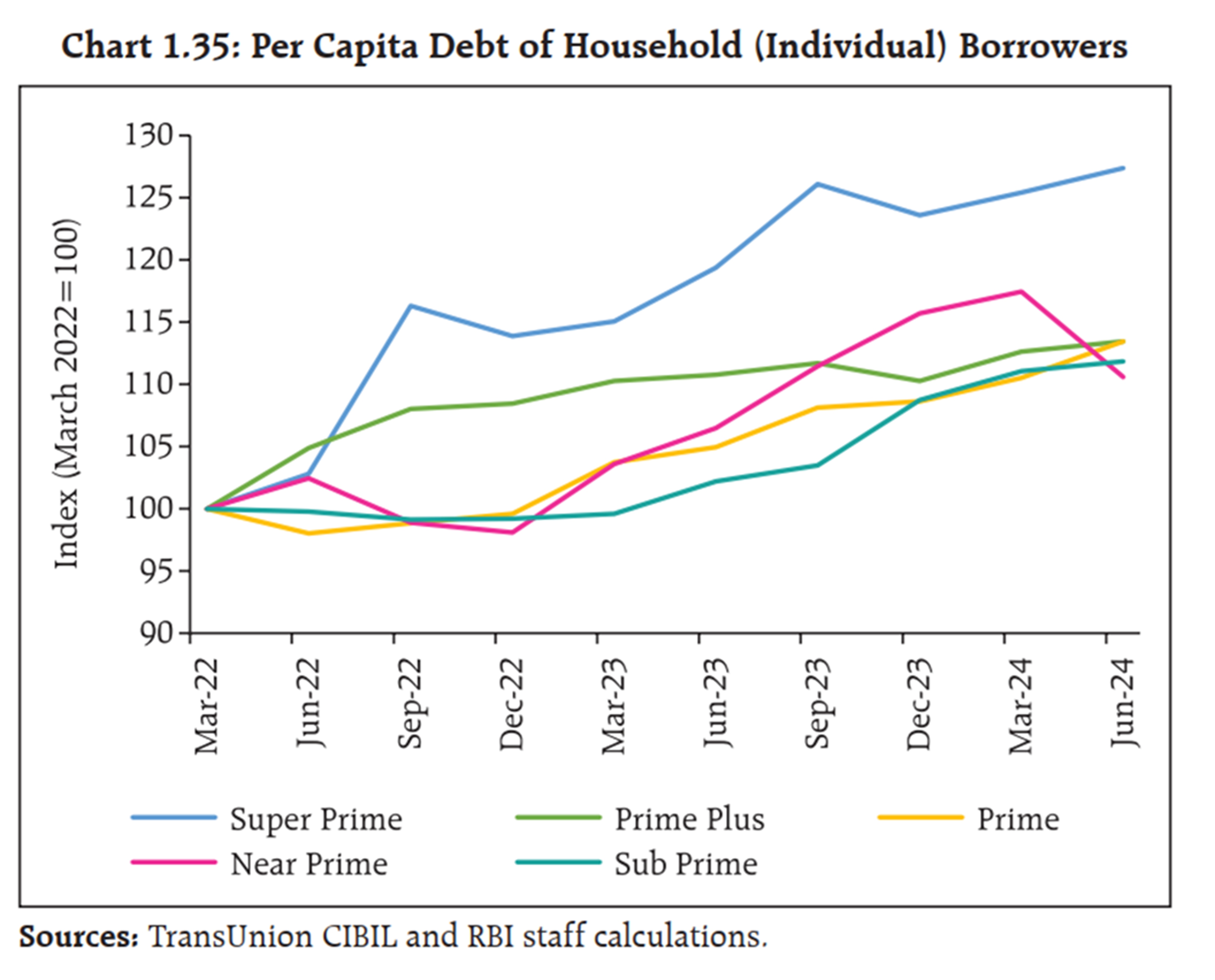

But there’s more. Household debt increase is primarily being driven by increase in total number of borrowers who accounted for more than half of the increase. Only about one-third of the increase is on account of the higher indebtedness of the same set of people, or increase in per capita debt, with the remaining classified as ‘interaction effect’. Increasing number of people getting access to formal credit implies higher financialization and, if accompanied by declining share of loan from informal sources, could mean success of government’s various programme of financial inclusion. Further, the increase in per capita debt is primarily driven by super-prime borrowers. As per the report, per capita debt for the super-prime category has increased by about 25% between March’22 and June’24 whereas the increase has been in the range of 7-10% for other groups. This is a positive trend since almost 70% of loan being taken by the super-prime borrowers is going for asset creation such as housing or vehicle loan or productive purposes such as agriculture loans, business loans and education loans, which would add to the productive capacity of the economy. “From a debt-servicing capacity perspective, the rise in per capita debt only among highly rated borrowers and use of debt for asset creation are credit positive and financial stability enhancing,” the report says. India’s debt service ratio has been in the range of 6.5-7.0% over the years, among the lowest in the world.

In effect, when one looks deeper, the news is not that all bad.

The growth in indebtedness is more due to more people taking credit as against the same segment taking on more. This is just financialization of the economy running its course.

And to the extent that per capital debt increased, the largest contributors were super-prime borrowers, who generally borrowed for asset creation.

So far, so good. But then, there’s some worrying data too.

And that’s related to the increasing share of consumption loan since 2019. At the time RBI had reduced the risk weights for consumption loans to push growth. More so because 50% of the loans being taken by the sub-prime borrowers is going towards consumption, where the chances of delinquency are higher. In comparison, the corresponding number for super-prime borrowers was just 31%. Taking cognizance of the trend, RBI increased the risk weightage for bank finance for unsecured personal loans and credit cards, apart from NBFCs, in November’23.

RBI’s move had the intended impact. Year on year growth in outstanding portfolio of personal loans of SCBs declined sharply to 12% in January’25 and more aligned with aggregate credit growth. Similarly, Gross loan portfolio (GLP) of micro-finance institutions, another subset of household loans, has declined by about 4% on yoy basis to Rs 3.85 trillion by Dec’24, as per Micrometer, the industry report by microfinance industry network.

Microfinance is small, unsecured loans, average ticket size being Rs 28,000 at the end of December’24, given primarily to low-income groups. Microfinance industry network includes NBFC-MFIs, Banks, Small finance banks and other NBFCs, with the first two accounting for over 70% of the GLP. The GLP of MFIs had risen by 25% between December’22 and December’23, when RBI increased the risk weights. Amount of loan disbursed by them has come down by 42% during Q3FY25 over Q4FY24, with number of loans disbursed declining sharply from 2.23 crore to 1.18 crore.

Yet, the damage may have already been done. As per the Mfin report, Portfolio at risk (PAR) for dues more than 180 days increased from 7.3% to 9.7% between Dec’23 and Dec’24. Total PAR, comprising of four buckets – 31-60 days, 61-90, 91-180 days and more than 180 days – has risen more sharply, from 9.3% to 16.2% during this period.

Interestingly, PAR (>180 days) had come down from 10.6% to 7.3% between Dec’22 to Dec’23. So, did the increase in risk weightage for loans to NBFCs, which may have to led to higher lending rate and higher monthly payout requirement for the borrowers, cause higher slippages? Was this among the reasons for RBI to reduce the risk weights for bank loans to NBFCs and Microfinance, effected in February? And more importantly, will this help save the small borrowers?

Summing Up

In all, while overall household indebtedness has indeed increased in India, the situation may not be as dire as the headline numbers suggest.

Disclaimer

Author is the founder of the portal – https://www.indiaeconomyandbusiness.com/

Disclosure: The writer and his dependents do hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.