Independent directors are finding the going tough with increasing instances of corporate frauds and accounting discrepancies coming to light.

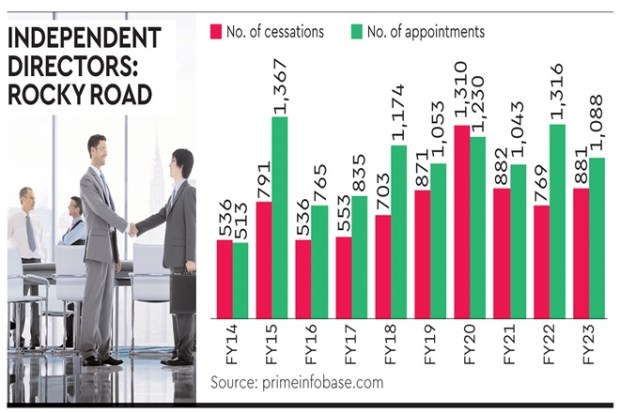

In FY23, 881 independent directors (IDs) quit the companies, data from primeinfobase.com show. This is 14.5% higher than the previous year. In absolute terms, the number of directors quitting was third highest in the last 10 years.

IDs carry both legal and regulatory obligations to raise red flags and record dissent on board matters.

Also Read: Leveraging the power of an independent board

The role of IDs in fraud detection has come under regulators’ scrutiny as they, along with auditors, are the first line of independent authorities to question any wrongdoing.

“The demands on the independent directors is much higher. Directors are aware that non compliance will lead to greater scrutiny and are aware of fraud risks and the liabilities that come with that. Older directors increasingly face the challenge of getting used to new technology,” said Shriram Subramanian, founder and managing director, InGovern Research Services.

There could also be scenarios where an independent director on the board of a wilful defaulter might get tagged as a defaulter in his personal capacity as a director for not showing dissent or for failing to act, according to experts. This could result in him being declared not fit and proper to hold any significant position in a financial intermediary or carry out any financial regulatory activity.

Last month, an independent director of Modulex Construction Technologies submitted a 65-page resignation letter to the exchanges flagging corporate governance issues at the company.

Also Read: Adani Green Energy gets certification from DNV for water conservation

To be sure, IDs are protected under the Companies Act. They are liable only in respect of those acts by a company that occurred with their knowledge and consent or connivance, or where they had not acted diligently.

That said, when something goes wrong, the IDs are among the first to come under scrutiny and have to demonstrate that they acted in good faith to be able to get any protection under the law.

While the enhanced duties, roles and responsibilities have been in force for a few years, the role of IDs has gained prominence with the implementation of the Companies Act 2013, and the Securities and Exchange Board of India’s (Sebi’s) Listing Obligations and Disclosure Requirements (LODR) Regulations, 2015.