We downgrade Sun Pharma (SUNP) to Neutral from Buy given: rising competition in Taro (US subsidiary: 35-40% of consolidated Ebitda); expiry of gGleevec exclusivity and increasing generic competition, pricing pressure on the US base business, muted margin growth despite synergy benefits of Ranbaxy merger due to rising R&D and upfront investments in specialty business; and imited scope for a rerating given close to long-term average valuations. We cut our EPS forecasts by 11%-7% over FY17-18e and tweak our triangulated PO to R855 based on revised estimates but roll over to June, 2018 (in line with the sector). While a likely resolution of regulatory issues at Halol remains the sole near term positive catalyst, concerns about sustenance of growth and increasing pressure on margins led us to downgrade the stock.

Taro facing greater competition

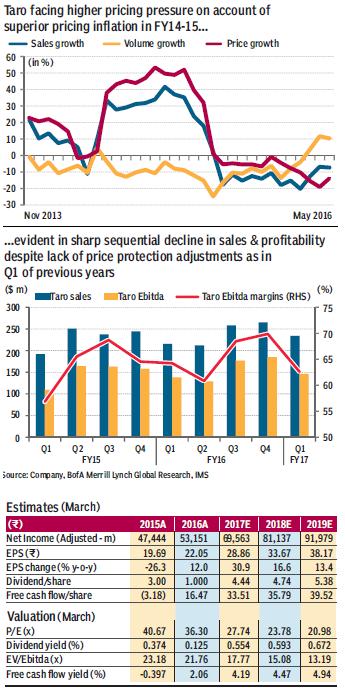

As highlighted in our quarterly results update, Taro is facing incremental competition in its portfolio of products in the US market. The niche derma space, in which Taro particularly operates (70% of Taro sales), had seen superior inflation during FY14-15, and hence is currently facing even sharper pressure on prices and market share on account of incremental competition. We cut Taro sales and Ebitda forecasts by 6%-4% and 10%-7%, respectively, over FY17-18e to factor in this incremental competition.

US growth likely to moderate; margins to remain muted

Two generic companies have already launched gGleevec in the US mkt post expiry of SUNP’s 180-day exclusivity. Given higher US base, pricing pressure in the US portfolio incl. Taro and pending resolution at Halol plant, near term growth in the US market remains challenging for the company.

Prefer Lupin over SUNP

We see long-term growth prospects for SUNP due to its evolving specialty portfolio, but on a 12-month view, we prefer Lupin among larger pharma companies.

Company description

Sun is India’s largest pharma company, with India and the US being its focus markets. Strength in high-growth chronic segments has propelled SUNP’s growth in the domestic market, while the merged entity (SUNP-RBXY) has emerged the largest player. SUNP management has a strong track record of turning around distressed assets, and with its largest M&A deal ever we believe SUNP is going to repeat its history again. We remain positive over SUNP’s long term growth prospects due to its evolving specialty portfolio.

Significant upside likely from R&D over LT

We continue to like SUNP from the long-term perspective given the evolving specialty business as company has been investing upfront in R&D as well as building front-end in specialty business. SUNP has strong track record of R&D productivity among Indian peers. Given that it has ramped up its R&D investments significantly over the last few years, we believe some of these investments are likely to bear fruit from FY19 onwards. We have attempted to value the R&D investments made by companies through three-stage DCF method with separate valuation for R&D. For valuing the R&D investments, we have computed the R&D productivity over the past 4-5 years as ratio of incremental sales from the US to R&D investment over the prior period. Though, we have assumed this productivity to hold over time for the companies, in order to build in risks associated with increasing R&D complexity, we have assigned probabilities of success to the NPV of R&D cash flows (50% for Sun Pharma). We have computed cash flows with further assumptions of 50% Ebitda margins, and elevated working capital cycle and appropriate capex and depreciation estimates. However, as visibility of cash flows from R&D is not as straightforward, we have discounted them at a higher WACC of 15% (compared with 11-13% for base businesses of various companies).

—Bank of America

Merril Lynch