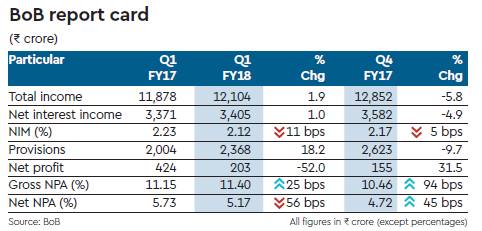

Bank of Baroda on Friday reported a 52% year-on-year drop in its net profit at Rs 203.39 crore in the April-June quarter, hurt by higher provisions for bad loans. On a sequential basis, the net profit rose 31.5%. Net interest income, which is the difference between income earned and income expended, stood at Rs 3404.95 crore, up 1% from the corresponding period last year and down 5% sequentially.

Provisions for bad loans grew 18.2% year-on-year to Rs 2368.06 crore, but sequentially, it fell 9.7%. Gross non-performing assets (NPAs) of the Mumbai-based lender stood at 11.40% of total loans, up from 11.15% in the year-ago period and 10.46% in the previous quarter. Net non-performing assets fell to 5.17% from 5.73% in the previous year, but rose 45 basis points sequentially.

Recovery and upgrade were at Rs 1,610 crore. There was no write-off during the quarter.

In a post-results press conference, the bank’s management said its share of exposure is barely beyond 3% to the 12 large accounts referred by the Reserve Bank of India for resolution under the Insolvency and Bankruptcy Code.

PS Jayakumar, MD and chief executive officer, said: “Our focus is on the accounts we control. On those, we need to be very aggressive in the use of NCLT (National Company Law Tribunal). We have done a few transactions. One of them is admitted.” He added that in the September quarter, there is a pipeline of 26 cases that BoB will refer to the NCLT. “These are not large accounts. They range between Rs 100 crore and Rs 500 crore.”

Jayakumar said BoB will stay with the net slippage guidance for the full year, which is Rs 4,000 crore. “We will claw back in the next three quarters,” he said. Jayakumar also said risks are not coming from new loans in legacy businesses. The bank will start the process of monetising its mutual fund business this quarter through a listing, while remaining invested in the insurance business.