ArcelorMittal has won the bid for bankrupt Essar Steel, finally — and arguably ‘fair and square’. The Committee of Creditors (CoC) for Essar Steel met late last night and selected ArcelorMittal’s bid as the winner, even as Ruia-family made a last-minute settlement offer to regain the control of the firm bypassing the Insolvency and Bankruptcy Code (IBC).

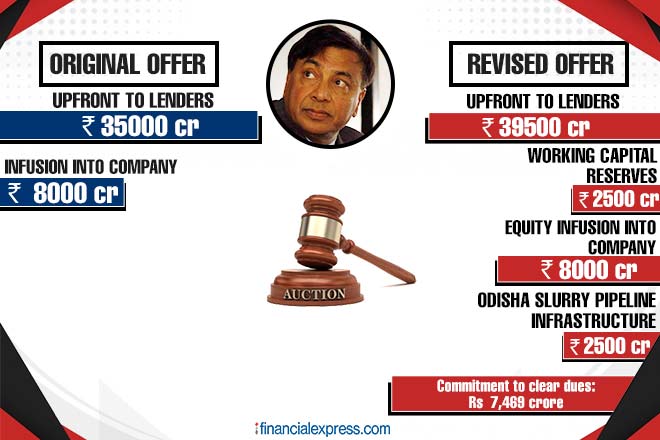

The CoC, which had earlier selected the Lakshmi Mittal company as preferred bidder, finally chose the bid on Thursday night following the companies’ revised offer of upfront payment from Rs 35,000 crore to Rs 42,000 crore. ArcelorMittal’s offer trumped Vedanta’s upfront offer of Rs 35,000 crore, while VTB-backed Numetal remained ineligible.

“ESIL’s CoC has now approved the Company’s Resolution Plan for ESIL, with the LOI (letter of intent) identifying it as the ‘Successful Resolution Plan’,” ArcelorMittal said in a statement to FE Online.

The Essar Steel IBC case got stuck in a long-drawn legal battle between ArcelorMittal and Numetal over ineligibility clause under section 29A. Ultimately, ArcelorMittal agreed to clear outstanding dues to the tune of Rs 7,000 crore as per the Supreme Court October 4 order.

ArcelorMittal winning bid for Essar Steel

“The Essar Steel resolution has finally reached a stage where it is acceptable and possible,” Punit Dutt Tyagi, Executive Partner, Lakshmikumaran & Sridharan Attorneys told FE Online on ArcelorMittal’s offer.

As far as the last-ditch effort by Essar Steel shareholder goes, Tyagi said, they do not have any locus as per the IBC law. “The section 12A says that the applicant — the Resolution Professional at the company — can withdraw from the IBC process before Expressions of Interest (EOI) have been invited,” Tyagi said.

However, one may expect this matter to reach the courts — which may delay the resolution but not help the shareholders of Essar Steel. “It’s been a year since EOIs in the case have been invited. I highly doubt Essar Steel shareholders have a case here,” he added.

Essar Steel’s shareholders on Thursday offered a lucrative settlement of an aggregate of Rs 54,389 crore including Rs 47,507 crore upfront cash payment to lenders, asking them to withdraw from the IBC case. Another legal expert, Saurav Kumar, Partner at law firm IndusLaw, also said that the deadline for withdrawing from the insolvency proceedings passed a long time ago.

“Technically speaking, the period in time for the resolution of Essar steel is past the cut off time provided under Section 12 A of the code for withdrawal,” Kumar said.