Zydus Lifesciences on Tuesday announced that it will be acquiring 85.6 percent stake in France-based Amplitude Surgical. In a press conference on Tuesday, Sharvil Patel, Managing Director, Zydus Lifesciences Ltd. announced that with this deal they will foray into the global MedTech space. Zydus MedTech currently markets interventional cardiology products.

“Amplitude Surgical is a European med tech leader in high quality lower limb orthopedic technologies. We believe that this was a natural extension in the field of medical technologies. Our commitment to quality excellence, continuous investments in R&D and expertise in manufacturing will guide us in this foray into the highly specialized med tech products, adding a new dimension to our operations,” Patel said.

Amplitude Surgical is a European MedTech leader in high-quality, lower-limb orthopaedic technologies. The Company provides numerous value-added innovations to best meet the needs of patients, surgeons and healthcare facilities. This includes the design and development of knee and hip prostheses, which are implanted in place of damaged or worn-out joints.

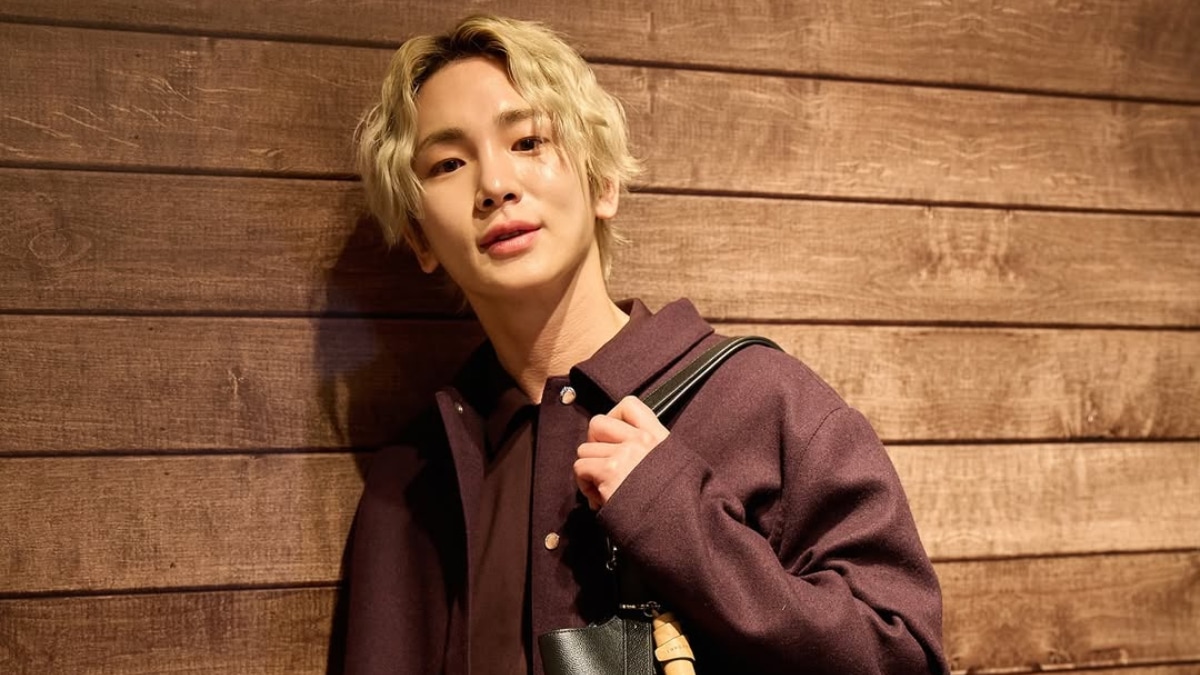

On the impact of this deal, the Managing Director told Financial Express.com: “…there are a couple of things that, are core to what we want to do. One is, the expectations on making sure that we keep patient at the center of what we do. And for that, we want to offer services beyond just the medicines. And so whether it is, medical devices which are highly technologically oriented or companion diagnostic or those kind of areas where we feel that better patient outcomes can be seen has always been the thinking as I did. The other is, obviously, we have had, we are a global company when it comes to pharmaceuticals, and we do have global aspirations from being a life sciences organization. This plans helps us in terms of globalising our plans for the med devices play that we want to do, going forward.”

He also informed that Amplitude brings great expertise in terms of technology, IT, and also the science behind what medical implants can do with Amplitude.

“…we hope to learn from those implants can do with Amplitude, and we hope to learn from those experiences and build a strong med tech business for the company,” Patel told Financial Express.com.

On the upcoming plans for the global market, Patel said that they are focused on entering high quality, high precision med tech products, which have a global demand.

“The Amplitude Equation obviously offers that opportunity in the arthroplasty market with this innovative solution for lower limb joints and joint replacement. Also, we also are forayed into cardiology and we are focusing, both on our product launches and exploring, partnerships and inorganic opportunities. And we also hope to build a strong presence in the interventional cardiology space. Also in line with the strategy on the interventional cardiology segment, we are also looking at other areas in terms of manufacturing, which we already have started to build up and research and also currently already in the commercialization phase when it comes to intervention cardiology,” he explained.

The company is also focused on the nephrology segment.

“We know there is a strong global burden on CKD, which is chronic kidney disease and we are a very relevant and large player in CKD amongst the top two players in India. And we are also establishing a state of the art dialysis manufacturing plant to produce high end membrane supporting better patient outcomes worldwide and, potentially, these are probably the first Indian company to make dialysis,” Patel told Financial Express.com.

Supported by PAI Partners, through its Mid-Market Fund, Amplitude Surgical has experienced significant growth over the last four years, driven by new product development, international growth, investments in manufacturing capabilities and R&D. In fiscal year ended June 30, 2024, Amplitude Surgical generated sales of €106.0mn and EBITDA of €27.1mn on a consolidated basis under IFRS. For the 6 months ended December 31, 2024, Amplitude Surgical’s consolidated sales amounted to €51.5mn (a growth of 5% Y-o-Y at current exchange rates) with an EBITDA margin of approximately 25.4% (unaudited figures).