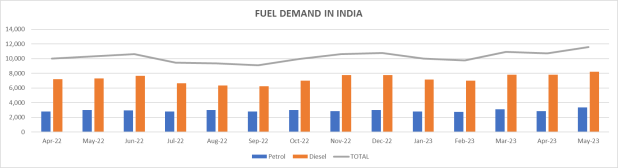

The consumption of petrol and diesel, which make up the bulk of automotive fuel demand, is expected to go down as has been the trend during the monsoon season. This is thanks to the reduction in vehicular movement, agricultural-related demand, and even reduction in power consumption compared to summers.

If one looks at the demand for petrol and diesel, the sale of diesel tends to soften between July to September and then again starts picking up from October onwards across India. For petrol, however, the change is not so pronounced. This is because people’s movement tends to come down only in select areas where the monsoon is severe.

Prashant Vasisht, VP and Co-Head, Corporate Ratings, ICRA shared that the softening of fuel demand is nothing new and is a usual phenomenon. Does this mean that there is room for a reduction in retail fuel prices? It does not seem so given that OMCs have been under pressure due to under-recovery. A closer look at the data (June 2022 onwards) shows that OMCs started seeing recovery in diesel rather recently, starting in February 2023.

Vasisht added that the demand for fuel will continue to grow by 4-5 percent in FY2024, similar to the Petroleum Planning & Analysis Cell’s projection of around 4.8 percent. The demand for diesel from the automotive space will be driven by commercial vehicles but will still be slower than that of petrol.

Despite the softening of global oil prices, the retail petrol and diesel prices in India have continued to remain in the upper range. There has been a demand to bring the fuel under the gambit of GST that may bring some respite to end-consumers, but that’s a complicated decision requiring consensus among Central and State governments. “Bringing fuel under GST will cause a huge tax loss for state governments, so it will be a bit difficult for the central government to convince the States to agree on it,” he pointed out.

Will the international prices soften? According to Industry observers, even if demand shrinks, oil-producing nations will revise output and keep the price of crude stable. It is expected that international crude prices could touch the $80/barrel position in the short- to medium term.

| Loss / Gain (per litre) | Jun-22 | Jul-22 | Aug-22 | Sep-22 | Oct-22 | Nov-22 | Dec-22 | Jan-23 | Feb-23 | Mar-23 | Apr-23 | May-23 | June-23 (till date) |

| Petrol | -16 | 0 | 5 | 11 | 11 | 11 | 13 | 8 | 8 | 9 | 8 | 13 | 13 |

| Diesel | -23 | -12 | -11 | -6 | -10 | -5 | 0 | -1 | 3 | 5 | 7 | 12 | 11 |

Responding to questions about major trends in the Indian or global oil consumption pattern Vasisht signed off saying, “I don’t see major disruptions for major petroleum products in the coming months globally as well as in India. These are essential commodities that run the economy for energy as well as mobility needs.”