By Sandeep Wasnik

Brazil is the fifth-largest country in the world, with a total area of 8.5 million square kilometres, a population of 210 million, and the seventh-most populous. It’s a diverse country with a rich culture and history. It is home to the Amazon rainforest, one of the world’s most important ecosystems.

In terms of the Brazilian economy, it’s the largest in Latin America and the ninth largest in the world, with a GDP of $2.126 trillion (nominal) and $4.102 trillion purchasing power parity (PPP) in 2023, It is a middle-income developing mixed economy. In 2021, the Brazilian economy grew by 5.0 percent, and in 2022, it grew by 2.9 percent. The World Bank expects that rate of growth to continue into 2023 by an increase of 2.6 percent.

Inflation challenges in Brazil Notwithstanding its recent growth, the Brazilian economy is confronted with several obstacles. High rates of unemployment, inflation, and inequality are some of these issues. Furthermore, the national debt of Brazil is comparatively substantial. Let’s talk about inflation. Brazil’s annual inflation rate rose from 4.61 percent in August 2023 to 5.19 percent in September 2023, which was lower than market predictions of 5.27 percent but the highest level in seven months. The outcome confirmed some predictions that the Central Bank of Brazil (Banco Central do Brasil: BCB) current lowering cycle may be milder than anticipated and increased the departure from the Brazilian government’s target of 3.25 percent. Below info-graph shows the Annual Inflation rates.

The Brazilian government is working to overcome these challenges. For example, the government has implemented economic reforms that are boosting productivity and investment in Brazil. It has also reduced public debt. Although at a slower rate than in previous years, the Brazilian economy is predicted to develop overall in the upcoming years.

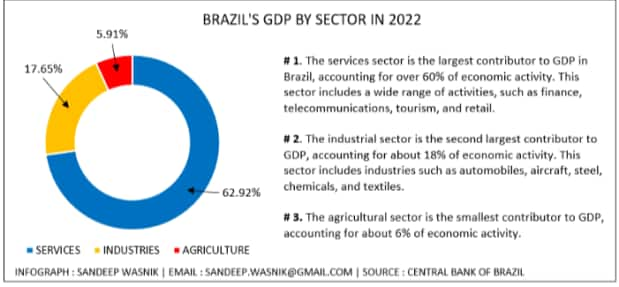

Brazil economy and its main drivers In Brazil, the industrial, services, and agricultural sectors are the main engines of

economic growth. The Brazilian agriculture sector contributes nearly 5.19 percent to GDP, also Brazil exports a lot of grain, meat, coffee, and soybeans.

Including sectors like travel, banking, and healthcare, the services sector makes up more than 62.91 percent of the Brazilian economy. Including sectors like manufacturing, construction, and mining, the industrial sector makes up more than 17.65 percent of the GDP.

Over the time, there has been a change in the GDP distribution in Brazil. The industrial and agricultural sectors have been declining in significance, while the services sector has been gaining ground. Numerous developed and developing

economies share this trend.

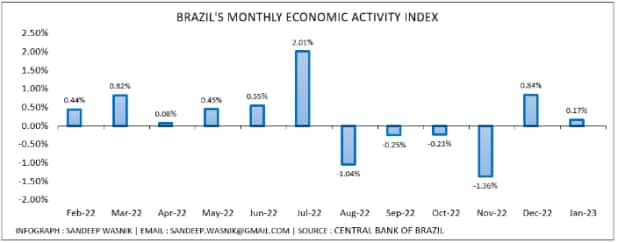

August 2023 marked a 0.77 percent decline in the Central Bank’s economic activity index (IBC-Br), a measure of Brazil’s growth rate that was marginally worse than what the markets had anticipated. A longer-term view of the indicator, which is more likely to accurately reflect the nation’s actual economic performance, is what most intrigues economists. Through August, IBC-Br climbed by 3.06 percent. Brazilian agribusiness and an excellent soybean harvest propelled the country’s actual economic growth, which was evaluated by the IBGE to be 1.8 percent in the first quarter and 0.9 percent in the second,

owing to a rebound in household spending and services output. Below info- graph shows Brazil’s monthly Economic Activity Index.

As of right now, the federal government anticipates a 3.2 percent rise in the nation’s GDP in 2023, which is a somewhat more optimistic estimate than the 2.9 percent growth predicted by the Central Bank, which is based on surveys of institutions for its weekly Focus Report.

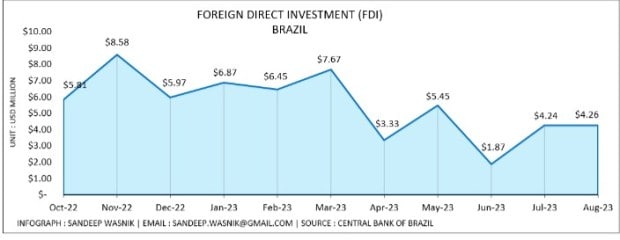

Brazil’s Foreign Direct Investment

One important aspect of a nation’s balance of payments is foreign direct investment (FDI). It tracks the amount of money that comes into and goes out of the economy via investments, exchanges of currencies, transfers of profits, and even travel.

According to Banco Central do Brasil (Central Bank of Brazil), Brazil received a net inflow of US$4.26 billion in foreign direct investment (FDI) in August 2023, a 57.4 percent decrease from the previous year. FDI in Brazil from January to August 2023 totalled US$40.14 million, almost 38 percent less than US$59.2 billion during the same period the year before. Since the beginning of 2023, the 12-month FDI has been declining; in August, it was US$65.9 billion, down from US$71.7 billion in July. This is the lowest index in a year, representing 3.21 percent of Brazil’s GDP. Below info-graph shows the Brazil Foreign Direct

Investment.

Brazil’s Exports and Import

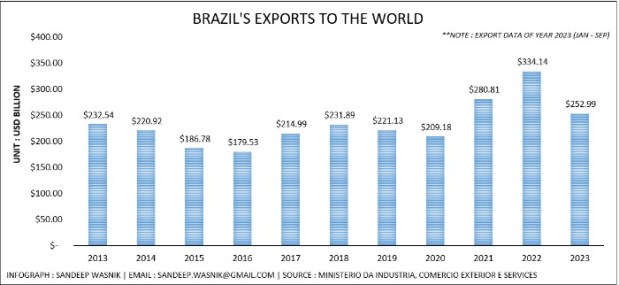

A significant component of the Brazilian economy is exports. Brazil’s GDP was made up of 13.5 percent exports in 2022. One of the main sources of foreign exchange gains for financing imports, paying off debt, and making investments in the economy is exports. Additionally, exports promote employment creation and economic expansion. Brazil usually exports more products and services than it imports, resulting in a positive trade balance. Brazil had a trade surplus of US$67.4 billion in 2022.

Brazil is a significant exporter of meat, corn, and soybeans among other agricultural products. Significant mineral exports from the nation include iron ore, copper, and gold. Furthermore, Brazil exports manufactured items, including machinery, cars, and airplanes. Brazil exports recorded in 2022 were US$334.14 billion (FOB); this shows a significant increase of 18.99 percent as compared to the previous year US$280.81 billion (FOB). The infographic shows the historic data of Brazilian exports to the world.

For Brazil the top importation country is China counted US$89.43 billion followed by USA US$37.44 billion, Argentina US$15.34 billion, Netherlands US$11.93 billion, Mexico US$7.05, Singapore US$8.40 billion, Spain US$9.75 billion, Chile US$9.09 billion, Japan US$6.62 billion, and Germany US$6.27 billion.

To encourage exports, the Brazilian government has implemented various kinds of policies, including lowering tariffs, offering subsidies, and negotiating trade agreements. Exports have increased recently as a result of these initiatives.

Brazil is a net importer of petroleum because domestic supply is insufficient to meet demand. Crude oil is imported from a number of countries, including Saudi Arabia, Angola, and Nigeria. In addition, Brazil imports refined petroleum products such as gasoline, diesel fuel, and jet fuel. Brazil is also major importers of tractors, motor vehicle parts and accessories, human and animal blood prepared for therapeutic, preventive, or diagnostic uses, petroleum gas and other gaseous hydrocarbons, and mineral or chemical fertilisers are its principal imports.

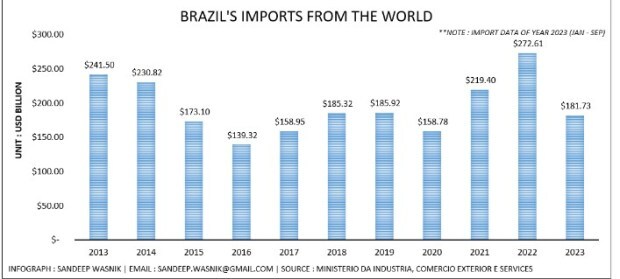

In 2022, Brazil importation recorded US$272.61 billion; this shows an increase of 24.25 percent in imports compared to the previous year record of US$219.40 billion. The infographic shows the historic data of Brazilian imports from the world.

Exportation Financing Program (Proex)

The federal government of Brazil decided to make the procedures of the Export Financing Program (Proex) more flexible in order to increase the competitiveness of Brazilian products abroad, promoting greater adherence with the complexity of the negotiation and logistics processes involved in exports, particularly those with higher added value.

According to Ministério do Desenvolvimento, Indústria, Comércio e Serviços: MDIC (Ministry of Development, Industry, Trade and Services) Proex is the key component in boosting Brazil’s exports. Its goal is to balance the conditions for practical international financing. In order to do this, the program provides equalization of interest rates for public and private financial institutions (Proex- Equalization) and direct financing using budgetary resources (Ex-Financing). In 2022, Proex-Equalização supported US$ 2.2 billion in Brazilian exports, with emphasis on the capital goods segment, while Proex-Financing made a total of US$ 140 million in the same period.

Brazil Trade Agreement

Brazil has been seeking to diversify its trading partners and minimize its reliance on traditional markets such as the United States and China. The country is also looking to expand its trade with other emerging economies. Today, Brazil has 17 trade agreements in force also country is a founding member of Mercosur, a customs union with Argentina, Uruguay, and Paraguay. Mercosur has free trade

agreements (FTAs) with various countries, including Chile, Colombia, Peru, Ecuador, Bolivia, Venezuela, Mexico, and the European Free Trade Association (EFTA).

Brazil’s trade agreements have contributed to increased trade with other countries. Brazil’s entire trade was valued at $420 billion in 2022. Brazil’s main trading partner, accounting for 25 percent of overall trade, is Mercosur. Brazil’s second largest trading partner, accounting for 20 percent of overall trade, is the EU.

Trade agreements are an essential part of Brazil’s economic strategy. To enhance trade and investment, the government is committed to expanding its network of trade agreements. Conclusion on the Brazilian economy growth I believe that Brazil is on the verge of a new economic cycle, and the country’s inflation rate has declined dramatically in recent years, also the current government has taken initiatives to address the country’s economic issues, such as lowering the budget deficit, these developments could lead to a period of sustained economic expansion. Brazil has the potential to achieve strong economic growth if it can address its challenges. Brazil has a huge and expanding domestic market, as well as plenty of natural resources.

The author is an Advisor of ASIA – Latin American and Caribbean countries and is also the Director of international trade and foreign investment at Grupo 108.

Disclaimer: Views expressed are personal and do not reflect the official position or policy of Financial Express Online. Reproducing this content without permission is prohibited.