By Amit Cowshish,

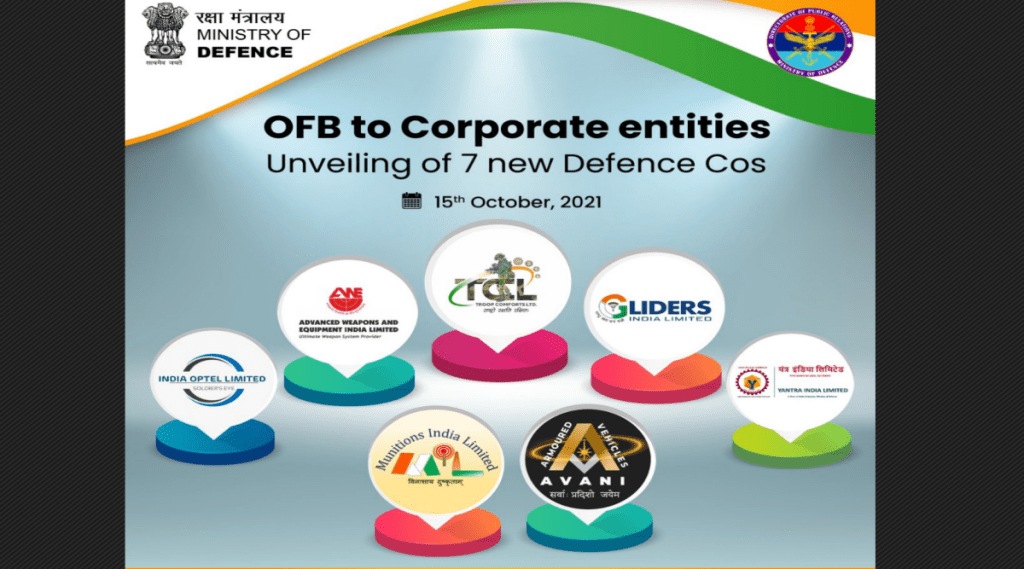

There has been a miraculous turnaround in the financial fortunes of the Public Sector Undertakings (DPSUs) constituted by the government on October 15, 2021, by reorganising 41 ordnance factories. Six of these seven companies have reported provisional profit after merely six months of operation from October 01,2021 to March 31, 2022.

India Optel Limited (IOL), comprising three units manufacturing opto-electronics instruments, communication and airfield lighting cables, and spring steel wires, tops the list with a provisional profit of Rs 60.44 crore.

The other companies to make profit are Armoured Vehicles Nigam Limited (Rs 33.09 crore), Munitions India Limited (Rs 28 crore), Troops Comfort Limited (Rs 26 crore), Advanced Weapons and Equipment India Limited (Rs 4.84 crore), and Gliders India Limited (Rs 1.32 crore) which manages just one parachute manufacturing unit at Kanpur.

Considering that each of these six companies had been making a loss in the preceding three years, ranging from six-monthly average loss of 5.67 crore by IOL to Rs 677.39 crore by Munitions India Limited, the turnaround is very creditable in the face of heavy odds faced by these DPSUs.

Yantra India Limited is the only company to be in the red, posting a loss of Rs 111.49 crore which is not so bad when seen in the backdrop of its six-monthly average loss of Rs 348.17 crore in the preceding three years. The company has eight units located across the states of Maharashtra, Madhya Pradesh, West Bengal, and Uttar Pradesh manufacturing specialised components and equipment required for making small arms, explosives, and artillery.

The encouraging financial performance of the new companies is not the only cause for cheer. In the first six months, these companies have achieved a turnover of more than Rs 8,400 crore which is important for two reasons.

One, it is just about Rs 480 crore less than the annual average value of supplies made by the erstwhile ordnance factories to the three servicesalone (excluding paramilitary forces) between 2018-19 and 2020-21. As a matter of fact, the turnover of the first six months is more than the total value of supply made to the services in 2019-20 and just about Rs 10 crore less than the value of supplies in 2020-21.

And two, these companies seem to be well set for achieving their maximum annual capacity to supply equipment to the three services which, according to 22ndreport of the Standing Committee on Defence submitted to the parliament in March 2021, stood at Rs 17,000 crore.

How has this feat been achieved? This is where the narrative becomes a bit hazy. The official Press Release of April 29 attributes it to ‘functional and financial autonomy provided to these new companies, coupled with hand holding by the Government’.

This is a sad commentary on the way the ordnance factories were being handheld by the Department of Defence Production (DDP) which exercise full administrative control over them through Kolkata-based Ordnance Factory Board (OFB). It also defies imagination as to why ‘functional and financial autonomy’ could not be given to the OFB before its corporatisation.

The Press Release gives another arcane explanation that these new companies had taken various measures for ‘optimal utilisation of their resources and cost reduction’, resulting in ‘cumulative savings of about 9.84% in the areas like overtime and non-production activities during the initial six months itself’. One wonders why these steps could not be taken before corporatisation.

‘Optimal utilisation of resources’ is handy bureaucratese which produces a profound effect but explains little. As for cost reduction on account of curtailment or discontinuation of overtime and non-production activities, these are welcome steps but provide inadequate explanation of how the turnaround has been achieved.

Hopefully, the turnaround is not the result of ‘clever accounting’. In 2021-22, the ordnance factories were given budgetary support of Rs 204 crore and Rs 4,254.81 crore for capital and revenue expenditure respectively. In 2022-23, another Rs 2,500 crore has been allocated as ‘emergency authorisation for newly created DPSUs’ under the capital budget and Rs 475 crore for revenue expenditure. It is unclear whether this infusion of funds had anything to do with the financial results.

This is not to disparage the achievements, or discourage the management, of the new enterprises which are undoubtedly making all possible efforts to make corporatisation work, but the financial performance of the first six months should not be allowed to induce complacency. The road ahead is still fraught with great challenges.

Take, for example, the business prospects of these companies. According to the Press Release ‘all outstanding indents with the OFB were grandfathered and converted into deemed contracts valuing about Rs 70,776 crore’at the time of its corporatisation. A sum of Rs 7,765 crore was also paid to them by way of mobilisation advance before commencement of the business as independent entities. Even during the current financial year, a sum of Rs 2,65.95 crore has been given to them for capital expenditure and by way of equity.

Sooner or later, this source of funding and assured orders will dry up which is when the real challenge will surface. That these DPSUs have bagged domestic contracts and export orders worth Rs 3,000 crore and Rs 600 crore respectively within six months augurs well but does not provide any assurance of continuous flow of supply orders.

The demand for state-of-the-art defence equipment is bound to rise, requiring heavy investment in research and development. If the experience of the old DPSUs is any indication, this would be challenging, not least because of the stiff competition from the private sector that these DPSUs did not have to face in their earlier avatar, and the domestic market whose potential is finite on account of enduring budgetary constraints.

(The author is Former Financial Advisor (Acquisition), Ministry of Defence. Views expressed are personal and do not reflect the official position or policy of Financial Express Online. Reproducing this content without permission is prohibited).