By Manish Kumar Tiwary

On November 29, 2023, the Union Cabinet, chaired by Prime Minister Narendra Modi, approved the Terms of Reference for the Sixteenth Finance Commission as part of the Azadi Ka Amrit Mahotsav celebrations. This approval marks a significant step towards setting the agenda for the commission, whose recommendations, once accepted by the government, will cover a five-year period starting April 1, 2026. As mandated by Article 280(1) of the Constitution, the President of India plays a crucial role in constituting the Finance Commission. The Sixteenth Finance Commission was constituted on December 31, 2023, with Shri Arvind Panagariya, former Vice-Chairman of NITI Aayog, as its Chairman. The following members have been appointed to the Commission with the approval of the President of India: Ajay Narayan Jha, former member of the 15th Finance Commission and former Secretary, Expenditure, as a full-time member; Smt. Annie George Mathew, former Special Secretary, Expenditure, as a full-time member; Dr. Niranjan Rajadhyaksha, Executive Director, Artha Global, as a full-time member; and Dr. Soumya Kanti Ghosh, Group Chief Economic Advisor, State Bank of India, as a part-time member. The commission is tasked with recommending the distribution of net tax proceeds between the Union and the States, allocating respective shares among the States, providing grants-in-aid, and suggesting measures to augment resources for Panchayats during the award period.

The Fifteenth Finance Commission, constituted on November 27, 2017, provided recommendations for a six-year period starting April 1, 2020, through both Interim and Final Reports. These recommendations will remain valid until the end of the financial year 2025-26. The newly established Sixteenth Finance Commission will build upon this foundation and will have specific Terms of Reference to guide its work. The commission’s Terms of Reference include several critical mandates: determining the distribution of net tax proceeds between the Union and the States under Chapter I, Part XII of the Constitution, and allocating the respective shares among the States. Additionally, it will establish principles for governing grants-in-aid from the Consolidated Fund of India to State revenues under Article 275 of the Constitution, excluding the purposes specified in the provisos to clause (1) of that article. The commission will also propose measures to augment the Consolidated Fund of a State, thereby supplementing the resources of Panchayats and Municipalities based on State Finance Commission recommendations. Furthermore, the commission is expected to review the current arrangements for financing Disaster Management initiatives, considering the funds constituted under the Disaster Management Act, 2005. The report from the Sixteenth Finance Commission is anticipated to be available by October 31, 2025, covering a five-year period starting April 1, 2026. Historically, the Fifteenth Finance Commission was tasked with making recommendations for the fiscal period 2020-21 to 2024-25. However, an amendment to its Terms of Reference on November 29, 2019, extended its scope to include an additional year, thus covering six years from 2020-21 to 2025-26. Typically, the Finance Commission takes about two years to finalize its recommendations. According to Article 280(1) of the Constitution, a Finance Commission is constituted every five years or earlier if necessary. Given that the recommendations of the Fifteenth Finance Commission extend until March 31, 2026, the Sixteenth Finance Commission is being constituted now to ensure continuous financial assessment and planning for the Union and States. The groundwork for the Sixteenth Finance Commission began with the formation of an Advance Cell within the Ministry of Finance on November 21, 2022, to oversee preliminary tasks pending the formal constitution of the commission. Subsequently, a Working Group, led by the Finance Secretary and Secretary (Expenditure), including members such as the Secretary (Economic Affairs), Secretary (Revenue), Secretary (Financial Services), Chief Economic Adviser, Adviser from NITI Aayog, and Additional Secretary (Budget), was established to assist in formulating the Terms of Reference. This group engaged in a consultative process, seeking and deliberating on views and suggestions from State Governments and Union Territories with legislatures, ensuring a comprehensive approach to the commission’s mandates. This strategic approach underscores the government’s commitment to structured financial governance, reflecting the broader goals of the Azadi Ka Amrit Mahotsav in celebrating India’s progress and preparing for future challenges in a coordinated and inclusive manner.

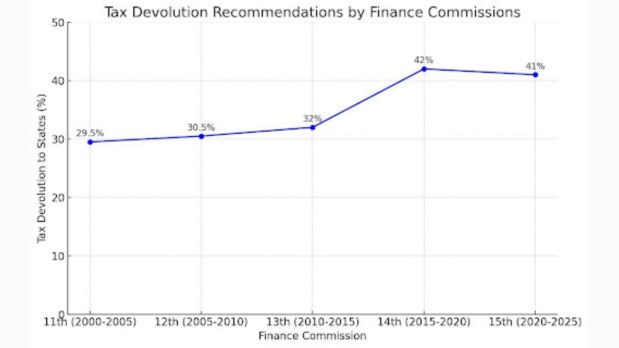

The Fig 1 titled “Tax Devolution Recommendations by Finance Commissions” explains the percentage of tax devolution to states recommended by successive Finance Commissions from the 11th (2000-2005) to the 15th (2020-2025). Starting with the 11th Finance Commission, the tax devolution to states was set at 29.5%. This relatively lower percentage indicates a higher retention of tax revenues by the central government during this period. The 12th Finance Commission (2005-2010) saw a slight increase to 30.5%, reflecting a marginal shift towards greater revenue sharing with states. The trend continued with the 13th Finance Commission (2010-2015), which recommended an increase to 32%, demonstrating a continued movement towards enhancing the states’ share of tax revenues. The most significant jump came with the 14th Finance Commission (2015-2020), which increased the tax devolution to 42%. This marked a pivotal shift in fiscal federalism, showing a strong move towards empowering states with a larger share of tax revenues, thereby facilitating greater autonomy and financial resources at the state level. The 15th Finance Commission (2020-2025) slightly reduced this percentage to 41%, but the level remained high compared to earlier periods, indicating sustained commitment to greater state financial empowerment.

This trend of increasing tax devolution underscores the importance of cooperative federalism in India. Cooperative federalism involves a collaborative relationship between the central and state governments, where both entities work together towards common national goals while respecting each other’s autonomy. The increased devolution of tax revenues is crucial for several reasons. Firstly, it empowers states by providing them with greater fiscal resources, enabling them to plan and implement development projects tailored to their specific needs, thereby addressing local issues more effectively. Secondly, it promotes balanced regional development, allowing states with fewer resources to boost critical sectors such as infrastructure, health, and education, fostering equitable development across the country. Additionally, increased funds enable state governments to improve the quality and reach of public services, benefiting citizens directly through better healthcare facilities, educational institutions, and public infrastructure. The enhanced fiscal autonomy also fosters trust and cooperation between the central and state governments, strengthening the overall federal structure. Furthermore, financially empowered states are more likely to experiment with innovative policies and programs, contributing to overall policy improvement by scaling successful initiatives to other states or the national level.

The gradual increase in tax devolution to states, as recommended by successive Finance Commissions, signifies a substantial shift towards cooperative federalism in India. This shift underscores the central government’s recognition of the importance of financially empowering states to achieve balanced and inclusive development. By providing states with a larger share of tax revenues, regional imbalances can be addressed more effectively, and state governments can enhance public services, such as healthcare, education, and infrastructure, directly benefiting citizens. Furthermore, greater fiscal autonomy fosters trust and cooperation between the central and state governments, strengthening the federal structure. It also encourages states to experiment with innovative policies and programs, which can be scaled up or adopted nationally, contributing to overall policy improvement. The substantial increase recommended by the 14th Finance Commission and the sustained high level of devolution in the 15th Finance Commission reflect a strong commitment to this approach.

In conclusion, increasing tax devolution to states is crucial for empowering them, promoting balanced regional development, and fostering a collaborative and innovative federal system, ultimately leading to more effective governance and improved quality of life for citizens across the country.

The author is PhD Scholar, Jamia Millia Islamia.

Disclaimer: Views expressed are personal and do not reflect the official position or policy of FinancialExpress.com Reproducing this content without permission is prohibited.