Baskin-Robbins, a global ice cream chain, is stepping up its game in India’s booming dessert market, where competition is heating up with brands like Amul, Vadilal, and Naturals vying for consumer attention. As demand for premium indulgences grows alongside India’s expanding middle class, the company is reimagining its ice cream parlour concept to strengthen its position in the segment. The India frozen dessert market size was valued at Rs 30,986 crore in 2024. Looking forward, IMARC Group estimates the market to reach Rs 62,459 crore by 2033, exhibiting a CAGR of 7.70% from 2025-2033. The market is driven by the growing demand for low-calorie, dairy-free, and gluten-free frozen desserts.

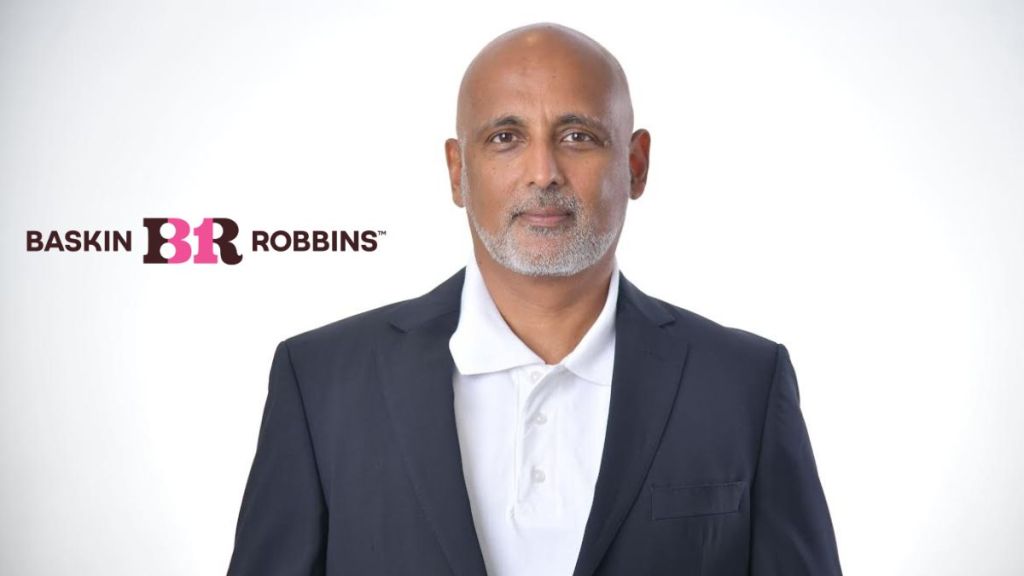

With FY25 nearing its end, Baskin-Robbins projects over 20% top-line growth for the year and is eyeing a potential 40% year-on-year expansion. Vikram Seth, managing director of Graviss Foods, told Shailja Tiwari that the brand’s aggressive expansion, franchise-driven model, and evolving product portfolio are key to sustaining its momentum.

Growth strategy and revenue projections

Baskin-Robbins is positioning itself as a full-fledged dessert destination rather than just an ice cream brand. This strategic transformation, which began a few years ago, is expected to continue driving strong double-digit growth. The company attributes this momentum to India’s economic expansion and rising disposable incomes, which have contributed to increased consumer spending on premium indulgences.

“Our long-term vision has been clear for several years—we aim to establish ourselves as a leading dessert destination in India. We are actively transforming this space and redefining the market,” Seth said.

Expansion milestone and franchise model

In September 2023, Baskin-Robbins marked a significant milestone by opening its 1,000th store in India, underscoring the brand’s aggressive expansion strategy. The company follows a predominantly franchise-based model, with over 300 franchise partners, many of whom operate multiple outlets. This model has proven successful, allowing rapid scalability without significant capital investment from the company itself.

“Nearly all our stores operate under a franchise model, with the company directly owning only a handful. Over the past three decades, we have refined this model, which has proven to be highly effective,” Seth highlighted.

The leadership team from the U.S. visited India to celebrate this milestone, signalling India’s growing importance in the global strategy of Baskin-Robbins. The company is now planning further expansion across existing and emerging markets within India.

Regional performance and emerging markets

Baskin-Robbins operates in 290 cities across India, making it one of the most widespread ice cream brands in the country. While the South, North, and West regions perform almost equally, the East remains an area of untapped potential. The company is focusing on expanding its presence in this region, particularly in the Northeast, where improved retail infrastructure and cold chain logistics are enabling growth. “Our top three markets have traditionally been Delhi, Ahmedabad, and Mumbai, but cities like Hyderabad, Bangalore, and Chennai are rapidly catching up,” Seth noted.

B2B and packaged Ice Cream business

While Baskin-Robbins is primarily a consumer-facing brand, it also has a presence in the B2B segment, supplying ice creams to restaurants, coffee chains, and cafés. Additionally, the brand has expanded into the consumer packaged goods (CPG) category, selling packaged ice creams through retail channels. This segment has grown steadily and now ranks as the company’s second-largest revenue driver. “Our business remains predominantly B2C, but B2B is an important niche segment,” he added.

Product innovation and flavour preferences

Despite continuous innovation in the ice cream industry worldwide, the three most popular flavours remain vanilla, strawberry, and chocolate. In India, however, flavours like mango, while celebrated, often take a backseat to chocolate in terms of ice cream preferences. Baskin-Robbins has introduced over 1,300 flavours globally, ensuring variety for its customers. “One unique aspect of Baskin-Robbins is our ‘31 flavors’ concept, offering customers a different flavour for each day of the month,” Seth said. “If you look closely at the Baskin-Robbins logo, you’ll find the number ‘31’ embedded within it.”

Premium positioning and pricing strategy

Baskin-Robbins maintains its premium brand positioning in India, distinguishing itself from mass-market players like Amul and Vadilal. The company has structured its pricing strategy to retain exclusivity while also catering to India’s expanding affluent consumer base. “Our premium pricing has allowed us to maintain exclusivity while tapping into the evolving aspirations of Indian consumers,” Seth stated. While there are no immediate plans to alter this pricing strategy, the company continues to focus on innovation and customer experience.

Health trends and new product offerings

With rising health consciousness, Baskin-Robbins has introduced products with 30% less sugar and continues to explore innovations in this space. However, the company has not yet introduced sugar-free options, citing limited demand in key international markets such as the U.S., Europe, Japan, and Korea. “We are closely monitoring consumer response to our healthier product lines while staying true to our brand’s indulgent experience,” Seth said.

Quick commerce and Ice Cream cakes

The rise of quick commerce (QCom) platforms has provided a valuable growth channel for Baskin-Robbins. The company has a dedicated team managing its presence on these platforms, ensuring wide accessibility. One of the fastest-growing segments within this channel is ice cream cakes, a relatively new category in India that is gaining traction through e-commerce. “We are present on nearly all major quick commerce platforms in India, and this has played a crucial role in building awareness for ice cream cakes,” Seth noted.

Marketing and consumer engagement

In 2024, one of the standout marketing initiatives for Baskin-Robbins was the celebration of its 1,000th store. The company launched special campaigns, including promotional pricing and customer engagement activities, to mark the occasion. Going forward, Baskin-Robbins plans to continue investing in marketing initiatives that reinforce its premium positioning while also driving footfalls to its stores.

As India’s dessert market continues to expand, Baskin-Robbins is strategically positioned to lead the premium segment, leveraging its global expertise, strong franchise network, and innovative product offerings to capture an even larger share of the market.

(Disclaimer: This story has been updated twice with correct revenue expectations and designation)