Beauty is in the eye of the beholder, but in the skincare market, it’s all about the bottom line. With a growing appetite for natural and Ayurvedic products, consumers are turning their attention to what’s on their shelves just as much as what’s in their mirrors. The demand for natural and Ayurvedic products is increasing as consumers favour traditional and organic ingredients. “We want to continue to outpace the industry, gain share, and grow at least twice as fast as the FMCG industry. From a profitability perspective, we aim to improve by about 100 basis points every year. That’s our objective,” Varun Alagh, co-founder and CEO, Honasa Consumer Ltd., told BrandWagon Online. The beauty and personal care market in India is projected to generate revenue of $31.51 billion in 2024, with an annual growth rate of 3.00% from 2024 to 2028, as per market research firm Statista. The personal care segment is the largest, estimated at $14.31 billion. Per capita revenue in India is approximately $21.86, and online sales are expected to contribute 6.6% of the total revenue.

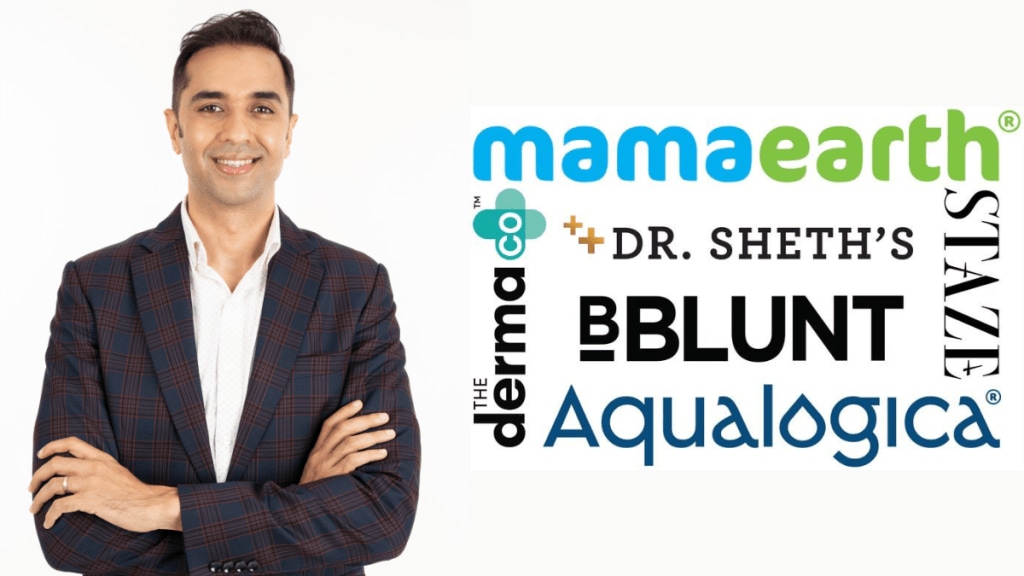

Honasa Consumer Ltd., the parent company of brands including Mamaearth, The Derma Co., BBlunt, Dr. Sheth’s, Aqualogica, and Staze, has been expanding rapidly. The company acquired BBlunt and Dr. Sheth’s in 2022, launched The Derma Co. in 2020, and introduced Aqualogica in 2021. Staze is its latest launch in the colour cosmetics sector. Following its IPO on November 7, 2023, Honasa reported FY 23-24 revenue of Rs 1,920 crore and a PAT of Rs 111 crore. New product launches contributed 18% of revenue, with 122 products introduced in 2023. Mamaearth, Honasa’s flagship brand, has achieved over Rs 1,000 crore in revenue within six years of its launch.

The company’s growth strategy includes ambitious revenue targets for its brands. Case in point: it aims to close an annual recurring revenue of Rs 1,000 crore for The Derma Co., besides another Rs 500 crore ARR, each for Aqualogica and Dr. Sheth’s and BBlunt for Rs 250 crore ARR. Mamaearth claims to have expanded to 1,88,377 FMCG outlets by March 2024 and opened 111 exclusive outlets. As per the company, online channels accounted for 65% of sales, with offline channels contributing the remaining 35%. The company employs 2,940 people, with 53% women. “The current market share of our company within the Beauty and Personal Care (BPC) industry is approximately two percent of the overall BPC market. However, there is significant potential for growth. In specific categories such as face washes, we hold about seven to eight percent market share. Nationally, our market share in sunscreens exceeds 20%. We aim to become the leading company in our core categories within the next two to three years,” Alagh highlighted.

Product is the Queen!

While advertising and marketing play crucial roles in building brand recognition and acquiring new customers, in the beauty and personal care industry, the product is the queen. Experts suggest that while marketing can initially attract consumers and generate buzz, it is ultimately the product’s quality and user experience that determine long-term customer retention and brand loyalty. Alagh opined that building a great brand relies on three key elements that is, a high-quality product, effective marketing, and a strong go-to-market strategy. While all three are important, the product is paramount. “We began as a baby care company with a focus on providing exceptional products, initially testing them on our own families. Our approach emphasises crafting products specifically for the Indian market, unlike many global brands that offer standard portfolios. We incorporate local ingredients and traditions, such as Kerala thali and multani mitti, to meet consumer needs. Our dedication to quality and relevance drives our success,” Alagh said.

India’s market is currently experiencing a surge in both domestic and international brands seeking to capitalise on its growth potential. As global brands enter the Indian market and tailor their offerings to local preferences, the landscape has become increasingly competitive, with a multitude of product ranges flooding the market. In this crowded environment, innovation and quality are crucial for brands to not only survive but also to thrive. Experts believe that to stand out and maintain a competitive edge, companies must focus on delivering superior products and continuous innovation.”It’s not easy to replicate a great product. For instance, our recent launch, Kerala Thali cleansing paste, includes 36 different natural ingredients. Assembling these ingredients at home would be time-consuming, but we provide it ready-to-use with advanced technology, such as nitrogen purging, which is a skilled process. Even when others attempt to replicate, the first mover retains a significant advantage. For example, we were the first to introduce onion shampoo and continue to hold a 60% market share in that segment. Similarly, we pioneered Ubtan and remain the leading brand for Ubtan face wash. Consumers strongly associate these ingredients with our brand, highlighting the impact of being first to market and creating a strong connection with specific ingredients,” Alagh emphasised.

Moreover, Alagh highlighted two major differences between their approach and that of global competitors. First, their focus on India sets them apart. He noted that they design their products specifically for Indian consumers, considering factors such as Indian skin types, weather conditions, and cultural preferences. This localised approach enables them to effectively compete with global brands.

Furthermore, as per the company, its scale provides a significant advantage over other Indian brands. With over 10 million transacting consumers across their brands, they benefit from improved procurement and supply chain efficiencies. He pointed out that their extensive consumer data allows them to execute more effective marketing strategies, giving them a considerable edge over newer, smaller brands.

Quality check?

Not long back, there was a debate regarding Mamaearth’s manufacturing practices, specifically that the company does not produce its own products but instead sources them from third-party manufacturers. While this approach is not uncommon, as Alagh mentioned, Mamaearth works with over 30 partners for its product manufacturing, all of which are third-party manufacturers. “Most of these units are dedicated exclusively to Honasa, meaning they only handle our manufacturing. For instance, many of our setups are entirely dedicated to Honasa. We develop formulations in our labs in Gurgaon, Mumbai, and other locations, and these formulations are then produced at our dedicated manufacturing units,” Alagh highlighted.

Interestingly, it has been claimed by detractors that Mamaearth does not possess any patented technology or unique formulations that distinguish it from other market players. Unlike some competitors, particularly in the skincare category, who rely on proprietary formulations and technologies, Mamaearth’s products do not have such distinctive features. “Patented technology is not very common in this industry. Instead, we utilise various technologies developed in collaboration with our partners, including encapsulation and other advanced mechanisms. While we do not have patented formulations, this does make it easier for others to replicate our products. In industries like pharmaceuticals, patents are essential because a single medication or technology can remain relevant for decades. However, in the personal care sector, where innovation occurs frequently, patents are less common and less practical,” Alagh stated.

Influencers are Honasa’a best friends!

Honasa’s primary revenue comes from the sale of baby care, skincare, haircare, and related products. The company has invested significantly in advertising and influencers, with expenditures of Rs 66.128 crore and Rs 182.6 crore, respectively in FY23, as per regulatory filings. Industry experts attribute Mamaearth’s rapid growth to its marketing-heavy strategy, which capitalised on the rise of social media and content creation. Launched in 2016, which was a period of exponential digital growth, Mamaearth was able to leverage the surge in mobile usage and the influence of content creators to reach a wide audience quickly. Its digital-first approach allowed the brand to scale efficiently, using targeted ads and influencer marketing to engage consumers at scale. “We closely follow consumer trends and ensure we are where our audience is. As long as consumers continue to engage on platforms like Instagram and listen to influencers, that’s where we will focus our efforts. If a new platform like TikTok emerges and gains traction in India, we’ll adapt and be there as well. We use media mix modelling to evaluate which types of media are most effective, shifting from long-format to short-format content as needed. Overall, our approach remains flexible and consumer-centric,” Alagh said.

However, this digital dependency also poses risks. While social media can offer brands rapid visibility and success, it also amplifies negative feedback. In Mamaearth’s case, a recent viral post saw a consumer harshly criticising the brand’s products, urging others to discard them.

The post garnered widespread attention, underscoring the vulnerability digital-first brands face when negative reviews spread en masse. Even though Ghazal Alagh, co-founder, Mamaearth, responded to the criticism, the incident highlights the double-edged nature of social media: it can drive a brand’s growth but also expose it to reputation risks from viral negativity.

Alagh emphasised that social media is a powerful platform for conversations and sharing experiences but noted a growing trend of negative content gaining more traction. “Unfortunately, this encourages some creators to take that route without real basis,” he said. Referring to a recent incident where Mamaearth was targeted, Alagh explained that despite Ghazal Alagh’s genuine attempt to address concerns, the individual escalated with personal attacks.

“We can’t let such actions slide,” Alagh stated, adding that the company pursued legal action for defamation, which resulted in the content being removed. He urged creators not to misuse the platform, stressing that negative content can unfairly damage a brand’s reputation.