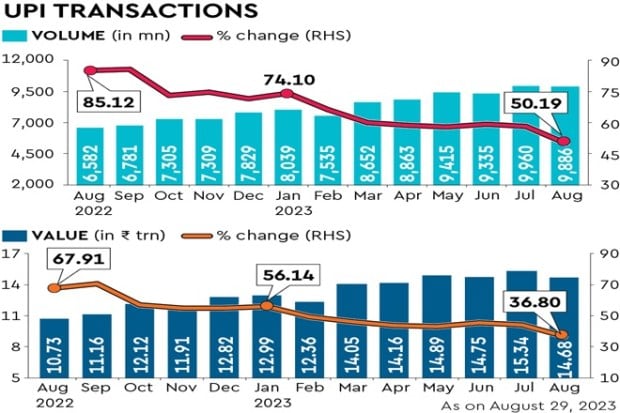

Transactions on the unified payments interface (UPI) are likely to have crossed the all-time high of 10 billion in August. Also, in terms of value, transactions are likely to have crossed Rs 15 trillion in August, projections made on the basis of the available data show.

While the National Payments Corporation of India (NPCI) is yet to release cumulative data for the entire month, transactions on the platform rose 50.2% year-on-year (y-o-y) to 9.9 billion as on August 29, latest data showed.

In terms of value, transactions rose nearly 37% y-o-y to nearly Rs 14.7 trillion as on August 29.

Transactions on the platform have been clocking a run rate of nearly 341 million per day. Transactions worth `50,525 crore were made on a daily basis.

Transactions on the UPI platform clocked nearly 10 billion in July with value at Rs 15.3 trillion.

“The data shows that UPI peer-to-merchant transactions are growing at a pace of over 100% on a y-o-y basis and have a higher share than peer-to-peer transactions,” Sunil Rongala, senior vice president – strategy, innovation & analytics, Worldline India, said, adding that UPI transactions are expected to hit 20 billion a month in 18-24 months

Since it was launched in 2016, transactions on the UPI have been on the uptrend. Transactions on the platform garnered momentum during demonetisation and the Covid-19 lockdown, when digital payments took centre stage.

In more recent times, the expansion of UPI into territories outside India, the launch of RuPay credit card on UPI and offline transactions through UPI Lite have also contributed to the growth in transactions.

Going ahead, experts feel that the growth in UPI transactions will be fuelled through continued increase in scale, where new users will get added to its ecosystem.

“The growth (in UPI) will be fuelled through continued increase in scale, where new users will get added to its ecosystem led by fintech-driven customer and merchant acquisition, and an increase in the scope of UPI payment use cases,” says Rohan Lakhaiyar, partner and fintech leader, Grant Thornton Bharat.

Lakhaiyar added that the bilateral cross-border arrangements for payments that run on UPI rails, credit on UPI (credit card and overdraft), enablement of UPI on non-resident external account shall be instrumental in driving the next stage of growth for UPI.