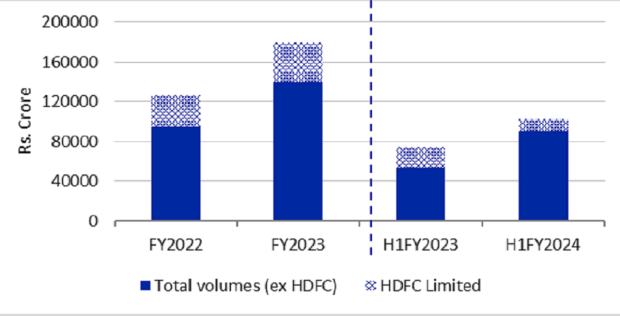

ICRA, in a report, announced that per its estimates, securitisation volumes slowed to ~Rs 47,000 crore in Q2FY2024 from ~Rs 56,000 crore in Q1 FY2024. This, it said, is largely driven by the exit of one key originator (viz. HDFC Limited) from the securitisation space following its merger with HDFC Bank. Nevertheless, ICRA said, the estimated securitisation volumes of Rs 1.03 lakh crore for H1FY2024 translate into a strong expansion of ~39 per cent over the Rs 74,000 crore recorded in H1FY2023.

Further, securitisation undertaken by the originators, excluding HDFC Limited, witnessed an even higher spike of ~69 per cent YoY to Rs 90,000 crore in H1FY2024 from Rs 54,000 crore in H1FY2023. The continued growth in the volumes is driven by the consistent rise in credit demand in the financial lending space reported by all lenders resulting in higher funding needs, ICRA said.

Abhishek Dafria, Senior Vice President and Group Head, Structured Finance Ratings, at ICRA, said, “Over the last 12 months, lending activity has seen a significant surge backed by stable macroeconomic conditions and huge credit demand to fuel the growing economy. Securitisation has become a reliable fund-raising tool for lenders. It provides diversity in funding along with improving the asset-liability profile of the lenders. Though HDFC Limited, which had a high contribution to overall volumes, exited from the market at the beginning of Q2, we expect the market to remain buoyant. In ICRA’s opinion, the annual securitisation volumes for FY2024 are expected to be close to the peak of Rs 2 lakh crore seen in the pre-covid era.”

Further ICRA projected that vehicle loans were the largest asset class with ~34 per cent share in securitised volumes in H1FY2024. This, it said, is due to the exit of HDFC Limited, which was involved in securitisation of mortgage-backed loans. As a result, mortgage-backed securitization, which used to dominate the share in total volumes, has reduced to ~27 per cent in H1FY2024. “This was followed by MFI loans (microfinance), which stood at ~18 per cent of the total volumes. Other major asset classes seen in the securitisation market are SME (small and medium enterprises) loans, gold loans, two-wheeler loans and personal/consumer loans. PTCs (pass through certificates) have seen an increase in share in the total securitised volumes to 49 per cent for H1FY2024 and 56 per cent for Q2FY2024 with the remaining share attributed to direct assignment transactions,” ICRA said.

In an earlier report from July 2023, ICRA had estimated that securitisation volumes, originated primarily by non-banking financial companies (NBFCs) and housing finance companies (HFCs), will be at ~Rs 53,000 crore in Q1FY2024, reflecting a strong growth of ~60 per cent over the ~Rs 33,000 crore securitised in Q1FY2023.

Overall securitisation market volume (PTC + DA)