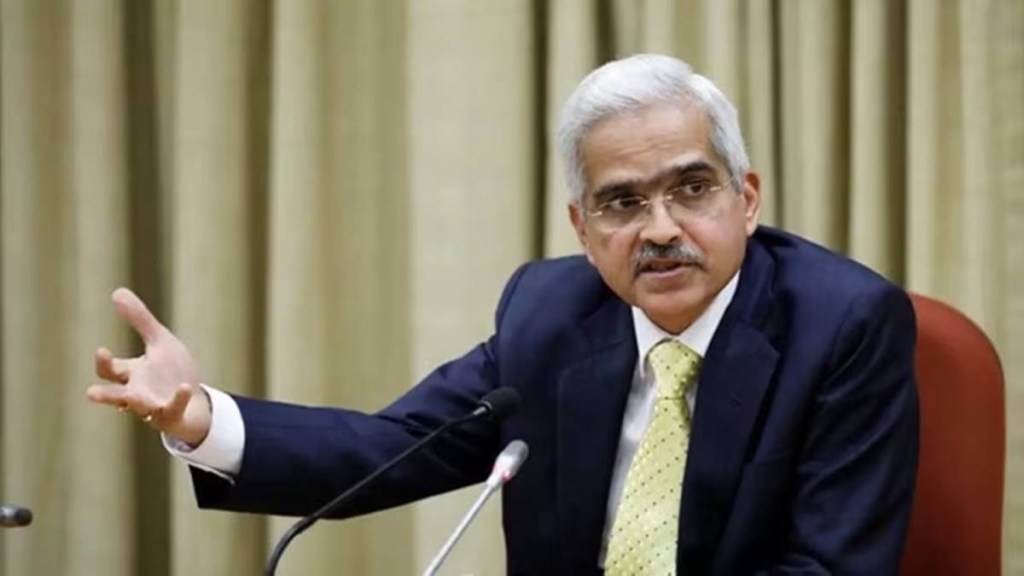

Reserve Bank of India governor Shaktikanta Das on Wednesday asked banks to step up efforts against ‘mule accounts’ and also intensify customer awareness and education initiatives, among other measures, to curb digital frauds.

A mule account is an account created by one person but operated by another person. These accounts are often used for money laundering and tax evasion. Currently, these frauds account for around 55% of all frauds in India.

Das held the meeting with managing directors and chief executive officers of public sector banks and select private sector banks in Mumbai. These interactions are part of the central bank’s continuous engagement with the senior management of its regulated entities. The meetings were also attended by deputy governors M Rajeshwar Rao and Swaminathan J, along with executive directors-in-charge of regulation and supervisory functions. The previous such meeting was held on February 14.

Das also emphasised the need for banks to ensure robust cybersecurity controls and effectively manage third-party risks.

While acknowledging the continued improvement in banks’ asset quality, loan provisioning, capital adequacy and profitability, Das highlighted the importance of further strengthening the governance standards, risk management practices and compliance culture in banks.

The persisting gap between credit and deposit growth, liquidity risk management and asset liability management-related issues and trends in unsecured retail lending were among the issues discussed in the meeting.

Talks were also held on strengthening of assurance functions, credit flows to MSMEs, increasing usage of the rupee for cross-border transactions and banks’ participation in innovation initiatives of the Reserve Bank.