WITH Facebook launching Marketplace in select markets, and Instagram and Pinterest having rolled out ‘shop now’ features to tap into in-app impulse purchases, niche fashion discovery sites in India are taking a leaf out of the success of their Chinese peers like Mogujie and XiaoHongShu (which means Little Red Book) that have made commerce central to their social, community-led business model. Welcome to purpose-led social commerce. Going beyond discovery and content, these players also enable their customers to buy merchandise directly through the apps, thus, in a way becoming a distribution channels for brands and small businesses.

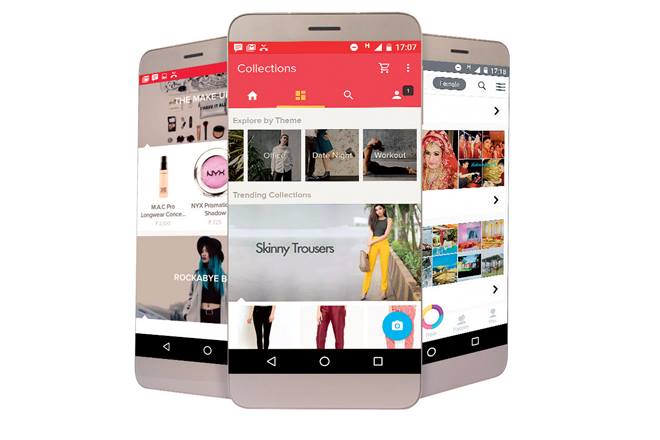

Whether it is Roposo, the Instagram for fashion aficionados, or Wooplr which likes to call itself the Mogujie of India, these platforms led by influencers means business for brands too — brands can leverage influencer stories and tap into these visual mediums to align marketing strategies. But can these social commerce players change the game in the fashion e-commerce space and build profitable businesses? Can blending social networks with shopping help fashion-centric e-commerce players scale up?

Yes, says Arjun Zacharia, CEO, Wooplr. “A key learning from Mogujie is that discovery is a highly personalised experience and it needs to be well integrated with commerce. It realised a long time back that the discount model is unsustainable.”

The biggest challenge in India for most e-tailers is the lack of differentiation, and price seems to be the lowest common denominator. “But novelty can only take you so far; ultimately a business transaction needs to happen,” says Devangshu Dutta, chief executive, Third Eyesight.

Also Watch:

From ‘like’ to ‘buy’

Fashion discovery-cum-commerce platform Wooplr moved to commerce in January, 2016, from a pure content-based discovery platform. What distinguishes Wooplr from its peers is that each of the looks is buyable and the whole commerce chain is intact. It aims to take advantage of the mushrooming fashion brands in India such as FabAlley and Nykaa and help them build credibility with the help of influencers. “We focus on the three Cs of the ‘influencer’ phenomenon — a community creates content and content leads to commerce. We have more than 10,000 influencers who create content,” Zacharia says. The fashion discovery platform for women has tie-ups only with brands and the logistics is handled by brands themselves.

Fashion social network Roposo comprises communities with small boutique owners, makeup artists, stylists, and celebrities. With a focus on influence, inspiration and discovery for millennials, it recently launched Bizdrum to create a virtual space which allows brands to interact with bloggers and social influencers.

In February, Roposo launched ‘chat-to-buy’ to streamline buyer-seller engagement. Currently 4,000 small sellers are active on Roposo. “Unlike Instagram, the platform is meant only for fashion. We are also working on seller rating, seller review and building intelligence on customer preferences to make the commerce experience good,” says Mayank Bhangadia, CEO and co-founder, Roposo. The company claims to have over a million monthly active users and three million downloads so far.

“Online fashion-centric marketplaces are all about merchandising and great price while our philosophy is social. It is not possible to first start as a commerce player and then add an equally strong social layer,” adds Bhangadia.

Myntra’s chief product officer Ambarish Kenghe, however, says that social is just one part of the overall e-commerce experience. “If commerce is the end goal, then there has to be investment on that front. Depending purely on a third party can dilute the customer experience,” he says. “If the service experience goes wrong, the user doesn’t care about anything. The basics have to be right.”

So there is a bit of a ‘give and take’ here: while fashion discovery platforms are working on their commerce bit, already established fashion commerce players are strengthening their social offerings. For Myntra, the idea of incorporating a social layer in addition to creating entry barriers such as ‘try and buy,’ is to create more ‘need states’ for consumers by giving fashion advice, helping consumers get socially validated and having brands interact with consumers. For example, at the Myntra Style Forum, users can ask questions, which other users and brands can answer. It also has ‘style chat’ where celebrities answer live questions.

Online fashion portal Limeroad has an active community of two lakh stylists who churn out close to 10 million looks every month.

“So our consumers get a constant inflow of new looks and products. This would not be possible if not for the community-led model,” says Suchi Mukherjee, founder and CEO, Limeroad.

Beyond trendspotting

Unlike social engagement platforms such as Instagram and Pinterest, Indian fashion discovery platforms are focussing on commerce from the start. Experts say it is important to get to monetisation faster. “The monetisation model should be such that it is linked back to commerce either on its own or through lead generation/affiliate businesses,” cautions Sreedhar Prasad, partner, internet business and start-ups, KPMG.

The online fashion market is about $4-5 billion in India and the potential is huge. “It is all about being relevant whether you are a social or a commerce company. Orkut died because it was not relevant. Innovation is the key,” explains Prasad.

Wooplr claims to have positive unit economics and charges upward of 20% as commission from brands. It plans to stay away from sponsored posts and banner ads. Instead it does fashion campaigns with brands. It worked with brands like Zara and Levi’s to launch their new collections, and even did a campaign with Forever21 and helped it create the 2016 calendar with 12 influencers. What makes the business viable, says Zacharia, is the lean business model. “Our overhead operational cost is near zero, and we only pay the payment gateway charges. Thus, cross contribution margin is 98%.” It aims to achieve annualised GMV run rate of $100 million by 2019.

On the revenue front, Roposo has tie-ups with marketplaces and works as an affiliate marketer to e-commerce players like Jabong. “Brands are approaching us for influencer marketing. And to leverage it we recently launched Bizdum to connect brands with influencers for their social reach. This will work as another revenue stream for us,” says Bhangadia. Roposo plans to reach $100,000/month in the next 8-9 months and breakeven by mid next year.

Conversation to commerce (C2C) is the future and that’s where social commerce will play a role, says S Swaminathan, CEO and co-founder, Hansa Cequity. “It is going to be community to commerce, conversation to commerce and content to commerce. That is where the future lies for brands,” he sums up.