Amid global shocks and challenges, the Indian economy presents a picture of resilience, noted Reserve Bank of India (RBI) governor Shaktikanta Das in his foreword in the 26th Financial Stability Report (FSR) on Thursday.

The report said that the global economy is facing formidable headwinds with recessionary risks looming large. The interplay of multiple shocks has resulted in tightened financial conditions and heightened volatility in financial markets.

Also Read: NBFC loans to MSMEs jump 14% in FY22 from 2.8% in FY21: RBI report

India, along with other emerging economies, faces several risks. These include rising borrowing costs, debt distress, elevated levels of inflation, volatile commodity prices, currency depreciation and capital outflows. The outlook for 2023 is even bleaker, with global growth expected to fall to 2.7% in the next year.

“The banking system is sound and well-capitalised… Stress test results presented in this issue of the FSR indicate that banks would be able to withstand even severe stress conditions, should they materialise. Furthermore, in spite of formidable global headwinds, India’s external accounts remain well-cushioned and viable,” noted Das.

According to the report several factors work in India’s favour: First, financial stability has been maintained; second, domestic financial markets have remained stable and fully functional; third, the banking system is sound and well-capitalised and lastly, the non-banking financial sector has also withstood these challenges.

Also Read: Past perfect, future uncertain: RBI

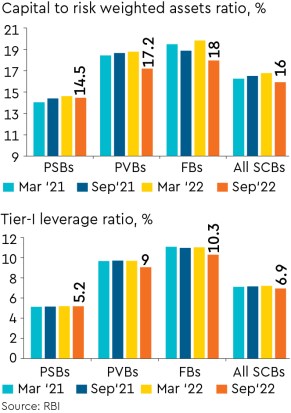

Banks have enough capital to maintain the ratio above the minimum requirement till September 2023, even in the absence of capital infusion and this has happened, despite a decline in the capital adequacy ratio by 77 bps to 16% in September-end – much higher than the minimum threshold limit of 9%. The decline in the capital adequacy ratio was on account of higher risk-weighted assets as lending activity picked up October onwards.

In addition, the decrease in slippages, increase in write-offs and an improvement in loan growth brought the gross non-performing assets (NPA) ratio of banks further down to a seven-year low of 5% as of September 30. The net NPA ratio stood at a 10 year low of 1.3%.

Banks will also be able to maintain a common equity tier-I capital ratio above the minimum requirement of 8%. In case of severe stress, the capital ratio would decline by 210 bps to 10.7% in 2023, the RBI said.

The net interest margin (NIM) witnessed an improvement of 20 basis points (bps) y-o-y to 3.5% as of September 30, reflecting a faster increase in lending rates compared to the deposit rates and credit costs. This is coupled with a 41% increase in the net profit of the banks and a 10% growth in net interest income (NII) as of September 30.

In an extreme scenario of sudden and unexpected withdrawals of around 15% of uninsured deposits along with the utilisation of 75% of the unutilised portion of committed credit lines, liquid assets — which include CRR and SLR investments at the system level — will decrease to 12.2% of total assets in 2023 from 21.4% as of September 30.

“Preserving macroeconomic stability in this challenging environment will require safeguarding the domestic economy and the financial system through actions that mitigate the build-up of vulnerabilities and help smooth financial market adjustments,” the RBI said.

The report came with a disclaimer that the adverse scenarios are stringent and conservative assessments under hypothetical adverse economic conditions and therefore, the model outcomes should not be interpreted as forecasts. RBI’s stress testing models have been criticised in the past for a significant upward bias.