Budget 2020 India: Absent a quick repair of the economy’s sputtering growth engines, finance minister Nirmala Sitharaman had little option but exert herself to roll out a fiscal stimulus with the hope that it would catalyse a growth rebound. However, stifled by a big tax revenue deficit, all that she could almost achieve was to spare the economy an additional blow from government expenditure compression.

Budgetary capital expenditure is estimated to grow at 18% to Rs 4.12 lakh crore in FY21, faster than the pace of overall Budgetary spending, but it is doubtful whether overall public capex would also rise in tandem. For the first time in several years, the Centre’s tax transfers to state governments have declined in FY20 – by Rs 1 lakh crore or 14% — circumscribing their ability to spend on asset-creating projects. Also, capex financed out of extra-budgetary resources is projected to decline by over 5% to Rs 6.72 lakh crore in FY21.

Sensing that the Budget 2020-21, the second by Modi government 2.0 , might not do much to pump-prime the faltering economy, the benchmark 30-share BSE Sensex dropped 2.43% on Saturday, its steepest fall since October 24, 2008. Dashed hopes of relief on capital gains tax also unnerved the markets.

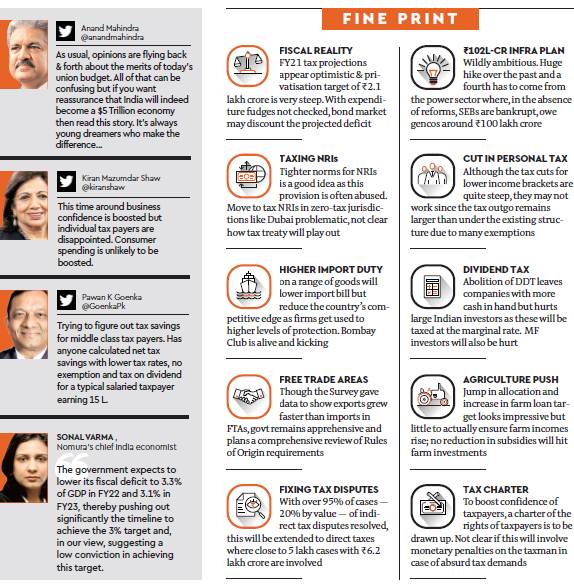

Taking a Rs 40,000-crore hit on the revenue kitty, personal income tax (PIT) slabs have been restructured to let taxpayers choose between two options — a new lower-rates regime that will require them to also surrender 70 of more than 100 exemptions including the popular ones and the extant one. This possibly heralds a simpler system of taxation with removal of all exemptions and deductions, but would prove to be an inadequate consumption booster.

An endeavour to increase productive, asset-creating expenditure is evident, but the quality of the fiscal deficit seems to deteriorate with the share of revenue deficit — elimination of which is a key fiscal goal — rising to 77% of the FY21 fiscal deficit, compared with 63% in FY20.

The Budget completed the project of aligning India’s corporate tax regime with the most benign among major economies by removing the levy of dividend distribution tax in the hands of firms. The move with estimated revenue impact of Rs 25,000 crore could increase foreign investors’ returns from investments in Indian companies. The minister invoked an exigency clause to enable deviations of 0.5% of GDP each from the fiscal road map for both FY20 and FY21 —the fiscal deficits for the two years would therefore be 3.8% and 3.5%, respectively. If one goes by the relevant rules, there aren’t circumstances to warrant the trigger, so the act was actually presumptuous. However, even with this step, the Centre’s Budget size relative to GDP would rise only marginally from 13.2% in FY20 to 13.5% in FY21.

On an estimated nominal GDP growth of 10%, 12% growth for gross tax revenue is assumed for FY21 compared with less than 4% in FY20 (GDP growth 7.8%). That requires tax buoyancy of 1.2 in FY21, against just 0.5 in FY20. This is indeed a tall order, though the government apparently pins hope on a direct tax amnesty scheme — Vivaad Se Vishwas — announced in the Budget as well as steps taken to cut compliance burden. “Continuing growth slowdown and tax cuts will make it difficult to achieve gross revenue target…”, rating agency Moody’s said.

A likely restructuring of the GST — the Centre’s revenue from this tax fell short by Rs 51,000 crore or 7.7% in FY20 — is going to be a key element in the government’s efforts to improve tax buoyancy. While states are crying foul over the Centre’s failure to release the guaranteed compensation amounts for their GST revenue shortfall, Sitharaman made it clear in Saturday’s speech that, “Hereafter, the (compensation) fund would be limited only to collection by way of GST compensation cess.”

The Budget FY21 relies heavily on disinvestment receipts — these are projected to surge 223% to Rs 2.1 lakh crore thanks to a proposed IPO by LIC and big-ticket transactions lined up including BPCL — and a 12% rise in telecom receipts to Rs 1.33 lakh crore. Corporate tax receipts in FY20 saw a shortfall of Rs 1.5 lakh crore or 20%, reflecting both India Inc’s subdued profitability and deep cuts in tax rates.

The fiscal slippage is not commensurately reflected in the estimated G-sec supplies in the market for FY20 and FY21 as the Centre has stepped up financing of its deficits through NSSF borrowings. According to the revised estimate for FY20, NSSF funded as much as 31.3% of fiscal deficit, against 19.3% in the previous year, and is projected to finance 30.1% of the deficit in the next fiscal. Net market borrowing for FY21 (Rs 5.36 lakh crore) and FY20 (Rs 4.99 lakh crore, up `50,000 crore from previous plan) were largely on the lines expected by bond market participants, so yields are unlikely to move up in the near term.

Outlays for many popular welfare and social-sector programmes were curtailed in FY20 — PM Kisan by close to Rs 21,000 crore and PM Gram Sadak Yojana by about Rs 5,000 crore, for instance — to avoid the deficits from widening more. For FY21, the popular jobs scheme MGNREGA has an FY21 outlay which is Rs 9,500 crore lower than in FY20.

Acceding to the demands from several quarters for greater transparency in Central government accounts, Sitharaman presented details of off-budget financing of expenditure for FY20 and FY21. Including these, a major part of which are again NSSF loans which have limited market impact, the fiscal deficits for FY20 and FY21 would be 4.6% and 4.4%, respectively.

Watch Video: What is Union Budget of India?

Sitharaman announced a hike in FPI limit in outstanding stock of corporate bonds from 9% to 15%, but did not go the whole hog on reforming this market, an acknowledged policy imperative for quite some time. Public issuance and listing of corporate bonds would have deepened the market and bolstered the resources for infrastructure projects. A sharp increase in insurance cover for bank deposits to Rs 5 lakh from Rs 1 lakh came with the minister’s assertion that depositors’ money is safe.

The Budget unveiled a slew of policy initiatives: 35 lakh farmers are being helped to set up solar pumps and sell the excess electricity to the Grid; 150 passenger trains would be operated by private parties on payment of lease rentals to the Railways; partial credit guarantee scheme for NBFCs buttressed; Rs 22,000-crore equity support being given to state-run IIFCL and an NIIF arm to cataylse resource mobilisation for the mostly-government-funded Rs 100-lakh-crore National Infrastructure Pipeline.