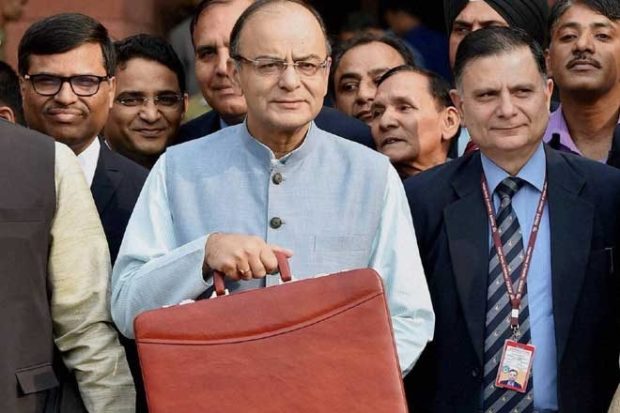

Finance Minister, Arun Jaitley announced the Indian Union Budget 2018 in the parliament today revealed allocation of funds across various sectors for financial year 2018-19. Post the implementation of GST, many indirect taxes have been bundled for one nation, one tax, however, with various GST slabs, additional cess and frequent changes have created a lot of confusion especially in the automobile sector. While there was nothing specific about automobile sector mentioned, FM did say reduce the corporate tax to 25% for companies with turnover of 250 crore. This was in the wish list of automakers in India.

While the Indian auto-industry has welcomed GST, it has also raised concerns on additional cess on SUVs and luxury vehicles. Budget 2018 speech by Arun Jaitley did not announce change in personal Income tax slabs but announced Rs 40,000 of benefit for salaried class.

Also read: Budget 2018 for drivers, motorists, cabs and how it will affect your pocket

Automakers’ request for increased weightage in Research and Development along with incentives and more funds allocated to the FAME (Faster Adoption and Manufacturing of Electric and Hybrid Vehicles) scheme was not addressed in Budget 2018 speech. There was also no mention of electric vehicles or reduction of taxes on ambulances that was expected.

Budget 2018: Live updates

1:30 pm: Excise duty on unbranded diesel and petrol reduced by 2 rupees each. Petrol by Rs 6.33/L and Rs 4.48/L

12:51 pm: Markets crash during Finance Minster, Arun Jaitley’s Budget 2018 speech.

12:49 pm: Share market reacts to FM’s speech; Down by more than 400 points.

12:47 pm: Mobile phones set to be expensive as custom duty raised from 15 percent to 20 percent

12:46 pm: Education cess increased from 3 percent to 4 percent

12:41 pm: No change in Tax exemption slab by Finance Ministry.

12:37 pm: Income Tax relief of Rs 40,000 in travel allowance for salaried people

12:36 pm: No change in personal Income-Tax returns

12:32 pm: Corporate Tax reduced to 25 percent for companies with annual returns of up to Rs 250 crore; Auto industry was expecting this big move.

12:26 pm: Huge increase in Income Tax returns, 8.27 crore people paid taxes

12:17 pm: Government sets a disinvestment target of Rs 80,000 crore

12:14 pm: Narendra Modi Government to spend on modernising defence forces says FM

12:11 pm: Defence gets a big boost, Industry-friendly defence production policy in FY 2018-19.

12:10 pm: Government says crypto currencies illegal and does not support it.

12:09 pm: Double allocation for cyber mission under digital scanner.

12:07 pm: Airport facilities in India to be upgraded to support 1 billion passengers every year across India.

12:05 pm: Airport Authority of India have 124 airports, Government to support funding for more expansion, 56 new airports under Udaan scheme. “Those wearing Hawai Chappals will do Hawai Yatra” says Finance Minster.

12:02 pm: Railway Ministry to electrify 4000 KM of Railway lines in India confirms Finance Minster in Budget 2018 speech.

12:00 noon: 9000 kms of highways to be built this year says Arun Jaitley

11:59 am: 2.04 lakh crore for ‘Smart’ and ‘Amrut’ cities

11:57 am: Government sets aside Rs 50 lakh crore for infrastructure development.

11:55 am: Indian government to invest more in sea planes activities says Arun Jaitley.

11:52 am: Govt to contribute 12% to ePF (employee provident fund) as against 8.3% for next three years.

11:43 am: Government to spend 1.38 lakh crore on health, social services and education during FY 2018-19. Funds for SC/ST welfare raised by 50%.

11:40 am: Government launches Health Protection scheme that will include coverage worth Rs 5 lakh per family per year to over 50 crore Indians. Arun Jaitley claims this to be World’s Biggest Health Scheme.

11:33 am: Narendra Modi led government of India to invest in securing 321 lakh rural jobs through rural road schemes.

11:28 am: Arun Jaitley announces big investments for rural roads construction.

11:23 am: Special schemes to be launched to reduce Air pollution in Delhi. Aims to reduce smoke released due to crop residue burning says Arun Jaitley.

11:18 am: Government allocates Rs 22000 crore for infrastructure development in agriculture. Launches Operation Green at an additional Rs 500 crore.

11:15 am: Government announces support price of at least 150% of input price per farm for farmers. This will help tractor and farm equipment manufacturers to grown.

11:12 am: Emphasis to double farmer’s income by 2022. More employment for farmers in farming and non-farming sectors.

11:10 am: IMF (international monetary fund) forecasts 7.5% growth for India during FY 2018-19.

11:08 am: Budget 2018 will consolidate all gains and will focus on good health, infrastructure development and improving the quality of education across the country.

11:07 am: Indian Economy has done very well since 2014 growing at 5% every year. India will become 5th largest economy very soon says Arun Jaitley.

11:04 am: Budget 2018 speech by Arun Jaitley begins. The journey over the last few years have been challenging but rewarding.

11:00 am: Budget 2018 session beings in Parliament. Sumitra Mahajan, Speaker, Lok Sabha begins the proceedings.

10:45 am: Union Budget 2018 gets cabinet approval. Finance Minster, Arun Jaitley is all set now to present the India Budget 2018 at 11 am today.

10:40 am: Luxury car makers who were left disappointed after the additional cess added to the top bracket of GST. Roland Folger, MD and CEO, Mercedes-Benz India says that Budget 2018 should relax personal Income Tax. He added “GST on goods attracting maximum (GST+ Cess) rates needs to be optimized. Additionally, there should be normalization of provisions and procedures under direct tax”

10:33 am: Prime Minister Narendra Modi and Finance Minster Arun Jaitley have reached the Parliament to present the Budget 2018. Scheduled to start at 11:00 am and for the first time since independence the Arun Jaitley’s budget speech will be in Hindi.

10:30 am: Expect the Budget 2018 to have an adequate focus on job creation. Apart from Government’s focus on rural economy and infrastructure development, key areas of job creation in the Manufacturing and Service Sectors, should be focused upon for an inclusive growth plan. Automobile sector is one of the biggest employers in India and expects to create more jobs with a EVs coming in.

10:25 am: Along with the presentation of Union Budget 2018, the Narendra Modi government will implement the way bill system in India. The implementation of the e-way Bill serves a dual purpose: It will curb tax evasion and reduce the commute time required by trucks for movement of goods across states.

10:15 am: At the 25th meeting of GST Council meeting held in Guwahati just before Budget 2018, Finance Minister Arun Jaitley revised the rates on various products, including old and used cars. The GST rates were slashed and cess was also taken off across several categories.

Jatin Ahuja, Founder and Managing Director, Big Boy Toyz had said “We welcome this move by the government which revised the new tax regime for Used motor vehicles. The tax rate which now stands at 18% will benefit the industry and boost consumer confidence at large.”

10:00 am: Budget 2018 might also consider bringing in Vehicle Scrappage policy that has been on cards for a while now. Auto Industry especially commercial vehicle manufacturers expects the proposed ‘Voluntary Vehicle Fleet Modernisation Plan’, which will keep older cars off the roads to be implemented.

Sumit Sawhney, Country CEO and Managing Director, Renault India commented that “an appropriately structured incentive scheme for scrappage of old cars (which invariably are more environment polluting) can be a game-changer for the industry. We have to bring newer technological cars that are more environmental friendly and fuel-efficient because India still is dependent on forex for oil import. Successful implementation of this will not only benefit the environment, but will also reduce fuel consumption and infuse further demand for greener and efficient vehicles.”

09:50 am: Toyota Kirloskar Motors hopes that “Union Budget 2018 brings in more growth oriented measures to promote growth of Auto Industry.” Company says that Modi led Government should aim at more long term policy so as to lower the effect of budget tinkering and bring long term stability. “Considering the critical issue of environment pollution, we hope the Government relax tax rate in favour of clean and green technologies such as strong hybrids similar to pre GST era.” Toyota added.

09:35 am: Automakers and SIAM has suggested Arun Jaitley’s Finance Ministry to exempt 10-13 seater ambulances from levy of compensation cess. Currently, ambulances are place at a tax bracket of 28% GST and an additional cess of 15%. A mention of this in FM’s Budget 2018 speech might bring some cheer to auto-industry.

09:25 am: Sumit Sawhney, Country CEO and Managing Director, Renault India says that Budget 2018 should further simplify existing GST rate structure for automobile sector. He says “After the roll-out of the revolutionary GST, the Government needs to have a simplified GST structure with not more than 2 rates – a merit rate for small cars and two wheelers, and a standard rate for most of the other vehicle categories. This will make the taxation regime less complex and will certainly help boost the demand for automobiles.”

09:15 am: Like other sectors, even the automobile sector of India expects Arun Jaitley to reduce Corporate Tax. In his Budget speech during 2015-16, FM had promised to lower the Corporate Tax to 25 per cent over the next four years and is expected to come during Budget 2018. A corporate rate tax cut from the present 30% to 27%-28% would help the Indian industry.

09:05 am: Government has announced its ambitious plan of 100% electric mobility in India and to reduce India’s fuel import bill, to align with this it is expected that petrol/diesel powered vehicles might get expensive. While reduction of excise duty on petrol and diesel is uncertain, it is also expected that travelling in cabs might get expensive starting April 2018.

08:55 am: In the Budget 2018, SIAM has also requested Narendra Modi led government further more clarity on clarity on the representation of various import routes and its taxation structure. This includes CKD (completely knocked down) and SKD (semi knocked down) units. Completely Built Units (CBU) will continue to attract higher import duty.

08:45 am: However, to support Make-In-India campaign, Auto-Industry representing body Society of Indian Automobile Manufacturers (SIAM) says that import duty on electric vehicles should not be reduced to support manufacturing in India. Reduction in import duty of some of the components required to manufacture electric vehicles might be on cards

08:35 am: Luxury car makers do expect reduction on import duty for its Completely Built Units (CBU) especially after increasing the Cess on luxury cars and SUVs. Post the implementation of GST, there has been a lot of changes to the tax structure and frequent changes in the GST slab and additional cess has left the many car makers disappointed. Many car makers had to slowdown its pace when it comes to product strategy and in the budget 2018 speech the industry expects a few major announcements specific to auto sector especially and otherwise.

08:25 am: Like all other sectors, Automobile Industry has its own wish list from the Modi government. In his today’s speech, Arun Jaitley is likely to announce some relief for manufacturing electric vehicles and might increase the overall R&D budget. Expect cars and SUVs to get a bit more expensive especially diesel powered cars. FM might also allocate more funds under FAME (Faster Adoption and Manufacturing of Electric and Hybrid Vehicles).

08:15 am: Arun Jaitley, Finance Minister, Government of India is all set to give his fifth budget 2018 speech and also first speech post the implementation of Goods and Service Tax popularly known as GST. Arun Jaitley’s budget speech is expected to be shorter as many indirect taxes have now been put under GST.