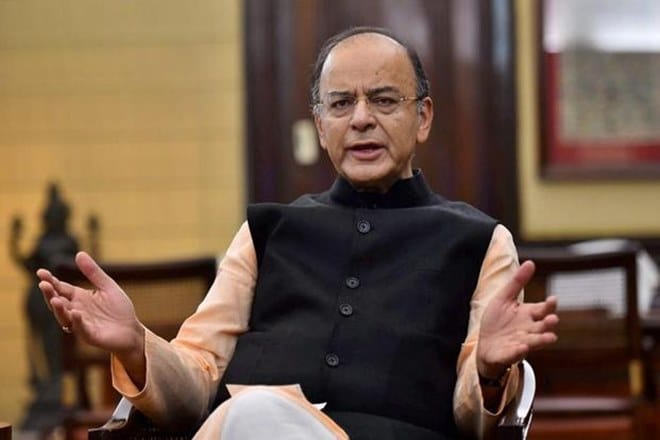

Budget 2018: In the upcoming Union Budget 2018, the first after the implementation of GST, while Finance Minister Arun Jaitley may not tinker around much with the different indirect tax heads, as any decision on indirect tax on goods and services is now taken by the GST Council, the budget may still address key issues relating to GST. Till last year, the Union Budget had two parts — Part A contains allocations to different sectors and schemes, while Part B contains tax proposals, both direct and indirect. Effective July 2017, most of the indirect taxes including excise duty, VAT, CENVAT, Sales Tax and Service Tax were subsumed into GST. Since the implementation of the Goods and Service Tax (GST), more than 12 different taxes including VAT, Excise Duty got subsumed, hence, leaving no room for the Budget manoeuvre under different indirect tax heads. We take a look at four key areas relating to GST which Union Budget 2018 is likely to focus on.

Address falling GST revenues

The GST revenues have been tapering since the implementation of the new indirect tax regime. According to latest data, the total Goods and Service Tax collection has been Rs 80,808 crore in November. A sum of Rs 83,346 crore was collected as the total revenue collection under the GST for October. “The challenge for the government is to ensure that the overall revenue does not go below the earlier indirect tax collections. One of the purposes of the government spending and investment in infrastructure is to propel GDP growth. A 100 basis points fall in GDP has had a deep impact on indirect tax collections and that is evident in the GST numbers. That is something the government will look to urgently address in this Union Budget,” Angel Broking said in a recent note.

Watch Video: Budget 2018 Needs To Address Pressing Issues Of Telecom Sector; Here’s Why

Lay out plans to simplify GST structure

The Finance Minister Arun Jaitley may be in favour of simplifying the GST structure. Although even changing the structure is now the job for the GST Council, Arun Jaitley might still lay a roadmap for the government’s plan to do so. “GST rates have also become quite complex. For example there is a 0% slab, 5% slab, 12% slab, 18% slab and 28% slab. Then there is gold with a special 3% GST. There are additional levies and the entire structure gets a lot more complex. The Union Budget will have to look at simplifying the whole thing structurally. It can probably reduce it to just 3 rates for essential goods, all other goods and demerit goods respectively,” Angel Broking noted.

Expand GST base

In the upcoming Union Budget 2018, the government may look to provide various incentives to bring more SMEs into the organised sector. “There may be incentives for GST registration and timely payment of GST which will act as an incentive for more people to register and also pay on time. Like the government has incentivised digital payments for small businesses, the budget can look at special incentives on those lines. This will push more businesses into the organized segment,” Angel Broking said in a recent note.

Also read: Budget 2018: Will FM Arun Jaitley raise income deduction by Rs 50,000 to Rs 2.5 lakh?

Dwindling exports due to GST

Angel Broking notes that the exports have fallen due to GST. “Exports growth has faltered and the trade deficit in December touched a high of $15 billion. One reason is that nearly $10 billion is stuck up in Exporter GST refunds. There are some quick answers we can expect in the budget. Providing liquidity to exporters against refunds, giving credit adjustment against past dues or even offering an amnesty scheme to tide over legacy issues of excise and service tax are likely in this budget,” said the firm.