Households contribute significantly for investment in financial assets in the economy; this segment has the highest financial net worth (88.3%…

Households contribute significantly for investment in financial assets in the economy; this segment has the highest financial net worth (88.3%…

Elevated global commodity prices and supply-side disruptions due to the Ukraine crisis have led to a steep rise in imported…

In listed companies, IDs make up more than half the board strength, whereas their share was just a shade under…

Based on the scheme characteristics, pension funds will have to assign a risk level for the seven schemes.

For overseas studies, students may need to take a top-up loan. Travellers going abroad may need to optimise their budget

As the capital markets remain volatile, PE/VC backed initial public offerings would be affected now.

But, while 80% of individual and small commercial clients of the industry are aware of climate risks, just 8% of…

LIC’s first day listing at over 8% discount dampens investor sentiment but experts say insurance stocks are always a long-term…

The spike in inflation strengthens expectations that the Reserve Bank of India may raise the repo rate once again in…

One reason for the wide variance in inflation among states is high rural inflation; states that are more urbanised will…

A comprehensive motor insurance will cover own-damage as well as the mandatory third-party insurance.

Returns from sectoral funds depend on the economic cycle and the entry point. So volatility can be much higher here

While the share of manufacturing in the new projects announced has grown to 43.5% in FY22 from 38.3% in FY21,…

The net borrowings ceiling was raised to 5% in FY21 and set at 4.5% in FY22 because of the pandemic-induced…

In contrast, the share of loans to industry dropped to 28.7% from 43% during the same period.

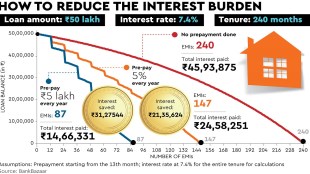

Regular pre-payments can go a long way in reducing your interest payouts

The panel has suggested that insurers will have to offer the product either as a group or an individual product…

The sustained decline in MCLR and the periodic resetting of loans at lower rates have benefited borrowers.