Operational cash breakeven expected this year against a deficit of 15bn seen last year

Operational turnaround underway: We expect a strong rebound in sales booking for DLF in Q4, led by a pick-up in new launches, especially in its core market of Gurgaon. DLF has launched over 5million square feet of new projects with a sale value of upwards R25bn in Q4. We see 5-10% upside risk to our FY12 booking estimate of R41bn (R16bn in Q4). We reiterate our Buy rating with PO (price objective) of R245 (25% upside) and believe the recent weakness (YTD?year-to-date?DLF up only 6% against 30% for Realty Index) offers good entry price.

Q4FY12 saw a strong pick-up in new launches for DLF across locations?Gurgaon, Hyderabad, Chandigarh and Panchkula. Of the planned launches of 10m sq ft. it has successfully launched 7m sq ft in Q4. We believe the launches have seen good demand helping DLF to achieve 11m sq ft of sales booking in FY12. We see 5-10% upside risk to our FY12 sales booking estimate of R41bn. We expect this strong uptrend in launches to sustain in H1FY13 as well, starting with launch of the super premium project in Gurgaon.

Gurgaon remains strong; Golf Course launch key trigger: DLF will be the key beneficiary of strong trends in Gurgaon given 43% of its NAV (net asset value) is derived from Gurgaon. DLF?s recent launches in New Gurgaon have been at a significant premium to our estimate and competition. If this trend sustains for future launches, we expect 6-8% upside risk to our gross NAV estimate of R288/share. The Golf Course launch in H1FY13 will be the key trigger as it will help DLF achieve 50% higher sales booking in FY13 (R62bn) against FY12 (R41bn).

DLF has launched two residential group housing projects in New Gurgaon at prices of R5,000/sq ft. The pricing was at a significant premium to its competition (R3,500-4,000/sq ft), but we understand it still managed to see a strong response. If the trend sustains for the future launches in New Gurgaon as well, we see a 6-8% upside risk to our NAV estimate of R288/share.

Execution has improved significantly on new launches: We have seen a sharp improvement in execution for its projects, particularly for the ones which have been launched in the last 6-9 months led by outsourcing of construction to third-party contractors and its strategy of launching projects only once all the approvals are in place. Its new project in Bangalore (Maiden Heights) launched in Oct 2011 and has already completed excavation with foundation work in full progress. Earlier we used to typically see 4-6months of lag between launch of new project and start of construction.

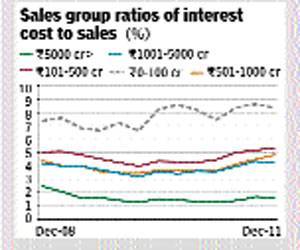

Operational cash breakeven expected in FY13: We expect DLF to achieve operational cash breakeven in FY13 against a deficit of R15bn seen in FY12 as (i) its sales booking improves in FY13 leading to additional cash flow of R2-2.5bn/ quarter and (ii) execution picks up pace due to measures undertaken in FY12. The fall in interest rates should also help cap interest cost expense in FY13.

Debt reduction hinges on non-core sale: Management expects to conclude three large non-core asset sales (Wind Mills, Aman Resorts and NTC Mumbai land, valued R50bn) in H1FY13 which would help reduce debt. This would further augment positive cash flows.

We reiterate our Buy rating on DLF with a price objective of R245 based on a 15% discount to the NAV of R288, offering a potential upside of 25% from the current levels. We foresee a sustained uptick in its operational performance in FY13 as we expect its core market, Gurgaon, to see good volume growth with no correction in prices. We are also encouraged by its launch pipeline, in Gurgaon where it plans to launch the super-premium project along the Golf Course. The conclusion of non-core asset sales leading to debt reduction will also remove the key overhang from the stock, in our view.

BofAML