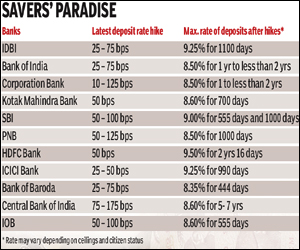

In less than two months of hiking deposit rates, banks are once again offering savers more for their money. After State Bank of India (SBI) upped deposit rates last Friday even as it said borrowers would need to pay more too, HDFC Bank said on Monday depositors could earn as much as 125 basis more depending on the period. On Tuesday, IDBI Bank and Oriental Bank of Commerce (OBC) tweaked their deposit rates by 25-50 basis points.

IDBI Bank hiked interest rates on retail deposits by up to 0.75% varying according to maturities on Tuesday. However, in an additional offering to woo customers in the current rising interest rates scenario, bank has decided to do away with penalties on premature withdrawals of fixed deposits.

IDBI Bank hiked interest rates on retail deposits by up to 0.75% varying according to maturities on Tuesday. However, in an additional offering to woo customers in the current rising interest rates scenario, bank has decided to do away with penalties on premature withdrawals of fixed deposits.

Bank of India increased interest rates on a few fixed deposit schemes by up to 0.75%, effective from Monday.

BA Prabhakar, ED, Bank of India, said, ?Banks are competing each other to hike interest rates. We have raised our deposit rates on Tuesday and would continue to do the same in future to remain competitive in the market.The growth in deposits depends on government spending, which I believe, will start in the current January-March quarter. Moreover, the government will also have to exhaust its annual Budget for spending before the financial year 2010-11 comes to an end.?

?It?s hard to offer a deposit rate that is less than that offered by SBI because customers can easily open an account with the bank given its reach,? observed a senior executive with a leading private sector bank.

The executive added that while other banks may not lose customers if deposit rates were lower for one category, it would be hard to compete with state-owned banks if rates were significantly lower. SBI increased its deposits rates by as much as 50-100 basis points across maturities. However, repeated hikes in deposit rates are yet to reflect in the overall deposit growth. Deposits are still sluggish and grew at 14.7% year-on-year for the fortnight ended December 17, 2010. RBI has set a target of 18% for deposit growth during 2010-11.

Indeed, deposits have been growing more slowly than increasing strong demand for credit. Deposit growth has been sluggish at 15% over the last year (comfortably below the increase in nominal GDP for example) with non-food bank credit growth running around 23%y-o-y.

This has inevitably pushed up banks? credit-to-deposit ratio towards a near record high of 75%. Sluggish deposit growth, in turn, must be considered essentially a function of the fact that deposit rates have been set too low for too long by banks. With inflation, especially food inflation running high, currency in hand too has remained high. Deposit rates are now moving up, which should ultimately help resolve the liquidity squeeze in the next few months.