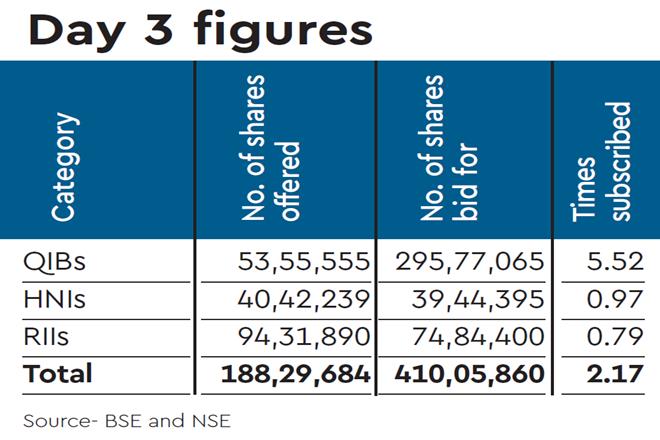

The CreditAccess Grameen IPO was subscribed 2.17 times on Friday, the final day of the share sale, with investors bidding for 4.10 crore shares of the 1.88 crore on offer. Qualified institutional buyers bid for 5.52 times the shares offered to them, high networth individuals for 0.97 timesand retail investors bid for 0.79 times of the shares offered.

The CreditAccess Grameen IPO was subscribed 2.17 times on Friday, the final day of the share sale, with investors bidding for 4.10 crore shares of the 1.88 crore on offer. Qualified institutional buyers bid for 5.52 times the shares offered to them, high networth individuals for 0.97 timesand retail investors bid for 0.79 times of the shares offered.

On Tuesday, the company allotted Rs 339.36 crore to 23 anchor investors at Rs 422 per equity share.Some of the anchor investors include Neuberger German Emerging Markets Equity Fund, ICICI Prudential Banking and Financial Services Fund, Sundaram Mutual Fund, HDFC Standard Life Insurance Company,Citigroup Global Markets and Bajaj Allianz Life Insurance Company.

CreditAccess Grameen Limited had set a price band of Rs 418 to Rs 422 per share for its initial public offering (IPO). The issue had a fresh issue of shares for up to Rs 630 crore and an offer for sale (OFS) of Rs 501.18 crore. CreditAccess Grameen Limited is an Indian micro-finance institution focussed on providing micro-loans to predominantly women in rural areas.

It has followed a strategy of continuous district-based expansion across 132 district in eight states. Those states include Karnataka, Maharashtra, Tamil Nadu, Chhattisgarh, Madhya Pradesh, Odisha, Kerala and Goa in addition to one union territory Puducherry. The company’s promoter is Credit Access Asia NV, a multinational company specializing in micro and small enterprise financing.