Even though banks are keen to sell stressed assets to asset reconstruction companies (ARCs) ? as evident from them offering to offload close to R25,000 crore in Q1FY15 itself ? Asset Reconstruction Company India (ARCIL) managing director & CEO P Rudran told FE that only four of every 10 assets have profitable recoveries.

?Of every 10 assets, we try to make up the losses in recovery of six assets from four profitable recoveries,? said Rudran. Asset reconstruction companies are specialists in loan recovery and banks sell NPAs to ARCs who try to recover them on their behalf.

According to Rudran, not all assets that ARCs buy are recoverable, and the rest, even if recovered, yield far less than the price at which they were bought from banks. Traditionally, ARCs buy assets from banks at a hefty discount and pay only 5% in cash; the remaining 95% is paid through security receipts (SRs) redeemable as and when the recoveries are made.

Rudran said of R20,000 crore worth of assets the company has bought so far, it has been able to recover around R9,000 crore. He added that ARCs have five years for recovery, and an additional three years are provided as extension in special cases.

In FY13, ARCIL had outstanding security receipts of R5,564 crore and the SRs redeemed in FY13 stood at R1,204 crore in the same period. Though the balance sheet of ARCIL for FY14 has not yet been published, official estimates put assets under management (AUM) or outstanding SRs at R9,400 crore due to the heavy buying activity it saw in the last fiscal.

?ARCs recover through compromise settlements (borrowers pay through during negotiations), restructuring the asset (conversion of debt into equity and reduction of interest rates) and also through the legal process of debt recovery tribunal (DRT),? said Rudran.

Though the ARC industry has been dominated by ARCIL, which was India’s first ARC, other players like Edelweiss ARC and JM Financial ARC have become more aggressive recently. According to industry insiders, Edelweiss has outstanding SRs worth R9,000 crore as in FY14-end whereas ARCIL has R4,500-crore SRs and JM Financial ARC R2,500 crore. In FY14, ARCs bought assets worth R22,000 crore, sources said.

?There weren’t many stressed asset buys till FY13. It is only after the RBI came out with revised guidelines for ARCs that we have seen a spurt in such transactions,? said Siby Antony, MD & CEO, Edelweiss ARC.

Phoenix Asset Reconstruction Company, sponsored by group companies of Kotak Mahindra group, has pending receipts of R1,750 crore in FY14. Eshwar Karra, CEO of Phoenix ARC, said: ?The recovery of assets varies from 100% to only 5% based on the collateral-backing they have.?

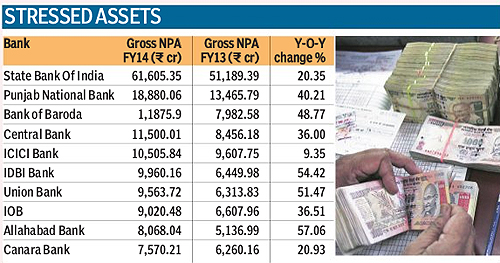

Owing to a jump in NPAs, banks have, of late, been selling very aggressively to ARCs to clean up their books, and this has prompted RBI to step in. At the end of March, 2014, loans worth R2,50,715 crore were non-performing, according to Capitaline data.

?A spurt in the activity of ARCs, driven by banks? efforts for cleaning up their balance sheets, calls for a closer look at the extant arrangements between ARCs and banks,? RBI said in its financial stability report last week. Meanwhile, in a recent report, HSBC pointed out that a limitation ARCs face is shortage of capital to buy these stressed assets.

?ARCIL, which has a 70% market share, has a capital base of R1,500 crore, of which about R1,000 crore is already committed to existing NPLs,? the report said.