Page 3 of fiis

Related News

‘No job in Canada without…’: NRI who returned to India 1.5 years ago calls it ‘best decision’

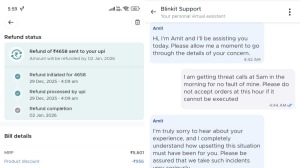

‘Getting threat calls at 5 am’: Blinkit customer alleges harassment over delivery dispute, tags Zomato CEO Deepinder Goyal

Employees leaving after Nov 21, 2025 must be paid revised gratuity under new labour laws, says ICAI

Mark Zuckerberg’s Meta Superintelligence Lab goes global: Chief AI Officer Alexandr Wang announces new hiring in Singapore

Stranger Things Season 5 finale review and release Live Updates: Last episode of Netflix series OUT in India