The theoretical understanding is that a weak or depreciated currency increases export competitiveness and results in higher exports. The East Asian experience of Japan, China, Korea and Taiwan reinforces this understanding. It is a well-known fact that China achieved its export-led double-digit growth by keeping its exchange rate deliberately undervalued. South Korea and Taiwan had experienced sharp export-led growth in the 1960s and 1970s. During the 1950s, both these countries engaged in traditional import substitution policies, with multiple exchange rates, high levels of trade protection, and repressed financial markets. But, by 1960s, the two countries adopted export-oriented policies which included unification of exchange rates accompanied by currency devaluations. These measures together with other policies like duty-free access for exporters to imported inputs, liberalisation of the import regime and public investment in infrastructure and human capital helped exports to take off in the mid-1960s, and the high growth rate of exports was sustained in the next two decades. This is the essential core of the widely known East Asian miracle. Chinese exports also took off in early 2000 after the currency was unified in 1998 and effectively depreciated by nearly 30% as China was securing its entry into the WTO. Since then, exports rose by an average of 20% annually, increasing its share in world exports, higher than Japan and overtaking Germany as the world?s largest exporter in 2009.

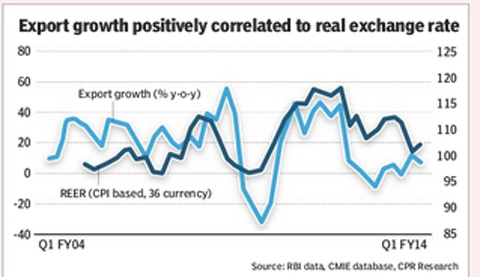

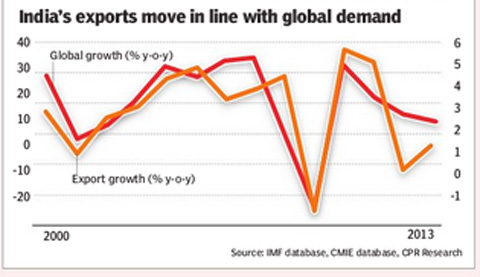

Given the above mentioned success of the East Asian economies, their experience should be attractive to the Indian policymakers. However, the argument has been made that, for various reasons, normally not explained, but relying on past performance, Indian exports do not respond positively to currency depreciation. A simple regression exercise between export growth, global growth and real effective exchange rate (REER?using the consumer prices for calculating the relative inflation ratio) yields a positive correlation between export growth and both rupee appreciation and world GDP growth. Regressing non-oil export earnings with REER also yields similar results. These findings correspond to those found in research reports of JP Morgan, Moody?s and NIPFP research by Bhanumurthy and Sharma. In the paper Impact of Exchange Rate Appreciation on India?s Exports by Veeramani in 2008, it was concluded that ??the appreciation of the REER leads to a fall in the dollar value of India?s merchandise exports. However, the degree of the (negative) association between exports and the REER has declined since 2002.?

These empirical findings lead to the non-intuitive conclusion that a depreciated currency would not help India?s export performance and global income is the only and by far the stronger driver of Indian exports. Such an argument helps the cause of capital market operators and those seeking to raise external commercial borrowings as it lowers the cost of debt servicing.

However, on further empirical probing, it turns out that India?s export behaviour is not all that different from other Asian economies and also not as vexingly counter-intuitive as the above simple regression analysis would have us believe. First, service exports, the fastest rising component of external earnings and particularly software exports, emerge to be clearly and significantly negatively correlated with exchange rate movements. This finding is substantiated by higher revenues of IT and BPO companies as rupee depreciates. Second, we achieve a statistically significant result when merchandise exports are regressed together (and not independently) with both global growth and currency exchange rate with one year lag. Merchandise exports emerge to be positively correlated to global incomes in the same period but are negatively correlated with the REER with a lag of four quarters. This makes eminent sense. Export orders result in physical exports with a time lag that varies across export products. In the case, for example, of mineral exports, only a sustained currency advantage would result in the needed capacity expansion necessary for expansion in exports.

Therefore, when carefully analysed, even in the case of Indian exports, we cannot ignore the impact of rupee exchange rate on export performance. We believe exchange rate has to remain stable and relatively depreciated for a sustained period for it to have a positive impact on exports. The exporters have to be assured against currency appreciation if they are to make exports more than just a residual activity. If employment generation is the policy objective, as it should be, export expansion must be an integral part of the policy package and sustaining high export growth requires an assurance of long-term currency softness for the exporters to make the necessary capacity expansion.

Several factors like global demand, productivity, competitive infrastructure, trade policies etc contribute to export growth. But we can argue that merchandise goods exports are helped by weak rupee if the depreciation of exchange rate is sustained over time and its volatility is minimised. India?s currency remained considerably overvalued on REER basis from 2012 to first part of 2013 that resulted in a loss of competitiveness of our export sector. This must be rectified and the new government must unambiguously spell out its preference for export promotion in order to achieve its objective of rapid employment generation.

India?s services exports?especially software services?are relatively more price-elastic and benefit from a weak rupee. India?s share of services exports in the world improved at a much faster pace than its share of merchandise exports. Services sector contributes around 60% to India?s GDP, 35% to employment, 30% to exports and accounts for more than 40% of FDI into the country. Promoting services exports?that include software, in-bound tourism, health sector earnings?and encouraging our NRI remittances and discouraging outbound tourism and payments to non-resident factors of production requires a suitably depreciated rupee. These measures will provide a real improvement in our current account balance and not the protectionist or administrative measures adopted recently.

Therefore, RBI needs to keep a sharp eye on any tendency for the rupee to appreciate, as an overvalued currency hurts India?s composite external earnings and helps directly in widening the current account deficit, thereby increasing the country?s structural external sector vulnerability. RBI?s pronouncements and policy stance should assure India Inc that it will not let the rupee appreciate and will work to reduce currency volatility. RBI Governor Raghuram Rajan had recently quoted a study by the finance ministry which showed that 60-62 was a reasonable range for the rupee against the dollar, given the CPI inflation, export competitiveness etc. We should assure the exporters of keeping it at that level and build up India?s foreign exchange reserves if that is needed to do so.

Strong appreciating currency is politically very seductive. With the emergence of strong decisive government at the Centre after the recent elections, capital flows are expected to increase in the short-term, resulting in an appreciation of the rupee. But the new government should resist this temptation to let the rupee appreciate prematurely. Its first priority is employment generation and, for that, the higher the rate of growth of external earnings, the better. Higher exports also result in higher industrial production and higher inflows of foreign direct investments as opposed to portfolio investments that are fickle and result in asset price bubbles. A relatively weak rupee has several advantages. It will inhibit merchandise and service imports; curb wasteful energy-intensive consumption; encourage import substitution; and promote energy conservation and the drive to become energy self-reliant. The exchange rate policy implications for both the government and RBI are hopefully unequivocally clear.

(Concluded)

Rajiv Kumar & Geetima Das Krishna

Rajiv Kumar is senior fellow and Geetima Das Krishna is senior researcher at the Centre for Policy Research, New Delhi