Bharat Electronics (BEL) has sprung a strong execution surprise for 2 consecutive quarters led by pick-up in execution in certain large projects. Key highlights: a) robust ~Rs 401 billion order book includes large projects like IACC/LR-SAM, which we believe pose an upside risk to consensus top-line estimates; b) Q1FY18 order intake appears strong at >Rs 22 billion (Rs 10 billion in Q1FY17), with Rs 15 billion from VVPAT (voting machines) alone; and BEL seems to be on track to post 20% order book CAGR over FY17-19E to Rs 580 billion (~5x sales) riding strong competitive edge and favourable positioning in high priority/large value projects. We revise up FY18/19E earnings ~2.5/4.0% building in the strong execution surprise owing to recent large wins and assign 25x (23x earlier) FY19E PE with revised TP of Rs 225 (Rs 200 earlier) given: (a) potential upsides to BEL’s order book in upcoming large projects; and (b) strong defence push by government. Maintain Buy.

Higher execution seems to be a new normal: BEL’s Q4FY17 and Q1FY18 top line jumped a robust 24% and 96% y-o-y led by execution pick-up in large projects including IACC. With rising proportion (~50%) of large systems in order book, on which execution is commencing, BEL’s ability to post higher revenue growth seems reasonable, especially with high priority orders and BEL’s improved preparedness. We estimate BEL to post ~19% revenue CAGR over FY17-19.

Sustainable competitive edge to drive 20% order book spurt: With favourable positioning in ~Rs 500 billion (~40% from SAMs) worth large value projects that are likely to be awarded over the next 12-24 months, BEL seems to be on course to clock robust 20% order book CAGR over FY17-19E with >5x order book to sales ratio by FY19E. Additionally, with more than 65-70% in-house product coverage in top line despite rising systems’ proportion, we expect margin to remain stable.

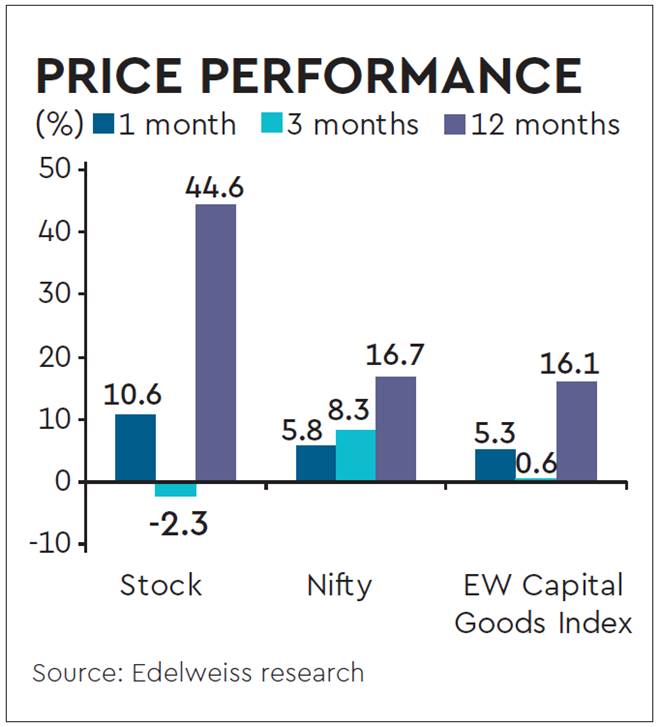

Outlook and valuations: Top pick in defence. Despite more than 4x returns in the past 3 years, BEL still remains our preferred pick in the defence sector given its unparalleled positioning in the strategic defence electronic space, which we believe remains a key business MOAT. Key value driver over the next 2-3 years remains healthy double digit growth in order book, sustainable OPMs and pick up in execution around large systems over FY17-19. We maintain ‘BUY/SO’.