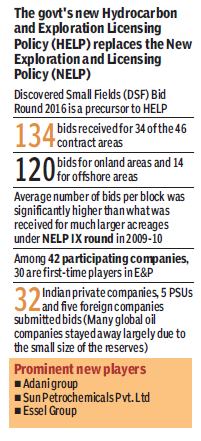

Weeks ago, India received 134 bids for 34 of the 46 contract areas offered under the Discovered Small Fields (DSF) Bid Round 2016, for the development and production of hydrocarbons. Coming at a time when the mood among international investors is rather gloomy, the interest shown in the auctions was considerable.

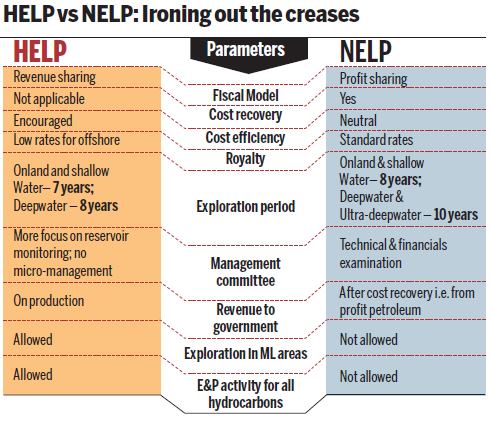

In March 2015, Prime Minister Modi set a goal of cutting oil imports by 10 per cent by 2022. Our analysis indicates that to achieve 10 per cent reduction by 2022, India would require to add about 5.4 million tonnes of crude oil every year. This would need significant augmentation in exploration and production activities. In January 2016, the government announced a new regime for the sector, namely the Hydrocarbon and Exploration Licensing Policy (HELP), a paradigm shift from the earlier NELP.

As a precursor to HELP, the government offered the 46 contract areas under the DSF bid round, comprising fields relinquished by PSUs. Among the 42 companies that participated in the bids, as many as 30 companies were first time players, credit for which goes to the Ministry of Petroleum and Natural Gas which aggressively wooed new players. The Directorate General of Hydrocarbons (DGH) adopted an open-door policy on concerns of bidders and extended strong support to make the process simple and transparent, and also reduce the risk elements that successful bidders would be exposed to.

On the whole, the simplified regulatory framework and the engagement by the government has been a departure from the past and is likely to have a large bearing on future larger exploration opportunities in India.

In effect, the DSF auction is just the beginning of the process. The government is eyeing large scale investment in its upstream sector. As part of the agenda, it has brought in transparency in data and processes to improve the ‘ease of doing business’ for global investors, with DGH setting up a National Data Repository (NDR) to manage geological data for all the E&P acreages.

The last frontier in this process is the development of a vibrant and competitive market. While oil remains a relatively freely traded commodity, the natural gas sector features very rigid market arrangements. Since India’s principal reserves are of natural gas, for creating wider investor interest it will be essential to evolve free gas trading arrangements. The interest in the DSF round has been a revelation and should encourage the government to pursue bolder reforms to transform the entire value chain from the well to the wheels and the burner tips.

The author is Partner and Head, Oil and Gas, KPMG in India. The views are personal and do not necessarily represent the views of KPMG in India